If you're a loan officer looking for a simple yet powerful way to manage leads, automate follow-ups, and close more deals, then GoHighLevel for Loan Officers is the perfect tool for you.

Instead of juggling multiple software tools for CRM, marketing, and communication, GoHighLevel brings everything under one roof – saving you time, reducing stress, and increasing efficiency.

As a loan officer, your success depends on building relationships, staying organized, and following up with leads at the right time.

But let’s be honest – doing all this manually can be overwhelming. That’s where GoHighLevel comes in.

GoHighLevel is the new CRM tool that is changing how professional loan officers approach marketing and sales.

It doesn't matter if you are:

In this guide, you’ll learn how to use GoHighLevel as a loan officer to streamline your workflow, generate high-quality leads, and improve client relationships.

Key Takeaways:

- GoHighLevel helps loan officers automate lead follow-ups, ensuring timely communication and higher conversions.

- GoHighLevel allows loan officers to optimize marketing campaigns and improve lead generation results with powerful analytics.

- GoHighLevel streamlines client communication with personalized templates and notifications, enhancing the client experience.

Let’s get started! 🚀

Why GoHighLevel is a Game-Changer for Loan Officers

If you're a loan officer struggling to keep up with leads, follow-ups, and marketing, GoHighLevel can completely transform how you work.

Instead of bouncing between multiple tools for CRM, emails, SMS, and appointment scheduling, GoHighLevel consolidates everything into one powerful platform.

Here’s why GoHighLevel is a game-changer for loan officers:

Automating Lead Generation & Follow-Ups

- Capture leads effortlessly with high-converting landing pages and funnels.

- Set up automated SMS and email follow-ups to nurture leads without manual effort.

- Reduce response time with AI-driven chatbots and automated reminders.

Improving Client Communication & Relationship Management

- Manage all conversations (SMS, email, calls, and social media) from a single inbox.

- Send personalized messages and automated updates to keep clients engaged.

- Use two-way texting to increase response rates and speed up loan processing.

Streamlining Appointment Scheduling & Workflow Automation

- Allow clients to book meetings directly through a self-service calendar.

- Automate appointment reminders via email and SMS to reduce no-shows.

- Create automated workflows for loan application processes, reducing manual work.

Reducing Dependency on Multiple Software Tools

- Replace outdated CRMs, email marketing tools, and scheduling apps with GoHighLevel.

- Integrate with major loan processing platforms for seamless operations.

- Access real-time reporting to track lead conversions and campaign performance.

GoHighLevel saves time, increases efficiency, and helps you close more loans with less effort.

How to Set Up GoHighLevel for Loan Officers

Here's how to set it up:

Step 1: Creating Your GoHighLevel Account

Since you will be setting up your account – you should do that for FREE!

Luckily, you can get a 30-day free trial here.

To start, go to GoHighLevel.com/30-day-trial and you will be redirected to the page below.

![What is GoHighLevel? [A User Experience] 6 GoHighLevel 30 Day Trial Home Page](https://theolaoye.com/wp-content/uploads/2024/11/GoHighLevel-30-Day-Trial-Home-Page.jpg)

Click on “30-Day Free Trial” and you will be asked basic information about your business, such as:

- Company Name

- Full Name

- Phone Number

- Email Address

![What is GoHighLevel? [A User Experience] 7 GoHighLevel 30 Day Trial Home Page 2](https://theolaoye.com/wp-content/uploads/2024/11/GoHighLevel-30-Day-Trial-Home-Page-2.jpg)

Upon filling in everything, click on “Go To Step #2” where you will be asked to select the plan you want.

For now, you need to Select the GoHighLevel Unlimited Plan and you will be able to upgrade or downgrade later.

You will be asked to input your credit card details next – you will not be debited anything until the end of your trial.

After that, the next is, the onboarding process.

Step 2: GoHighLevel Onboarding

Once you finish the steps above, Go High Level will ask you some onboarding questions to ensure that your account is well set up.

Let’s take a look at them!

The first thing is to tell GHL more about your business, you would need to:

- Select the industry you operate in

- The primary purpose of using GoHighLevel

- The number of your customers

- And if you have a website

Supply the information based on what is right for you.

![What is GoHighLevel? [A User Experience] 8 GoHighLevel Onboarding Process Stage 1](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-1-1024x493.jpg)

If anything isn’t clear to you now, select anything and continue because you can always change it later.

