Today, I will show you how to use GoHighLevel for Credit Repair professionals – and explode your business this year.

Credit Repair is an industry where efficiency, organization, and effective communication are paramount, GoHighLevel stands out as a tool that is changing the game.

GoHighLevel is a powerful all-in-one platform that caters to the unique needs of credit repair professionals.

It is a comprehensive solution designed to streamline and enhance various aspects of credit repair processes, making it an invaluable tool for individuals and businesses in the credit repair industry.

Whether you're a credit repair specialist, a credit counseling agency, or a firm dedicated to improving credit scores, HighLevel offers a suite of features that can elevate your operations and contribute to the success of your credit repair endeavors.

Key Takeaways:

- GoHighLevel offers a wide range of features and tools specifically designed to streamline credit repair processes.

- You can automate repetitive tasks and workflows and focus your time and energy on high-value activities.

- GoHighLevel for credit repair complies with credit repair regulations and implements security measures to protect sensitive client information.

Let's start!

Why Do You Need GoHighLevel for Credit Repair?

Let's explore why GoHighLevel is the best solution for credit repair right now:

- Comprehensive Client Management

GoHighLevel offers a robust CRM system that allows you to organize and manage client information effectively.

With features such as contact management, lead tracking, and appointment scheduling, you can keep detailed records of your client's credit repair journey in one centralized location.

- Automated Workflows

One of the key benefits of using GoHighLevel for credit repair is its ability to automate repetitive tasks and workflows.

You can set up automated processes for sending dispute letters, following up with clients, and tracking progress over time.

This saves you time and ensures that important tasks are completed efficiently.

- Customizable Communication

Effective communication is essential in credit repair, and GoHighLevel provides a range of communication tools to help you stay connected with your clients.

From personalized email campaigns to SMS messaging and voice broadcasts, you can communicate with your clients in a way that suits their preferences and keeps them informed throughout the credit repair process.

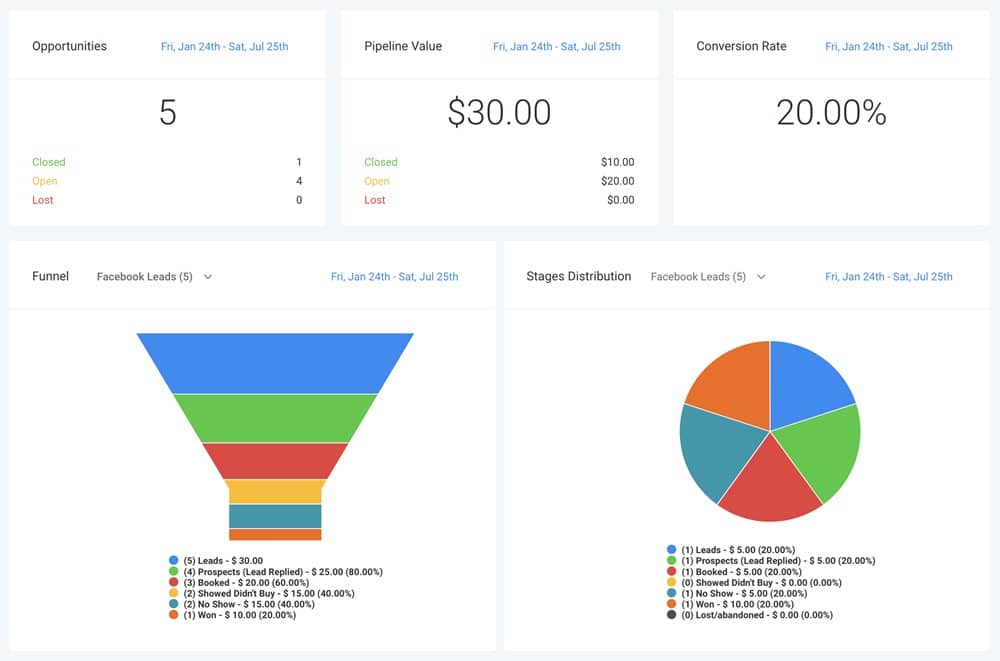

- Advanced Reporting and Analytics

GoHighLevel offers powerful reporting and analytics features that allow you to monitor credit repair progress and track key metrics over time.

