If you desire to generate high-quality hot leads for your mortgage services business, nurture them, and convert them into paying customers, then GoHighLevel for Mortage is all that you need.

You understand that the mortgage loans business industry can be a very competitive market. With more than 83% of mortgage house loans businesses fail within the first 3 years of business.

If you must succeed, you need a that's working for other mortgage businesses and a system that runs itself on automation.

A system that helps you generate leads, follow them up, convert them into paying customers, and get the funds deposited into your bank account.

Without you lifting a finger.

That is where GoHighLevel for mortgage loans comes in!

It doesn't matter if you need GoHighLevel for:

- Fixed-rate mortgage (FRM)

- Adjustable-rate mortgage (ARM)

- FHA loans

- VA loans

- USDA loans

- Jumbo loans

- Conventional loans

- Interest-only mortgages

- Balloon mortgages

- Reverse mortgages

GHL will work for you – GoHighLevel is the all-in-one CRM tool that is changing the way mortgage loan professionals run marketing campaigns and sales – through the power of a sales funnel.

High Level has powerful features and tools that are designed specifically for the mortgage home industry. GHL empowers mortgage house agents, and brokers to streamline business operations, improve client management, and drive greater revenue.

This post will work you through all there's to know about using GoHighLevel for mortgage agents.

Key Takeaways:

- Simplified Lead Management – Capture and track mortgage leads with an organized CRM.

- Automated Follow-Ups – Use SMS and email automation to nurture prospects and clients.

- Seamless Appointment Booking – Schedule consultations and streamline client interactions.

Let's start!

What is a Sales Funnel for Mortgage?

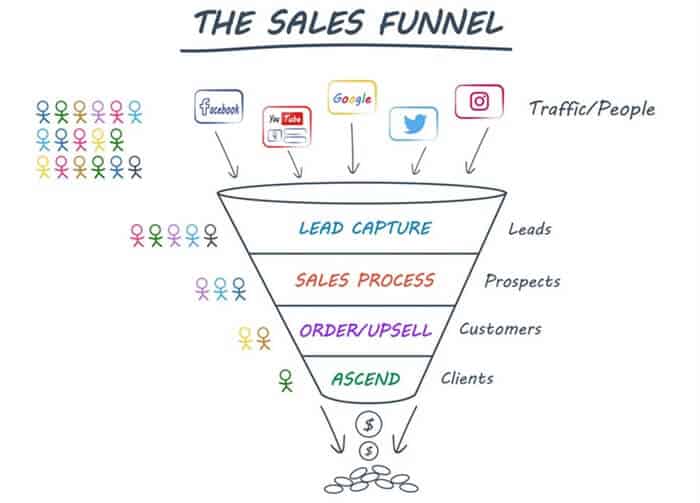

A sales funnel for mortgages is a simple structured process designed to guide potential borrowers through the stages of acquiring a mortgage loan, from the initial awareness stage to the final decision of securing a loan.

The sales funnel outlines the steps and interactions a borrower goes through, to convert them from a lead into a qualified mortgage applicant.

For most sales funnel, the stages clients pass through before securing a deal are normally five stages, but it's seven stages for a mortgage sales funnel.

Here's a simple breakdown of the stages in a mortgage sales funnel and strategies that work well for each stage:

- Awareness: Your objective here is to make borrowers aware of your mortgage services and why your brand is the best.

Strategies: You can leverage content marketing, social media advertising, search engine optimization (SEO), and educational webinars on homeownership.

- Interest: This is a stage where you make borrowers develop an interest in acquiring the loan through you.

Strategies: You need to provide informative content to the borrowers and offer free value. Value could be: Types of mortgages, low-interest rates, free home-buying process guides, free webinars, offer free mortgage calculators.

- Consideration: This is a stage where potential borrowers are considering partnerships with your brand and alternative options available.

Strategies: To secure the deal, you can show your potential clients testimonials from satisfied clients who obtained loans from you, offer free personalized consultations to discuss specific needs and options, or offer low-interest rates.

- Application: This is a stage where a borrower is ready to fill out an application form for the loan. To make this possible, you need to make the whole process easier.

Strategies: Make the online application forms easy to fill, and provide easy access to pre-qualification tools, you can also offer incentives to encourage the borrowers to start the application.

- Approval: At this stage, you guide applicants through all the paperwork and documents necessary for approval.