The next page will ask for your business address and billing information.

Then, you need to specify if you’re willing to resell GoHighLevel or not.

Reselling GoHighLevel means that you can resell the entire platform on your name – at your prices and keep the balance.

![What is GoHighLevel? [A User Experience] 9 GoHighLevel Onboarding Process Stage 2](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-2-1024x498.jpg)

Just fill in the blank as you can see above and proceed to the next stage.

![What is GoHighLevel? [A User Experience] 10 GoHighLevel Onboarding Process Stage 3](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-3-1024x516.jpg)

If you take a closer look at the image above, you will see that it’s asking you to select the tools you currently use.

Selecting the tools is going to keep you organized under one single dashboard.

So, select all that apply and proceed to the next stage.

And if you have none for now, just click on “Next ->“

![What is GoHighLevel? [A User Experience] 11 GoHighLevel Onboarding Process Stage 4](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-4-1024x510.jpg)

So, the next stage will ask you to set up your password and a code will be sent to your email for confirmation.

Input the code and you will have the page below which confirms that your GoHighLevel account has been created.

I want to say congratulations, you have just set up your HighLevel account.

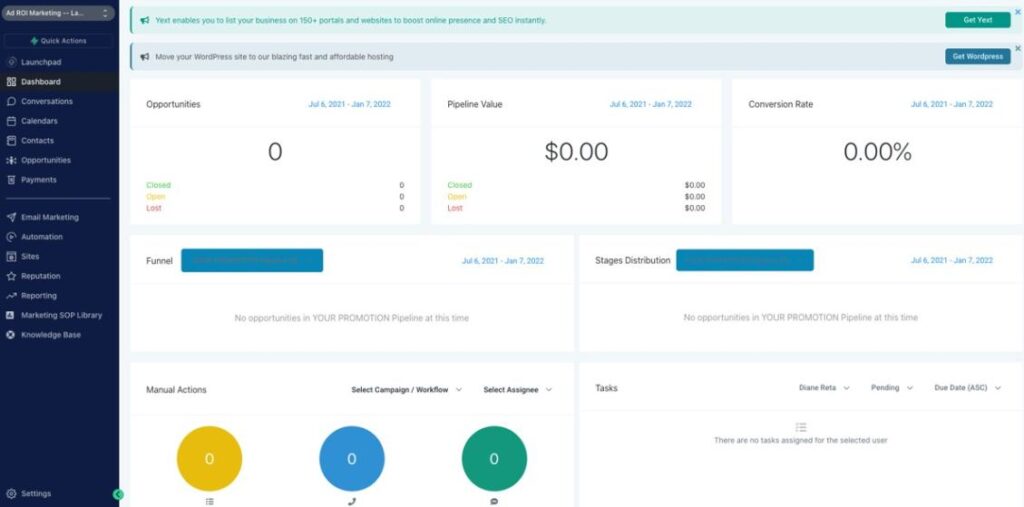

Now, you have access to your dashboard which looks like the image below.

![What is GoHighLevel? [A User Experience] 12 GoHighLevel Agency Dashboard](https://saaspen.com/wp-content/uploads/2024/08/GoHighLevel-Agency-Dashboard-1024x463.jpg)

Once you have everything set up, you’re ready to start using GoHighLevel to generate, nurture, and convert leads efficiently.

Important Settings for GoHighLevel for Loan Officers

To complete the setting up of your GoHighLevel Account and make it work for your loan business.

These are important steps to take right away:

CRM & Lead Management

Managing your leads and clients is at the heart of GoHighLevel. With its CRM, you can track every interaction, every loan application, and automate the entire follow-up process.

What You Can Do:

- Organize contacts by status (e.g., New Leads, In Progress, Approved, Closed)

- Use custom fields to track specific client information (e.g., loan type, application status)

- Set up automated follow-ups based on client behavior and status updates

How to Use It:

- When a new lead comes in, add them to your CRM pipeline and categorize them based on their stage.

- Set up automated SMS and email sequences to follow up with leads based on their pipeline status (e.g., “Loan Pre-Approval Reminder” or “Document Submission Follow-Up”).

- Regularly update the lead status to track progress and move clients through the pipeline (New → In Progress → Approved → Closed).

Tips to Get the Best Out of CRM & Lead Management:

- Customize your pipeline stages to match your loan process.