You can generate custom reports to analyze credit score changes, account statuses, dispute outcomes, and more.

This data-driven approach enables you to make informed decisions and adjust your credit repair strategies as needed.

- Compliance and Security

Compliance with credit repair regulations is crucial, and GoHighLevel takes security and compliance seriously.

The platform adheres to industry standards and regulations, such as the Fair Credit Reporting Act (FCRA), to ensure that your credit repair activities are conducted legally and ethically.

By leveraging GoHighLevel's comprehensive features and tools, you can streamline your credit repair processes, improve client management, and achieve better results for your clients.

How to Use GoHighLevel for Credit Repair Professionals

let's explore how to effectively utilize GoHighLevel's features and tools for credit repair:

Free Trial Account Creation

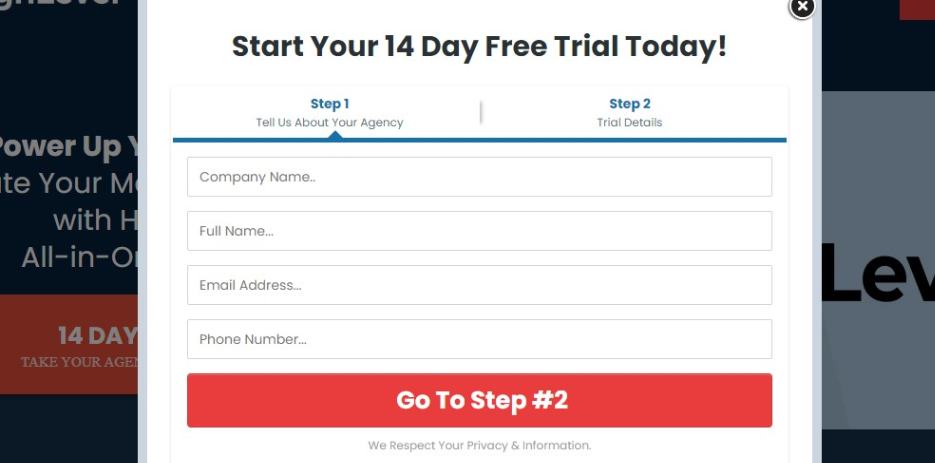

To start using GoHighLevel for your credit repair business, you first need to create an account.

There's a free trial for that which you can use to learn how GoHighLevel works and set things together before full commitment.

Now, go to GoHighLevel.com/14-day-trial and “Start Your 14-Day Trial“.

A new page will pop up that will ask for basic information about you and your business.

This is what is required:

- Company name

- Your full name

- Email address

- Phone number

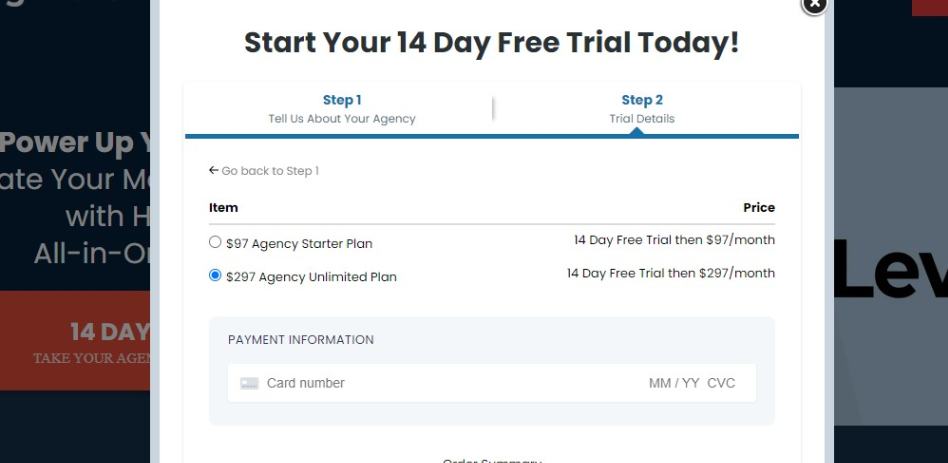

Now, click “Go To Step #2” and provide your card details to start the trial – You will not be debited any amount until the end of your trial.