Strategies: You need to provide clear information on required documents, offer assistance in gathering necessary paperwork, and maintain transparent communication throughout the approval phase.

- Closing: This is a stage where you finally close the loan deal and disburse whatever is in question.

Strategies: Coordinate with relevant parties (title companies, appraisers, etc.), keep applicants informed about the progress, and address any concerns promptly.

- Post-Closing Follow-Up: Your goal here is to foster long-term relationships and gather feedback.

Strategies: Send post-closing surveys, provide resources for homeowners, and maintain communication for potential future transactions.

Keep in mind that a well-optimized sales funnel for mortgages considers the unique needs and concerns of potential borrowers at each stage.

In simple words, a sales funnel is a step-by-step process that guides potential customers through various stages of the buying journey.

Note: Not every individual who enters your funnel will progress to the final stage. However, those who successfully reach the end are genuinely interested about your product or service and recognize its value.

GoHighLevel for Mortgages

Go High Level for Mortgage provides an exceptional service for creating highly effective sales funnels that attract and convert leads into long-term customers.

With a mortgage loan funnel, you can guide your customers through a step-by-step process that nurtures them with valuable information, transforming them from leads to prospects, and ultimately converting them into clients.

How Does GoHighLevel Work for Mortgage?

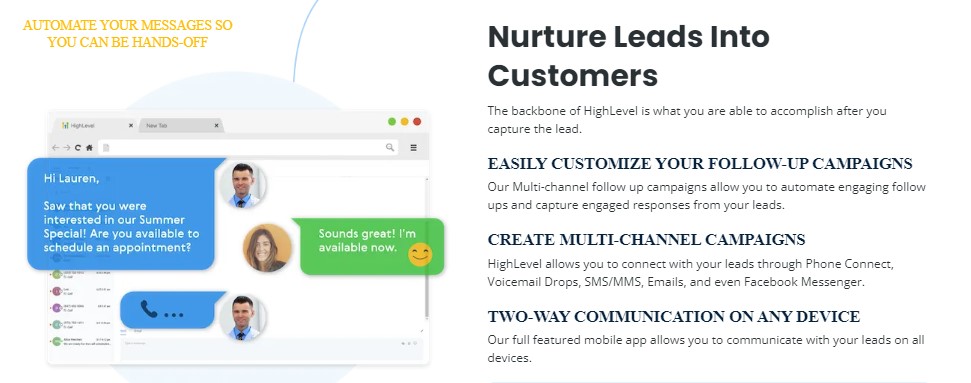

GoHighLevel for mortgage brokers helps you to construct a lead generation funnel to gather potential leads and arrange appointments. Also, it has a built-in email service to nurture and follow up with these leads and convert them into clients.

You need to understand that traditional marketing tactics aren’t as effective as they used to be.

You need to think outside the box of:

- Cold calling

- Door-to-door visits

- Offering complimentary meals to boost attendance at presentations

- Arranging fishbowls for business card collection at trade shows, and hosting events.

And a lot of outdated methods that were used by our grandpa years back.

These days, all your clients are online. That's where you need to be 24/7.

You might be thinking of gathering a hefty sum for a designer to get your website running, right?

Well, that's even worse. 🙁

Websites aren't built to capture leads and convert them to clients.

Websites are there to provide information about your business.

And do you know the worst part? 😒

They overwhelm visitors with menus and distractions, leaving no clear action for people to take and once they're gone. You will never see them again.

This is where a sales funnel platform like GoHighLevel comes in handy.

GoHighLevel has built-in tools and features you need to effortlessly run your business on autopilot, without needing a web designer.

And you don't even need any prior experience to use GHL.

GoHighLevel is focused on making you money. And nothing more.

More on all of GoHighLevel's features…

Before we delve into the super-simple strategy you can use to build your mortgage loans business sales funnel on GoHighLevel to generate leads, further them, and convert them to clients.

Firstly, you need to pinpoint exactly who your ideal clients are.

This way, you can tailor your entire marketing message to the target audience for easy conversion.

As a mortgage professional, your job is to guide clients through the complex landscape of mortgage financing.

You specialize in crafting mortgage strategies that align with their financial goals, whether it's securing a home, refinancing for better terms, or exploring investment opportunities.

With this, your goal is to find and market to people:

- Those who have a problem (and are actively seeking a solution) managing their mortgages

- People who likely have these problems (but may not be aware yet) and you make them aware and provide solutions.