- Use tags to categorize leads (e.g., “Mortgage”, “Refinance”, “Commercial Loan”) for better organization.

- Take advantage of automated workflows to send reminders, status updates, and pre-qualification messages.

Automating Marketing & Lead Generation

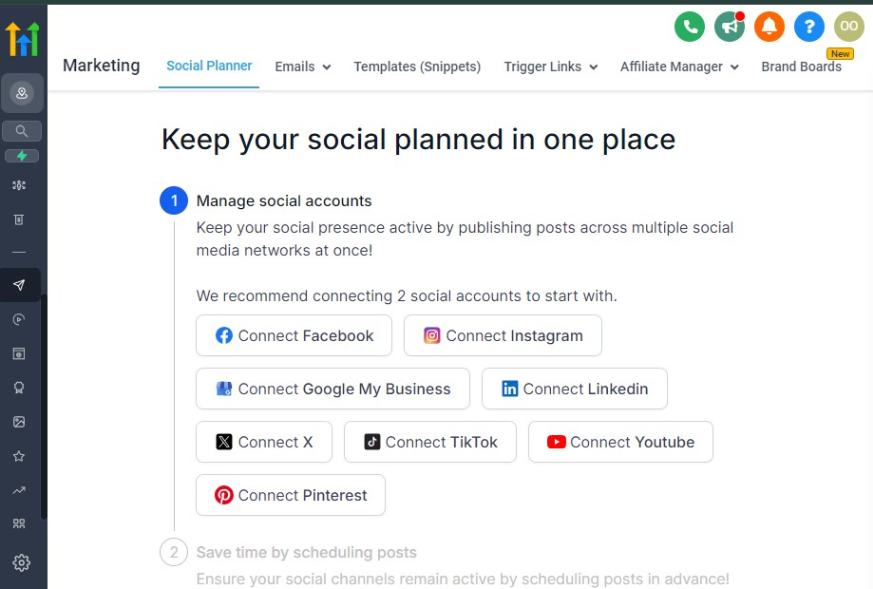

GoHighLevel allows you to set up automated marketing campaigns to attract high-quality leads.

You can build funnels, landing pages, and automated email and SMS campaigns to generate and nurture leads without manual effort.

What You Can Do:

- Create landing pages that capture borrower details for loan pre-qualification or consultation.

- Set up marketing funnels that guide leads from awareness to conversion.

- Automate email and SMS sequences to nurture leads and keep them engaged.

How to Use It:

- Use GoHighLevel’s funnel builder to create a high-converting mortgage funnel. This could include a landing page for a free loan consultation or a quiz that pre-qualifies borrowers.

- Integrate your CRM with automated email sequences that follow up with leads based on their behavior (e.g., lead magnet download, form submission).

- Create SMS automation to send personalized loan offers or reminders to follow up on a lead.

Tips to Get the Best Out of Marketing & Lead Generation:

- Always test your landing pages and funnels with A/B testing to improve conversions.

- Integrate GoHighLevel with Facebook and Google Ads to run campaigns directly from the platform.

- Use lead magnets like free mortgage calculators, homebuyer guides, or loan pre-qualification forms to capture high-quality leads.

GoHighLevel for Loan Officers – Funnel & Website Builder

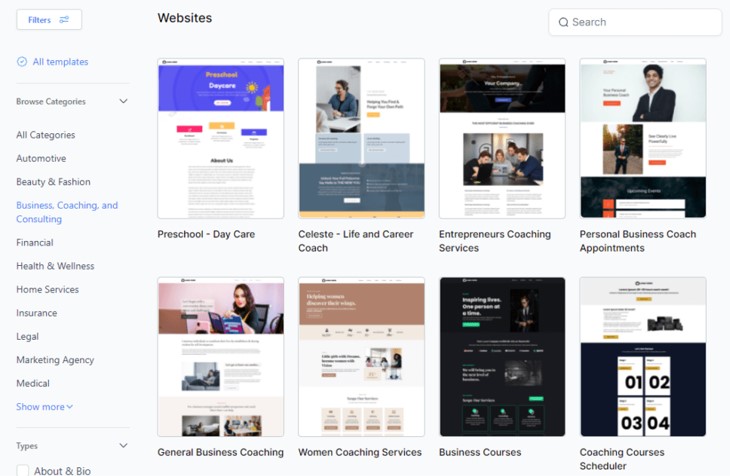

GoHighLevel includes a robust funnel and website builder that allows you to create professional websites and high-converting landing pages without needing a developer.