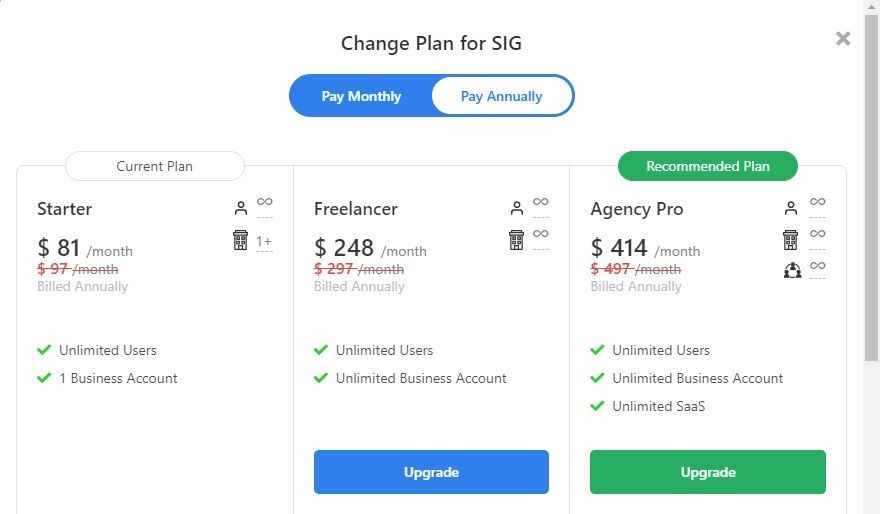

You also need to choose the plan you want to opt-in for – you do not hard time deciding this, you can always change it later.

You will also be able to save hugely if you continue to use GHL at the end of your trial.

You only pay for 10 months of service fee and get 2 months free should be in case you go for the yearly plan.

You get a 17% discount instead of the normal price.

The table below shows you a piece of more detailed information on this.

| GoHighLevel Plan | Monthly Price | Annual Price | Price Per Month (Paid Annually) |

|---|---|---|---|

| Agency Starter | $97 | $970 | $80.83 |

| Agency Unlimited | $297 | $2,970 | $247.50 |

| Agency SaaS Pro | $497 | $4,970 | $414.16 |

Organizing Client Information

Now, the next thing is to start organizing your client information and you have to take your time to set this up properly.

By setting it up in the proper way, will prepare the ground for success for you since you understand each and every one of your clients properly.

To do that, us the CRM system to create detailed client profiles, including contact information, credit scores, account statuses, and dispute histories.

This centralized database will serve as the foundation for managing your clients' credit repair journey.

If you take a look at the image above, you will see that it contains so much information and that is how yours should be when you start generating data.

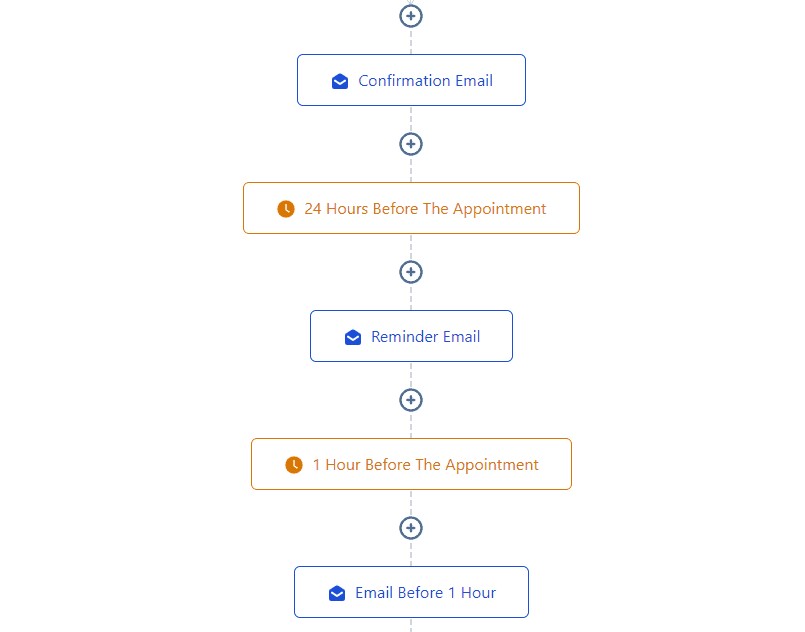

Creating Automated Workflows

Workflow makes your work easier on GoHighLevel and setting it up will contribute to your business success hugely.