Also, remember to consider factors like age, marital status, blue/white-collar, income levels, kids/no kids, etc., of your customer avatar.

Start thinking about things they would like/be interested in and concerns they would have for a mortgage professional like you in their life.

This will enable you to craft your offer based on the problems you're going to help them solve and that will help you appear professional in either eye.

In simple words, you play a vital role in simplifying the mortgage process, ensuring clients make informed decisions, and ultimately, helping them achieve their short- and long-term real estate objectives.

Learn More: GoHighLevel Review: (My Experience After 4 Years)

How to Use GoHighLevel For Mortgage Brokers

Here, I outlined simple steps you can also use for your Mortgage business using GoHighLevel.

Here are the steps for using GoHighLevel as a mortgage services business:

Here's how to set it up:

Step 1: Creating Your GoHighLevel Account

Since you will be setting up your account – you should do that for FREE!

Luckily, you can get a 30-day free trial here.

To start, go to GoHighLevel.com/30-day-trial and you will be redirected to the page below.

![What is GoHighLevel? [A User Experience] 6 GoHighLevel 30 Day Trial Home Page](https://theolaoye.com/wp-content/uploads/2024/11/GoHighLevel-30-Day-Trial-Home-Page.jpg)

Click on “30-Day Free Trial” and you will be asked basic information about your business, such as:

- Company Name

- Full Name

- Phone Number

- Email Address

![What is GoHighLevel? [A User Experience] 7 GoHighLevel 30 Day Trial Home Page 2](https://theolaoye.com/wp-content/uploads/2024/11/GoHighLevel-30-Day-Trial-Home-Page-2.jpg)

Upon filling in everything, click on “Go To Step #2” where you will be asked to select the plan you want.

For now, you need to Select the GoHighLevel Unlimited Plan and you will be able to upgrade or downgrade later.

You will be asked to input your credit card details next – you will not be debited anything until the end of your trial.

After that, the next is, the onboarding process.

Step 2: GoHighLevel Onboarding

Once you finish the steps above, Go High Level will ask you some onboarding questions to ensure that your account is well set up.

Let’s take a look at them!

The first thing is to tell GHL more about your business, you would need to:

- Select the industry you operate in

- The primary purpose of using GoHighLevel

- The number of your customers

- And if you have a website

Supply the information based on what is right for you.

![What is GoHighLevel? [A User Experience] 8 GoHighLevel Onboarding Process Stage 1](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-1-1024x493.jpg)

If anything isn’t clear to you now, select anything and continue because you can always change it later.

The next page will ask for your business address and billing information.

Then, you need to specify if you’re willing to resell GoHighLevel or not.

Reselling GoHighLevel means that you can resell the entire platform on your name – at your prices and keep the balance.

![What is GoHighLevel? [A User Experience] 9 GoHighLevel Onboarding Process Stage 2](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-2-1024x498.jpg)

Just fill in the blank as you can see above and proceed to the next stage.

![What is GoHighLevel? [A User Experience] 10 GoHighLevel Onboarding Process Stage 3](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-3-1024x516.jpg)

If you take a closer look at the image above, you will see that it’s asking you to select the tools you currently use.

Selecting the tools is going to keep you organized under one single dashboard.

So, select all that apply and proceed to the next stage.

And if you have none for now, just click on “Next ->“

![What is GoHighLevel? [A User Experience] 11 GoHighLevel Onboarding Process Stage 4](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-4-1024x510.jpg)

So, the next stage will ask you to set up your password and a code will be sent to your email for confirmation.

Input the code and you will have the page below which confirms that your GoHighLevel account has been created.

I want to say congratulations, you have just set up your HighLevel account.

Now, you have access to your dashboard which looks like the image below.

![What is GoHighLevel? [A User Experience] 12 GoHighLevel Agency Dashboard](https://saaspen.com/wp-content/uploads/2024/08/GoHighLevel-Agency-Dashboard-1024x463.jpg)

I want to say congratulations and this is what you should do next!

What To Do Next

- Create your funnels

Use the user-friendly drag-and-drop funnel builder of GoHighLevel to craft personalized funnels specifically designed for your mortgage business.

Develop engaging landing pages, effective lead capture forms, and automated follow-up sequences effortlessly.

- Capture Leads

Strategically position lead capture forms on your landing pages, or social media platforms to gather essential contact information from prospective mortgage clients.