This is particularly useful for loan officers who want to showcase their services and generate leads online.

What You Can Do:

- Build a fully branded website with your contact details, services, and loan application forms.

- Create loan-specific funnels, like a mortgage pre-qualification funnel or a loan consultation funnel.

- Add booking forms to your landing pages to allow clients to schedule appointments easily.

How to Use It:

- Use GoHighLevel’s drag-and-drop builder to design your website and funnels, no coding required.

- Include client testimonials, loan application details, and clear calls-to-action (e.g., “Get Pre-Qualified Today”).

- Add appointment scheduling forms so clients can book consultations directly through the funnel.

Tips to Get the Best Out of Funnel & Website Builder:

- Keep your funnel simple, with clear steps for your clients to follow, such as “Get Pre-Qualified → Schedule Consultation → Submit Documents.”

- Use SEO-friendly settings to make your website easily discoverable on Google.

- Optimize your website for mobile users, as many clients will browse on their phones.

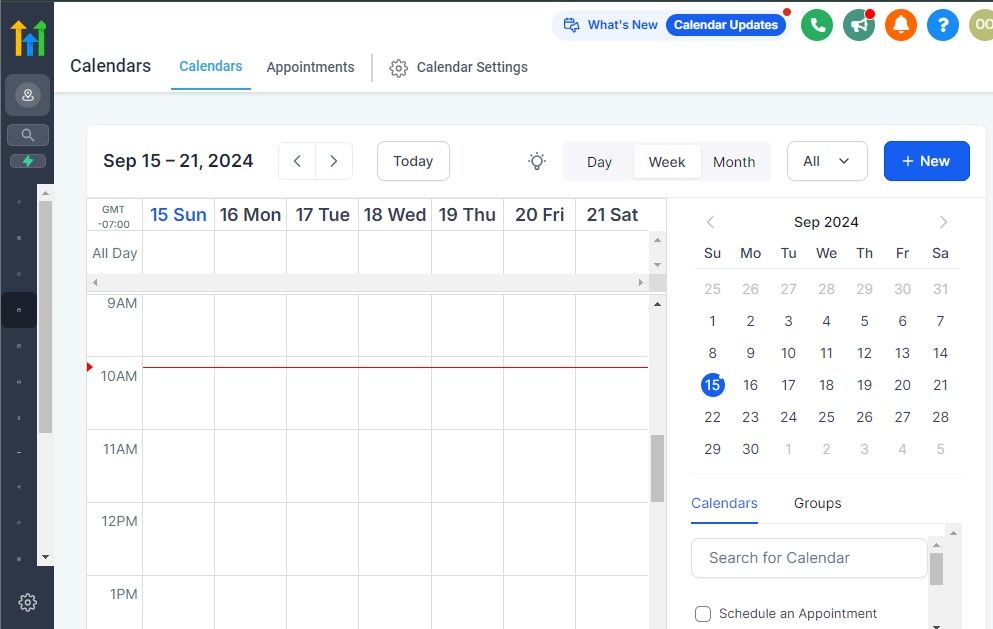

Calendar & Appointment Scheduling

Gone are the days of sending endless emails to schedule a meeting.

With GoHighLevel, clients can book appointments directly through your calendar, reducing back-and-forth and ensuring a seamless scheduling process.

What You Can Do:

- Set up a calendar link that clients can use to book consultations or follow-up calls.

- Sync your calendar with Google Calendar for a unified scheduling experience.

- Send automated reminders to clients before scheduled meetings to reduce no-shows.

How to Use It:

- Customize your availability settings, making sure clients can only book meetings when you’re free.

- Share your calendar link in email sequences, SMS messages, or directly on your website.

- Automate appointment reminders via SMS and email to ensure clients show up on time.

Tips to Get the Best Out of Calendar & Appointment Scheduling:

- Use the group appointment feature to allow multiple clients to book slots within the same time frame, such as for group mortgage consultation sessions.

- Integrate your calendar with Zoom or Google Meet to set up virtual meetings directly from GoHighLevel.

- Set up buffer times between appointments to avoid running late and manage your time better.

With these key settings, GoHighLevel can help you manage leads, automate your marketing, and streamline the loan application process – all from one place.