Take advantage of GoHighLevel's automation capabilities to streamline credit repair processes.

Set up automated workflows to send dispute letters, follow up with clients, and schedule reminders for important tasks.

By automating repetitive tasks, you can save time and ensure that nothing falls through the cracks.

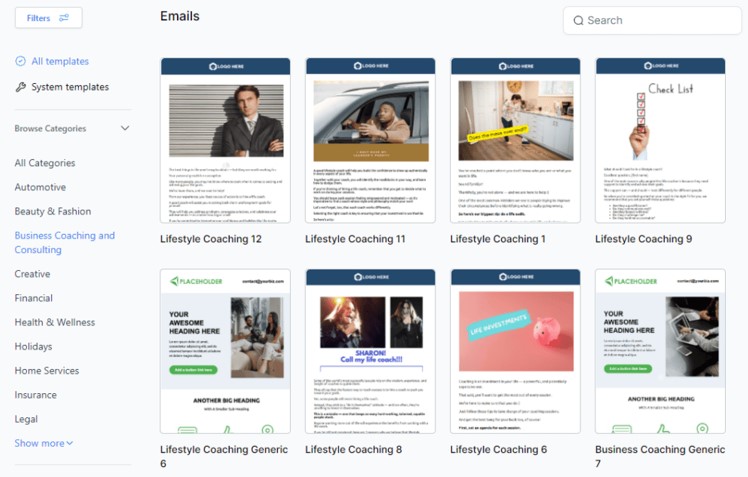

Customizing Communication

Effective communication is key to successful credit repair. Use GoHighLevel's communication tools to stay connected with your clients throughout the credit repair process.

And you can easily use templates to set this up.

Customize email templates, SMS messages, and voice broadcasts to provide updates, share important information, and encourage client engagement.

Tracking Progress and Analytics

Monitor credit repair progress and track key metrics using GoHighLevel's reporting and analytics features.

Generate custom reports to analyze credit score changes, dispute outcomes, and client satisfaction levels.

By tracking progress over time, you can identify areas for improvement and adjust your credit repair strategies accordingly.

Ensuring Compliance and Security

When using GoHighLevel for credit repair, it's essential to prioritize compliance and security.

Familiarize yourself with credit repair regulations, such as the Fair Credit Reporting Act (FCRA), and ensure that your credit repair activities adhere to legal and ethical guidelines.

Additionally, implement security measures within the platform to protect sensitive client information and maintain trust and credibility.

By effectively utilizing GoHighLevel's features and tools for credit repair, you can streamline your processes, improve client management, and achieve better results for your clients.

Strategies for Using GoHighLevel Effectively in Credit Repair

Now that we've explored the foundational aspects of credit repair and how GoHighLevel can be leveraged for this purpose,

Let's dive into specific strategies and best practices for using GoHighLevel effectively in your credit repair business:

Optimize Client Onboarding Processes

Streamline the client onboarding process by creating customized intake forms and automating data collection.

Use GoHighLevel's forms feature to gather essential client information, such as personal details, credit reports, and financial histories, and automatically populate client profiles within the CRM system.

Segment Clients for Targeted Communication

Segment your clients based on their credit repair needs, goals, and preferences.

Use tags and filters within GoHighLevel's CRM system to categorize clients into different groups, such as those with specific credit issues or those at different stages of the credit repair process.

This allows you to send targeted communications and personalized messages to each client group, increasing engagement and effectiveness.

Implement Automated Follow-Up Sequences

Set up automated follow-up sequences to keep clients engaged and informed throughout the credit repair process.

Create drip campaigns using GoHighLevel's automation tools to send timely follow-up messages, reminders, and updates to clients at key milestones.

This helps to maintain communication, build trust, and keep clients motivated as they work towards improving their credit scores.

Utilize Task Management for Workflow Optimization

Take advantage of GoHighLevel's task management features to streamline workflow processes and ensure tasks are completed efficiently.

Create task lists and assign responsibilities to team members or yourself for various credit repair activities, such as sending dispute letters, reviewing credit reports, and following up with creditors.