Craft compelling forms that provide value, encouraging visitors to willingly share their details.

- Automate your follow-up

Establish automated email sequences and SMS campaigns within GoHighLevel to nurture your mortgage leads.

Personalize your messages, delivering valuable content to build trust and maintain engagement with your leads over time.

- Manage your contacts

Use GoHighLevel's contact management capabilities to organize and categorize your mortgage leads.

Effectively track their interactions, preferences, and relevant details related to their mortgage requirements.

- Track and analyze your campaigns

Utilize GoHighLevel's analytics tools to monitor the performance of your mortgage funnels and campaigns.

Keep an eye on metrics such as click-through rates, conversion rates, and engagement to gain valuable insights into the effectiveness of your strategies and identify areas for improvement.

- Provide exceptional customer service

Use GoHighLevel's communication features, including SMS and email, to maintain regular contact with your mortgage clients.

Ensure timely delivery of updates, valuable mortgage information, and personalized offers, enhancing your customer service and fostering stronger client relationships.

- Continuously optimize and refine

Consistently review and analyze your mortgage campaigns, funnels, and customer interactions within GoHighLevel.

Make informed, data-driven decisions, and implement necessary improvements to optimize your results and achieve maximum success in your mortgage business.

Mortgage professionals attract prospective clients with appealing incentives, like complimentary property valuations or other relevant services, showcased on their landing pages. Once individuals sign up, they can either be directed to the offered service or presented with choices such as scheduling an appointment, booking a call, or taking any preferred action.

The process is simple and effective.

GoHighLevel Mortgage Sales Funnel Templates

Here are free mortgage broker funnel templates available for download directly into your GoHighLevel account. Customize them according to your preferences and needs.

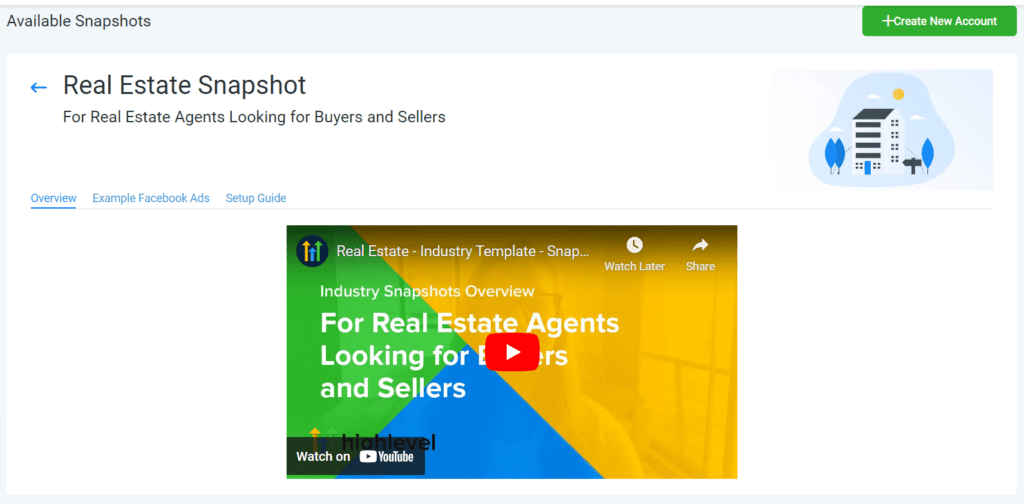

Quick one: Snapshot is a name that is used in GoHighLevel instead of templates. Keep that in mind so that it doesn't look strange to you.

Note: Make sure you’re signed up to GoHighLevel before downloading these. If not, you can get a free 14days trial here.

GoHighLevel Mortgage Service Snapshot

Here's what you need to understand before the templates.

The two primary views within GoHighLevel are the Agency View and the Sub-Account View.

In the Agency View, you gain entry to the overarching settings for the GoHighLevel platform, educational resources, and the opportunity to acquire supplementary services.

On the other hand, the Sub-Account View empowers you to leverage the full control of GoHighLevel features tailored specifically for your mortgage brokerage business.

Upon your initial registration with GoHighLevel, you'll be prompted to establish a sub-account dedicated to your mortgage brokerage.

To streamline this process and furnish you with valuable tools promptly, GoHighLevel introduces Snapshots.

Snapshots are pre-configured sub-accounts equipped with pre-designed marketing campaigns and workflows. This feature significantly reduces the time and effort required, sparing you the task of creating everything from the ground up.