Managing Your Reputation with GoHighLevel

For loan officers, reputation is everything. Positive reviews and a solid online presence can make the difference between gaining a new client and losing one.

GoHighLevel offers powerful reputation management tools that can help you maintain and improve your reputation online.

What You Can Do:

- Automate the process of asking clients for reviews after loan closings.

- Monitor and respond to reviews across multiple platforms (Google, Facebook, etc.) from one dashboard.

- Set up automated follow-up sequences to encourage happy clients to leave positive reviews.

How to Use It

Set Up Review Request Automation

- Create a workflow that automatically sends review requests to clients after their loan is approved or closed. You can send a message via email or SMS, thanking them for their business and requesting a review.

- Personalize the message by addressing the client by name and including a link to your review page.

Monitor Your Online Reputation

- GoHighLevel pulls in reviews from platforms like Google, Facebook, and Yelp into one centralized dashboard. This allows you to quickly check feedback and respond promptly.

- When a new review comes in, you'll get notifications, so you can stay on top of your reputation.

Respond to Reviews

- Respond to both positive and negative reviews in a timely manner. Show appreciation for positive feedback, and address any negative reviews professionally and respectfully. This helps show your clients that you value their opinions and are committed to improving.

Use Reputation Management to Attract More Leads

- Having positive reviews on your website, funnels, and landing pages can help build trust with potential clients. Use testimonials in your marketing efforts to show prospects that you’re a trusted expert in your field.

Tips to Get the Best Out of Reputation Management

Set up automated reminders to follow up with clients and encourage reviews. The more positive feedback you collect, the more potential clients will trust your services.

Respond quickly to any negative reviews. A prompt, professional response can help diffuse dissatisfaction and show that you care about your clients’ experiences.

Ask satisfied clients for specific feedback about their experience. Reviews that highlight specific aspects of your service, such as helpfulness, responsiveness, and professionalism, can be more persuasive to potential clients.

A strong online reputation can lead to more referrals, stronger relationships with clients, and a steady stream of new business. GoHighLevel’s reputation management tools make it easier than ever to stay on top of client feedback and build trust online.

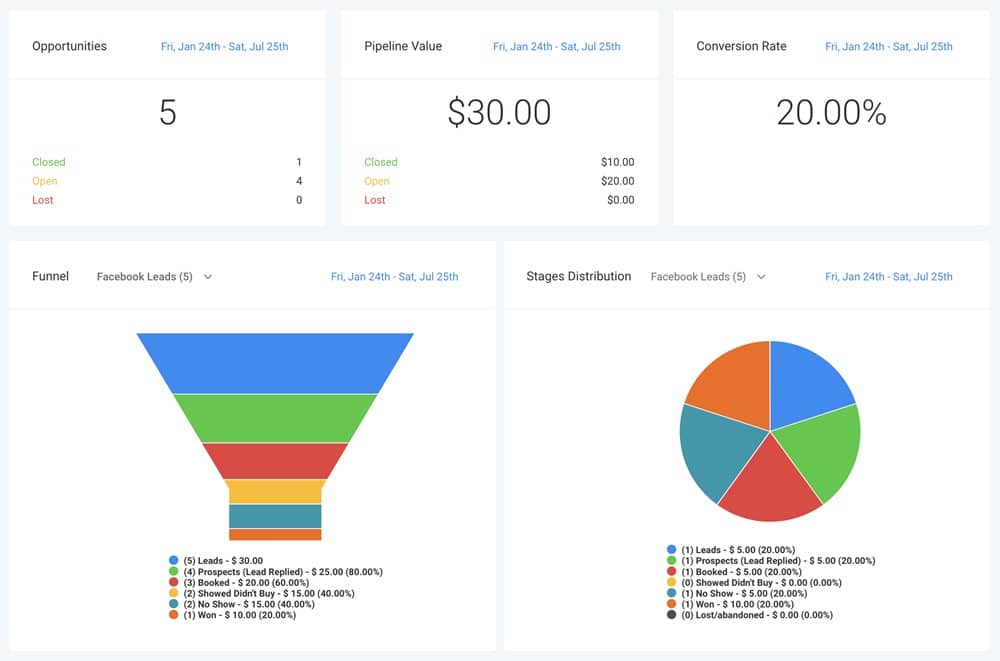

Reporting & Analytics with GoHighLevel

Tracking your performance as a loan officer is crucial for continuous improvement.