Set deadlines and priorities to stay organized and on track with your credit repair efforts.

Track Key Performance Indicators (KPIs)

Monitor key performance indicators (KPIs) related to credit repair progress using GoHighLevel's reporting and analytics tools.

Track metrics such as credit score changes, dispute resolution rates, client retention rates, and revenue generated from credit repair services.

Analyze trends and patterns over time to identify areas for improvement and optimize your credit repair strategies for better results.

Provide Ongoing Education and Support

Offer ongoing education and support to clients throughout the credit repair process.

Use GoHighLevel's communication tools to share educational resources, tips, and guidance on credit management, budgeting, and financial literacy.

Provide personalized support and encouragement to help clients stay motivated and committed to their credit repair goals.

By implementing these strategies and best practices, you can maximize the effectiveness of GoHighLevel in credit repair and provide exceptional service to your clients.

GoHighLevel Features for Credit Repair

Key Features of GoHighLevel for Credit Repair Professionals that you will need as you start using GoHighLevel to run your business:

- Lead Generation Tools

GoHighLevel simplifies lead generation for credit repair professionals with robust tools like landing pages, forms, and automated campaigns. Capture and nurture leads effortlessly.

- Communication Hub

The platform acts as a centralized communication hub, allowing professionals to engage with clients through various channels—SMS, email, phone calls, and more—ensuring timely and effective communication.

- Automation for Efficiency

Automation features streamline repetitive tasks, such as follow-ups, status updates, and appointment scheduling.

This efficiency allows professionals to focus on strategic aspects of credit repair.

- Client Relationship Management (CRM)

The CRM system enables credit repair professionals to manage client information, track interactions, and maintain detailed records.

This organized approach enhances client relationships and simplifies ongoing services.

- Project Management Tools

GoHighLevel provides project management features that enable professionals to assign tasks, set deadlines, and monitor progress.

This ensures that credit repair projects stay on track and deadlines are met.

- Task Automation and Reminders

Set automated reminders for important tasks and deadlines. This feature ensures that no crucial step in the credit repair process is overlooked, enhancing overall project efficiency.

- Customizable Client Portals

Credit repair professionals can create personalized client portals within GoHighLevel.

These portals provide clients with real-time updates on their credit repair status, fostering transparency and trust.

- Appointment Scheduling

Seamlessly schedule appointments with clients using GoHighLevel.

The built-in calendar and scheduling tools simplify the process, ensuring efficient time management for both professionals and clients.

- Document Management

Store and manage documents securely within the platform.

This feature facilitates easy access to essential files, agreements, and client documents, promoting a paperless and organized workflow.

- Analytics and Reporting

Gain insights into the performance of credit repair campaigns and overall business operations.

GoHighLevel offers analytics and reporting tools to track key metrics, allowing professionals to make data-driven decisions.

These features collectively make GoHighLevel a powerful and comprehensive solution for credit repair professionals, addressing their specific needs and enhancing the overall efficiency of their operations.

Benefits of Using GoHighLevel for Credit Repair Professionals

Let's explore the benefits you stand to gain when you start using GoHighLevel for Credit Repair:

- Efficient Client Management

GoHighLevel's CRM system allows credit repair professionals to efficiently manage client information.

The platform centralizes client data, making it easy to track interactions, monitor progress, and provide personalized services.

- Streamlined Communication

The integrated communication channels, including SMS, email, and phone systems, enable seamless communication with clients.

Automated messaging and personalized communication strategies enhance engagement and responsiveness.

- Automated Follow-Ups

Credit repair often requires consistent follow-ups.

GoHighLevel's automation features allow professionals to create automated follow-up campaigns, ensuring clients receive timely updates, reminders, and status reports without manual intervention.

- Project Organization

GoHighLevel's project management tools aid in organizing credit repair projects.

Credit repair professionals can assign tasks, set deadlines, and monitor project progress, leading to enhanced team collaboration and efficient project completion.

- Appointment Efficiency

The built-in calendar and scheduling tools simplify appointment scheduling for credit repair professionals.

Clients can easily book appointments, reducing administrative burden and enhancing overall time management.

- Enhanced Transparency

GoHighLevel's client portals provide clients with real-time access to their credit repair status.