These GoHighLevel for Mortgage Broker snapshots will be available to you upon configuring the sub-account.

- Home Buyer Nurture: This is designed for marketing a single property. This campaign is created to generate leads by inviting potential buyers to provide their information to receive more details about the property.

- Home Buyers List: This is designed to showcase a curated list of properties tailored to a particular area or price range, enticing leads to explore further and request additional information or schedule viewings.

- Home Sellers List: It is designed for property sellers and offers a seller's guide or a free home valuation. It serves as a lead magnet to capture potential sellers' information and initiate conversations.

- No-Show Campaign: This is to address situations where a contact fails to show up for a scheduled viewing. It includes follow-up steps to encourage the individual to re-engage and re-book their viewing.

- Not Yet Ready: The “not yet ready” campaign is designed to re-engage contacts who have shown little to no action after being added to the previous campaigns. It utilizes a gentle re-engagement strategy by sending periodic emails and SMS to nudge the contacts and keep them informed about any promotions or available properties.

- Booking Requested Reply: The “booking request-response” campaign is designed to handle incoming booking requests from leads. If you haven't set up automated calendar bookings, this campaign ensures that you receive a prompt notification when a booking request is made.

- Appointment Reminders: GoHighLevel offers an automated reminder campaign that helps reduce the likelihood of a missed property viewing. Once a booking is made, the system can send out timely reminders to the contact, ensuring that they are well-informed and prepared for their scheduled property viewing.

Mortgage Broker Funnel Template #1:

Snapshot download link: https://app.gohighlevel.com/funnels/10032690/share/iebgqr5zdmllhgtc

Mortgage Broker Funnel Template #2:

Snapshot download link: https://app.gohighlevel.com/funnels/10032788/share/jd3ou3epcdgnm6qk

Mortgage Broker Funnel Template #3:

Snapshot download link: https://app.gohighlevel.com/funnels/10088388/share/zfx3djt6b2z46hrx

GoHighLevel Features for Mortgage Brokers

With GoHighLevel features for Mortgage Brokers, you would not need:

- Landing page software

- Payment gateways

- Shopping cart/checkout platform

- email autoresponder

- Split testing software

- CRMs

Everything is under one roof plus you would not need any hosting or domain name.

#1. Lead Generation Tools

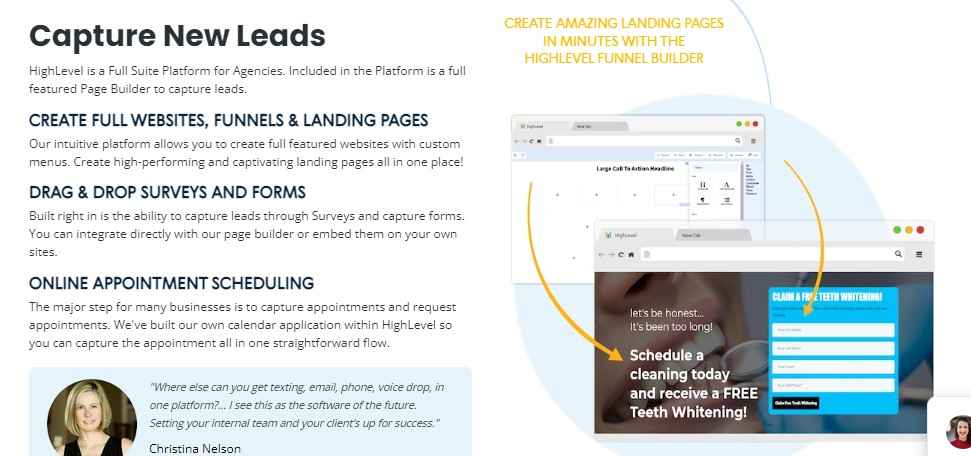

GoHighLevel equips mortgage professionals with advanced lead capture forms designed specifically for mortgage inquiries.

These forms seamlessly integrate with mortgage calculators, providing a powerful tool to attract potential clients.

With this feature, you will go beyond generic landing pages with templates tailored to showcase your mortgage services and engage potential borrowers.

#2. Automated Follow-up Systems

GoHighLevel offers an automated follow-up system that ensures no lead falls through the cracks.

You will be able to implement automated email sequences to nurture mortgage leads and set up SMS and call reminders for crucial appointments and follow-ups.