GoHighLevel’s reporting and analytics tools provide insights into how your marketing campaigns are performing, how your lead generation is going, and how efficiently you're closing deals.

By utilizing these features, you can make data-driven decisions to optimize your processes.

What You Can Do:

- Monitor key metrics such as lead conversions, funnel performance, and email/SMS open rates.

- Track the ROI of your marketing campaigns to see where your efforts are paying off.

- View detailed reports on your client interactions, pipeline stages, and loan status to understand where bottlenecks may occur.

How to Use It

Track Funnel & Campaign Performance

- Go to the Reporting Dashboard where you can see the performance of your funnels, campaigns, and automation. Track metrics like conversion rates, click-through rates, and lead-to-client ratios.

- Adjust your marketing strategy based on the data you see. For example, if a funnel isn't converting well, you can tweak your landing pages, emails, or CTAs.

Monitor Client Pipeline Analytics

- View detailed reports on each stage of your loan process pipeline. This helps you understand how many leads are in each stage, from initial contact to closing.

- Identify any bottlenecks where clients may be dropping off, so you can address issues early on, whether it's a delayed document submission or a communication gap.

Assess Campaign ROI

- GoHighLevel tracks your campaign expenses and lead conversion rates, allowing you to calculate ROI for paid ads or organic campaigns.

- This will help you determine which marketing channels and campaigns are delivering the best results and where you should allocate more of your budget.

Generate Custom Reports

- Customize reports to focus on what matters most to your loan business. You can create detailed reports that show insights like total leads, conversion rates, closed loans, and more.

- Schedule automated reports so you’re always in the loop without having to manually check the data.

Tips to Get the Best Out of Reporting & Analytics

Set clear goals for each campaign and funnel so you can track progress and measure success.

Use A/B testing to optimize funnels, landing pages, and email sequences based on the data you collect from reports.

Regularly review your reports to catch any early signs of issues, such as low conversion rates or stalled leads. The quicker you notice these, the faster you can make adjustments.

Focus on lead quality, not just quantity. A smaller but higher-converting list of leads is more valuable than a larger but unqualified one.

By using GoHighLevel’s reporting and analytics features, you can stay on top of your performance, make informed decisions, and continuously improve your loan business.

Integrating Apps via the GoHighLevel App Marketplace

GoHighLevel’s App Marketplace allows you to integrate with a variety of third-party apps and tools that can enhance your loan business operations.

Whether you need additional functionality for marketing, CRM, or lead management, the App Marketplace gives you access to the best solutions to supercharge your workflow.

What You Can Do:

- Integrate third-party applications to extend the capabilities of GoHighLevel.

- Use apps for additional marketing tools, accounting software, video conferencing, and more.

- Sync your existing tools with GoHighLevel for a seamless experience and greater automation.

How to Use It

Browse the App Marketplace

- GoHighLevel offers a comprehensive App Marketplace where you can find integrations for various tools. Start by browsing through categories like CRM, communication tools, project management, and more.

- Popular integrations include Zapier, Calendly, Stripe, and Zoom, which can easily be added to your GoHighLevel account.

Add an App Integration

- Once you find the app you want to integrate, click on it to learn more about the features. Some apps require you to create an account, while others may need to be connected via API keys.

- Follow the simple setup instructions provided in GoHighLevel to link the app to your account.

Sync Data Across Platforms

- After the integration is set up, GoHighLevel will sync data between the app and your GoHighLevel account. For example, if you connect Stripe, GoHighLevel will automatically track payments and invoices in your CRM.

- If you integrate with Zapier, you can create custom workflows that automate tasks between GoHighLevel and other apps you use, like syncing leads from Facebook Ads or sending data to a Google Sheet.

Automate Tasks Across Apps

- Use automation rules to trigger actions across multiple apps. For example, when a lead completes a loan application form on your website, GoHighLevel can automatically add them to your CRM and trigger an email follow-up.

- Create workflows that involve third-party apps, like automatically scheduling a Zoom meeting with a client after they book an appointment through your calendar.

Tips to Get the Best Out of the App Marketplace

Choose integrations carefully to avoid app overload. Only integrate tools that add real value to your loan business and streamline your workflow.

Keep your tools connected – ensure your CRM, payment processors and email systems are integrated to avoid manual data entry and reduce errors.