This transparency fosters trust and confidence, as clients can stay informed about the progress of their credit improvement journey.

- Paperless Workflow

The document management features within GoHighLevel contribute to a paperless workflow.

Credit repair professionals can securely store and manage essential documents, agreements, and client files within the platform.

- Task Automation

Automation extends to various credit repair tasks, allowing professionals to optimize their workflow.

From document collection to progress tracking, GoHighLevel's automation features save time and increase overall operational efficiency.

- Customizable Campaigns

Credit repair professionals can create customized campaigns to attract and capture leads.

GoHighLevel's lead generation tools offer flexibility in designing landing pages and forms, enhancing the effectiveness of marketing efforts.

- Scalability and Growth

As credit repair businesses grow, GoHighLevel provides scalability.

The platform accommodates increasing client loads, ensuring that credit repair professionals can expand their services without compromising efficiency.

By leveraging these benefits, credit repair professionals can elevate their operations, improve client experiences, and achieve sustainable growth with GoHighLevel.

GoHighLevel for Credit Repair: Case Studies and Success Stories

In this section, I'll explore real-life case studies and success stories of individuals who have successfully used GoHighLevel for credit repair.

These examples will provide insights into how GoHighLevel can be effectively utilized to improve credit scores and financial wellness.

1. Case Study: John's Credit Repair Journey

John, a freelance financial advisor, struggled with a low credit score due to past financial mistakes.

Determined to improve his credit and achieve his financial goals, John turned to GoHighLevel for assistance.

Using GoHighLevel's CRM system, John organized his client information, tracked credit repair progress, and automated follow-up tasks to stay on top of his clients' needs.

By implementing targeted communication strategies and providing personalized support.

John was able to help his clients dispute inaccuracies, negotiate with creditors, and ultimately improve their credit scores.

Within six months, John's clients saw significant improvements in their credit scores, leading to better financial opportunities and improved overall financial wellness.

2. Success Story: Sarah's Credit Repair Success

Sarah, a small business owner, faced challenges with her credit due to past financial difficulties and identity theft. Determined to rebuild her credit and secure financing for her business, Sarah sought assistance from a credit repair professional using GoHighLevel.

The credit repair professional used GoHighLevel's automated workflows to streamline the dispute process, track progress, and communicate with Sarah throughout her credit repair journey.

Through targeted dispute efforts and ongoing support from the credit repair professional, Sarah was able to remove inaccuracies from her credit report, improve her credit score, and qualify for financing to grow her business.

Sarah's success story highlights the effectiveness of GoHighLevel in helping individuals overcome credit challenges and achieve their financial goals.

These case studies and success stories demonstrate the real-world impact of using GoHighLevel for credit repair. By leveraging GoHighLevel's features and tools effectively, individuals and businesses can improve credit scores, gain access to better financial opportunities, and achieve greater financial wellness.

GoHighLevel for Credit Repair – FAQs

Frequently Asked Questions about GoHighLevel for Credit Repair.

Does GoHighLevel Work for Credit Repair?

Yes, GoHighLevel is well-suited for credit repair professionals. Its comprehensive CRM features, communication tools, and automation capabilities streamline credit repair processes, which enhances overall efficiency.

How Does Automation Benefit Credit Repair Professionals?

Automation in GoHighLevel allows credit repair professionals to automate follow-ups, client communication, and various tasks. This significantly reduces manual workload, ensuring a more streamlined and efficient workflow.

Is GoHighLevel Secure for Managing Sensitive Client Information?

Yes. GoHighLevel prioritizes data security, employing industry-standard encryption protocols to safeguard sensitive client information. The platform ensures compliance with data protection regulations.

Final Thoughts

GoHighLevel offers a powerful set of tools and features that can revolutionize the credit repair process.

By leveraging GoHighLevel effectively, individuals and businesses can streamline workflows, improve client management, and achieve better results in credit repair efforts.

Whether you're a seasoned professional or just starting, GoHighLevel provides the support and resources you need to succeed in the world of credit repair.

Take advantage of its automation capabilities, communication tools, and analytics features to unlock your full potential and help your clients achieve their financial goals.

Sign up for a 14-day free trial to experience firsthand how GoHighLevel can transform and elevate your credit repair business.