This tool is integrated with a Customer Relationship Management (CRM) system to effortlessly manage and track your mortgage leads throughout their journey.

#3. Customized Sequences

GoHighLevel allows mortgage professionals to create customized sequences based on clients' specific preferences and needs.

You will be able to deliver personalized content related to various mortgage options, utilizing artificial intelligence-driven communication to enhance the overall client experience. Tailor your approach to each client, fostering a deeper connection and understanding.

#4. Appointment Booking

Easily streamline your appointment scheduling process with GoHighLevel's integrated calendar system.

Mortgage advisors can benefit from automated appointment confirmations and reminders, reducing no-show rates and optimizing their schedules.

The best part is that you will be able to enjoy seamless integration with your preferred calendar tools, ensuring a hassle-free booking experience for both mortgage advisors and clients.

#5. Remarketing and Retargeting

GoHighLevel's remarketing and retargeting capabilities are one of the most powerful tools of the platform.

You can craft campaigns that specifically target individuals who have shown interest in mortgages, utilizing various channels such as display ads and email campaigns.

GoHighLevel simplifies the process, providing performance tracking and analytics to optimize your return on investment.

#6. Webinars and Educational Content

Establish yourself as a thought leader in the mortgage industry with GoHighLevel's webinar features.

Host engaging webinars on mortgage-related topics, leveraging collaboration tools to invite industry experts as guest speakers.

You can automate webinar sequences to ensure continuous engagement, providing valuable insights to your audience and showcasing your expertise.

#7. Sales Funnel Optimization

Constantly optimize your mortgage sales funnel with GoHighLevel's robust features. You will be able to implement A/B testing to refine your mortgage-related offers and messages, which ensures you stay ahead of the competition.

You can use analytics and insights provided by GoHighLevel for continuous improvement, and integrate seamlessly with external analytics tools for comprehensive data analysis.

#8. Client Communication

As you already know communication is the backbone of successful mortgage transactions.

GoHighLevel offers automated communication tools to keep clients informed about updates on their mortgage applications.

Which ensures secure and confidential communication between advisors and clients through integrated messaging systems. Choose communication channels preferred by your mortgage clients for a personalized and secure experience.

GoHighLevel provides a comprehensive suite of features designed to elevate your mortgage business. From lead generation to personalized communication, GoHighLevel empowers mortgage professionals to thrive in a competitive market.

Leads Generation for Mortgage Broker

In this section, I will cover how you can use GoHighLevel to generate leads for your Mortgage Services.

#1. Create An Attention-grabbing Landing Page

To kick off your journey with GoHighLevel for your mortgage business, begin by crafting an attention-grabbing landing page.

Ensure it's loaded with compelling content, attractive visuals, and straightforward calls to action, prompting visitors to share their contact details.

Moreover, leverage the landing page to gather specific details from potential mortgage clients, like their budget, preferred property type, and other pertinent information.

This added insight allows you to grasp their needs better, enabling you to customize your services to fit their requirements seamlessly.

#2. Create an Automated Follow-up Process

Once you have your mortgage client's contact details, use GoHighLevel to establish an automated follow-up system, guiding the lead until they're prepared to make a purchasing decision.

Use tools like email, text messages, phone calls, or other preferred communication methods.

GoHighLevel's customization features enable you to design sequences delivering personalized content tailored to your client's specific property preferences.

This targeted approach enhances your sales process's efficiency, offering a smooth and tailored experience for your customers.

For example.

If a client is interested in single-family homes, you can automate the delivery of pertinent content, streamlining the process and saving you valuable time that would otherwise be spent on manual message sending.

#3. Use Remarketing and Retargeting Campaigns

After obtaining information from potential mortgage clients, GoHighLevel empowers you to create remarketing and retargeting campaigns tailored specifically for those leads.

Remarketing and retargeting efforts can span various channels, including display ads, search engine marketing campaigns, and email campaigns.

Go High Level simplifies this process with a user-friendly interface, enabling seamless integration of tracking pixels from different ad networks.

By leveraging GoHighLevel, you can effortlessly implement effective remarketing and retargeting strategies, staying connected with your mortgage leads and enhancing the likelihood of converting them into satisfied customers.

#4. Create an Automated Webinar

With GoHighLevel, you will be able to effortlessly organize and host webinars covering topics relevant to the mortgage industry.