Use Zapier to connect GoHighLevel with apps you use outside the marketplace, creating more customized workflows.

Regularly check the Marketplace for new integrations or updates to your current apps that may offer new features to enhance your business.

The App Marketplace is a powerful resource to expand the functionality of GoHighLevel, allowing you to automate processes, improve workflows, and integrate the tools you’re already using.

Best Practices for Loan Officers Using GoHighLevel

To get the most out of GoHighLevel, it’s essential to follow best practices that will help you streamline your processes, improve client relationships, and avoid common pitfalls.

Here are the key best practices for loan officers:

Setting Up a Smooth Client Onboarding Process

A seamless onboarding process sets the tone for a positive relationship with your clients.

Here’s how you can set it up effectively:

- Create a Welcome Sequence

As soon as a client shows interest, send an automated welcome email and SMS.

This should include a brief introduction to your services, what they can expect during the loan process, and any necessary steps they need to take.

- Provide Clear Documentation Requests

Use GoHighLevel’s automation to send clients a checklist of documents they need to submit for the loan application. This can be an automated email sequence that also sends reminders if documents are missing.

- Set Expectations for Communication

Outline the preferred method and frequency of communication upfront, letting your clients know they’ll receive timely updates about their application status.

Personalizing Automation for Better Client Relationships

While automation is powerful, personalization can make all the difference in client relationships.

Here’s how to enhance your communication:

- Segment Your Leads and Clients

Use GoHighLevel’s tags and filters to segment your leads based on loan type, status, or client profile.

This enables you to send more targeted, relevant communications, whether that’s for first-time homebuyers or commercial loan applicants.

- Use Personalization Tokens

When setting up email and SMS automation, use GoHighLevel’s personalization tokens to automatically include each client’s name, loan details, or other personalized information.

This creates a more tailored and professional experience.

- Follow Up at Key Moments

Set automated reminders to check in with clients at critical points in the loan process.

For example, after submitting documents, an automated message could ask if they need any further assistance or information.

Avoiding Common Mistakes in GoHighLevel Setup and Usage

To ensure you’re using GoHighLevel effectively, avoid these common mistakes:

- Not Fully Utilizing Automation

One of the biggest advantages of GoHighLevel is its ability to automate many tasks.

Make sure you’re setting up automated workflows for lead nurturing, follow-ups, and appointment reminders to save time and reduce manual errors.

- Neglecting Data Integration

Ensure that GoHighLevel is fully integrated with your other tools (like loan processing software) to avoid data silos.

Use integrations to sync client information, loan statuses, and marketing campaigns for a unified workflow.

- Not Testing Your Workflows

Before rolling out any automation, always test your workflows.

This ensures that clients receive the right communication at the right time and that your processes are running smoothly.

- Failing to Monitor Campaign Performance

Don’t just set your marketing campaigns and forget about them.

Regularly check GoHighLevel’s analytics to see what’s working and what’s not, allowing you to tweak your strategies for better results.

By following these best practices, you’ll ensure that GoHighLevel is working effectively for your business, leading to better client relationships, increased conversions, and smoother operations.

Real-World Use Cases of GoHighLevel for Loan Officers

GoHighLevel isn’t just a tool; it’s a game changer for loan officers.

Here are some real-world examples of how GoHighLevel has been used to drive success across different loan officer roles.

How Independent Mortgage Brokers Use GoHighLevel

Independent mortgage brokers face a variety of challenges when managing leads, tracking client communications, and staying organized.

GoHighLevel helps streamline these tasks:

- Lead Management and Automation

Mortgage brokers use GoHighLevel to automatically capture and nurture leads through customizable workflows.

For example, when a lead fills out an online inquiry form, GoHighLevel automatically sends a welcome email and follows up with additional resources on loan options.

- Client Engagement

Using the platform’s communication tools, brokers stay in touch with clients via automated emails, SMS, and call reminders, ensuring timely follow-ups and preventing missed opportunities.

- Tracking Loan Application Progress

GoHighLevel’s CRM lets brokers monitor the progress of each client’s application, sending automated reminders for any pending documentation or tasks.

Success Stories from Commercial Loan Officers

Commercial loan officers deal with larger, more complex transactions, requiring careful tracking and high-level client communication.

GoHighLevel simplifies this process:

- Streamlined Lead Follow-Up

A commercial loan officer shared how they reduced their manual workload by 40% by automating follow-ups and reminders for all loan inquiries.

With GoHighLevel, each lead received an email and text reminder about their loan application status.

- Optimized Marketing Campaigns

Another commercial loan officer reported success using GoHighLevel’s funnel builder to launch a targeted marketing campaign for a new commercial property loan offering.

By utilizing GoHighLevel’s analytics, they fine-tuned the campaign and saw a 30% increase in lead conversion.

- Enhanced Client Retention

GoHighLevel’s reputation management tools also helped improve client retention.

Automated review requests were sent after each loan was finalized, leading to better client feedback and referrals.

Case Studies on Lead Conversion Improvement with GoHighLevel

Improving lead conversion is a top priority for every loan officer, and GoHighLevel plays a critical role in making that happen.

Here are a few success stories:

- Lead Nurturing through Automation

A loan officer specializing in first-time homebuyer loans shared how GoHighLevel’s automated workflows dramatically improved their conversion rates.

By automating email sequences, calls, and SMS messages, they saw a 25% increase in the conversion of leads into applications.

- Better Client Interaction and Retention

A mortgage loan officer using GoHighLevel for client follow-up noted that sending personalized messages after each meeting or loan milestone helped increase engagement.

This led to more referrals and repeat clients, boosting their overall revenue by 15%.

- Lead Scoring and Qualification

GoHighLevel’s lead scoring system helped a commercial loan officer quickly identify high-potential leads and prioritize them, leading to faster processing and higher conversion rates.

By nurturing leads based on their level of interest and readiness, they improved their closing rate by 20%.

These real-world use cases show how GoHighLevel transforms how loan officers manage leads, communicate with clients, and increase conversions, ultimately making it an invaluable tool in the loan industry.

Learn More:

- What is GoHighLevel? [A User Experience]

- GoHighLevel Features: Complete List

- GoHighLevel Integrations

- GoHighLevel Pricing: (Costs Breakdown)

- Is GoHighLevel a CRM?: (Find Out Here💡)

- Is GoHighLevel Legit?: (Find Out Here 💡)

- Is GoHighLevel Worth It? (Find Out Here 💡)

- 15+ GoHighLevel Benefits: (Why You Need It)

Frequently Asked Questions

Here are some common questions loan officers have about using GoHighLevel for loan officers.

Is GoHighLevel compliant with mortgage and financial regulations?

Yes, GoHighLevel is compliant with mortgage and financial regulations

Can GoHighLevel replace my existing CRM?

Yes, GoHighLevel can replace your existing CRM, especially if you're looking for an all-in-one solution. It combines CRM functionalities with marketing automation, lead management, and reporting tools, giving you everything you need in one platform.

How does GoHighLevel integrate with other loan processing software?

GoHighLevel offers several integration options, allowing it to work seamlessly with other loan processing tools, such as Encompass or LoanPro. Through Zapier and API integrations, GoHighLevel can send and receive data between systems, helping to automate processes and reduce manual work.

What are the best automation workflows for loan officers?

Loan officers can use a variety of automation workflows to streamline their daily tasks.

Some of the best workflows include:

Review Requests: After a successful loan closing, automatically send requests for reviews to improve your online reputation.

Lead Follow-Up: Automatically send emails and SMS messages to nurture new leads. Use reminders for follow-ups, ensuring timely engagement.

Loan Application Status Updates: Set up automated email sequences to update clients on their loan application status, next steps, and document requests.

Appointment Scheduling: Automate the booking and reminder of client meetings or calls to keep your calendar organized and reduce no-shows.

Does GoHighLevel offer mobile access for on-the-go management?

Yes, GoHighLevel offers mobile access, allowing you to manage your loan business on the go. Whether you're meeting clients or traveling between appointments, you can use the mobile app to manage leads, track communications, access your calendar, and monitor your marketing campaigns.

Final Thoughts

GoHighLevel is a robust tool that, when used to its full potential, can drastically improve your business operations as a loan officer.

Whether you’re automating communications, optimizing marketing campaigns, or tracking performance, GoHighLevel provides the tools needed to help you grow and scale your business effectively.

By integrating the tools, personalizing your setup, and focusing on automation, you’ll save time, improve client relationships, and ultimately close more loans.

Remember, the power of GoHighLevel lies in your ability to tailor the platform to your unique needs, so don’t hesitate to dive deep into each feature and make it work for you.