During these webinars, seize the opportunity to showcase your mortgage services, address common questions, and offer valuable insights to your audience.

Furthermore, you can tap into the expertise of industry professionals like fellow mortgage brokers or specialists by inviting them as guest speakers in your webinars.

This collaborative approach not only boosts your credibility but also demonstrates your dedication to providing comprehensive solutions to your mortgage clients.

Traffic Generation: GoHighLevel for Mortgage Agents

Generating traffic is crucial for any online business, including a mortgage brokerage. Here are some smart ways to boost traffic and gain more exposure for your mortgage brokerage:

#1: Using Facebook

Here Are The Ways to Attract More Mortgage Clients Leads with Facebook

1: Once you've signed up for GoHighLevel and set up your funnel, it's important to optimize your Facebook page to attract the right audience and guide them into your sales funnel.

For example:

The first you need is a professional picture and a well-designed banner that relates to your Mortgage business and CTA.

In your bio, clearly state that you are a realtor and include a link back to your Mortgage services funnel.

It is going to serve as an organic promotional method. In addition, when you post a new listing, in the end, you could write Learn More Here.

2: Use 360 video and photo ads

Using 360 videos and photos in Facebook ads allows potential buyers to virtually explore the property, creating a stronger desire to purchase.

You can run a Facebook ad that links to the funnel created in GoHighLevel for Mortgage.

You can do a Facebook ad that links to the funnel created in ClickFunnels for Mortgage Broker.

3: Connect with Facebook Live

Facebook Live is a powerful tool for realtors as it provides an authentic and unedited view of the property, which has been proven to drive more sales.

By going live, Mortgage brokers can connect with potential borrowers on a personal level, engage in real-time conversations, address any questions or concerns, and ultimately encourage a sale.

This interactive approach builds trust and allows buyers to get a better sense of the property's features and atmosphere.

Some ideas of the types of content you can share include on your Facebook lives:

- Sneak peek into upcoming mortgage events

- Q&A session about mortgages, interest rates, and home listing tips

- Tips for preparing to list or run a mortgage-related open house

- Neighborhood walk highlighting key features and amenities for potential homebuyers

- Highlights from your experience at a mortgage industry event

- Reminder about an upcoming mortgage-related event and its highlights

- Interview with a recent client who has successfully closed on a home loan

#2: Using Google and SEO

Optimizing your Mortgage business for organic search traffic from Google includes focusing on local SEO, starting with claiming your Google

My Business (GMB) page. It's important to ensure that your Name, Address, and Phone (NAP) details are consistently added across your sales funnel and websites.

Generating leads through SEO for your real estate business requires creating a content-rich website that attracts visitors and guides them to your sales funnel on GoHighLevel.

Also, implementing the above-mentioned tactics can help drive traffic to your site.

To create a website, you'll need a domain (if you don't have one) and can sign up for a hosting account on Bluehost.com, which simplifies the process.

GoHighLevel for Mortgage Business: FAQs

Here's an updated list of questions we do receive from our blog users regarding GoHighLevel for Mortgage Business.

Can GoHighLevel be Used for Mortgage Agents?

YES, GoHighLevel is a valuable tool for mortgage agents. It provides comprehensive features that allow mortgage agents to streamline their marketing efforts, automate processes, and enhance client communication.

Can GoHighLevel be integrated with other tools used in the mortgage industry?

Yes, GoHighLevel offers integrations with various third-party tools, allowing seamless integration with other software commonly used in the mortgage industry.

Does GoHighLevel offer Customer Support for Mortgage Brokers?

Yes, GoHighLevel provides customer support through various channels, including live chat, email support, and a knowledge base with tutorials and guides.

Final Words on GoHighLevel For Mortgage Broker

One of the best ways Mortgage Brokers can win new clients on automation (while having a nice time with their loved ones) is doing effective marketing online and exploiting sales funnels to their advantage.

Traditional marketing methods doesn't longer works, obviously.

If you’re a Mortgage broker looking to grow your business, using GoHighLevel can help take your sales to funnel to the next level. With its intuitive user interface and powerful features, it’s easy to see why GoHighLevel is becoming increasingly popular for small business owners.

From generating automated email sequences to creating, free funnels and templates, A/B testing landing pages, and identifying new leads, using GoHighLevel ensure that you’ve got everything needed to execute a successful sales funnel and build relationships with prospects.

Get started with GoHighLevel for a free 14days FREE trial here.