It is no news managing a financial advisory business requires a high level of organization, effective client communication, and consistent lead generation.

However, many financial advisors struggle with disorganized client management, inefficient follow-ups, and outdated marketing strategies.

This is where GoHighLevel for Financial Advisors comes in.

Unlike traditional CRMs, GoHighLevel is an all-in-one platform that allows you to:

✅ Manage your clients efficiently with an integrated CRM

✅ Automate appointment scheduling and follow-ups

✅ Run high-converting marketing campaigns to generate leads

✅ Streamline client onboarding and service delivery

✅ Track and optimize business performance with in-depth analytics

It doesn't matter the aspect you operate:

You name it – GHL has got you.

This step-by-step guide will show you exactly how to use GoHighLevel to optimize your financial advisory business.

Key Takeaways:

- AI & automation save time – Automate scheduling, follow-ups, and lead management to focus on high-value tasks.

- Integrations enhance efficiency – Connect GoHighLevel with QuickBooks, Stripe, and DocuSign for a seamless workflow.

- Data-driven decisions boost growth – AI analytics help you track client engagement, optimize marketing, and improve conversions.

Let's start!

How to Use GoHighLevel for Financial Advisors

I won't waste your time, first, we will set up an account and all of the strategies you can use will follow.

Here's how to set it up:

Step 1: Creating Your GoHighLevel Account

Since you will be setting up your account – you should do that for FREE!

Luckily, you can get a 30-day free trial here.

To start, go to GoHighLevel.com/30-day-trial and you will be redirected to the page below.

![What is GoHighLevel? [A User Experience] 6 GoHighLevel 30 Day Trial Home Page](https://theolaoye.com/wp-content/uploads/2024/11/GoHighLevel-30-Day-Trial-Home-Page.jpg)

Click on “30-Day Free Trial” and you will be asked basic information about your business, such as:

- Company Name

- Full Name

- Phone Number

- Email Address

![What is GoHighLevel? [A User Experience] 7 GoHighLevel 30 Day Trial Home Page 2](https://theolaoye.com/wp-content/uploads/2024/11/GoHighLevel-30-Day-Trial-Home-Page-2.jpg)

Upon filling in everything, click on “Go To Step #2” where you will be asked to select the plan you want.

For now, you need to Select the GoHighLevel Unlimited Plan and you will be able to upgrade or downgrade later.

You will be asked to input your credit card details next – you will not be debited anything until the end of your trial.

After that, the next is, the onboarding process.

Step 2: GoHighLevel Onboarding

Once you finish the steps above, Go High Level will ask you some onboarding questions to ensure that your account is well set up.

Let’s take a look at them!

The first thing is to tell GHL more about your business, you would need to:

- Select the industry you operate in

- The primary purpose of using GoHighLevel

- The number of your customers

- And if you have a website

Supply the information based on what is right for you.

![What is GoHighLevel? [A User Experience] 8 GoHighLevel Onboarding Process Stage 1](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-1-1024x493.jpg)

If anything isn’t clear to you now, select anything and continue because you can always change it later.

The next page will ask for your business address and billing information.

Then, you need to specify if you’re willing to resell GoHighLevel or not.

Reselling GoHighLevel means that you can resell the entire platform on your name – at your prices and keep the balance.

![What is GoHighLevel? [A User Experience] 9 GoHighLevel Onboarding Process Stage 2](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-2-1024x498.jpg)

Just fill in the blank as you can see above and proceed to the next stage.

![What is GoHighLevel? [A User Experience] 10 GoHighLevel Onboarding Process Stage 3](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-3-1024x516.jpg)

If you take a closer look at the image above, you will see that it’s asking you to select the tools you currently use.

Selecting the tools is going to keep you organized under one single dashboard.

So, select all that apply and proceed to the next stage.

And if you have none for now, just click on “Next ->“

![What is GoHighLevel? [A User Experience] 11 GoHighLevel Onboarding Process Stage 4](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-4-1024x510.jpg)

So, the next stage will ask you to set up your password and a code will be sent to your email for confirmation.

Input the code and you will have the page below which confirms that your GoHighLevel account has been created.

I want to say congratulations, you have just set up your HighLevel account.

Now, you have access to your dashboard which looks like the image below.

![What is GoHighLevel? [A User Experience] 12 GoHighLevel Agency Dashboard](https://saaspen.com/wp-content/uploads/2024/08/GoHighLevel-Agency-Dashboard-1024x463.jpg)

Step 3. Setting Up Your CRM for Client & Lead Management

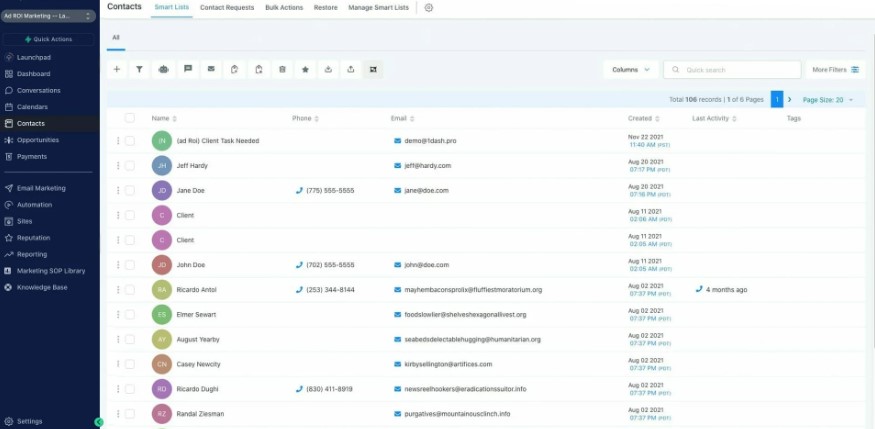

As a financial advisor, managing your clients effectively is critical to your success.

GoHighLevel’s CRM (Customer Relationship Management) system allows you to organize your leads, track client interactions, and automate follow-ups – all from one platform.

Creating and Organizing Your Client Database

The first step is to import or manually add client information into GoHighLevel’s CRM.

Here’s how:

🔹 Manually Adding Clients & Leads

Go to ‘Contacts’ in GoHighLevel.

Click ‘Add Contact’ and fill in key details:

- Full Name

- Email Address

- Phone Number

- Lead Source (How they found you: Website, Referral, LinkedIn, etc.)

- Financial Interest (Retirement planning, investment advice, tax optimization, etc.)

Click ‘Save’ to add them to your CRM.

🔹 Importing Leads from a Spreadsheet

If you already have a list of clients in an Excel sheet, you can bulk import them:

- Go to ‘Contacts’ > ‘Import Contacts’

- Upload your CSV file with lead details

- Map the fields (Match column names in your file to GoHighLevel fields)

- Click ‘Start Import’ to add them to your database

Segmenting Clients into Categories

To manage your clients efficiently, you should segment them into different categories for targeted follow-ups.

🔹 Using Tags to Categorize Clients

You can add tags to each client to classify them based on their financial needs:

📌 Prospect – New leads who have not booked a consultation

📌 Active Client – Clients who are currently working with you

📌 Past Client – Clients you’ve worked with in the past

📌 High-Net-Worth – Clients with significant investments

📌 Retirement Planning – Clients interested in retirement planning

How to Add a Tag in GoHighLevel:

- Open a client profile in the ‘Contacts’ section

- Click ‘Edit’ and scroll to the ‘Tags’ field

- Enter a custom tag (e.g., ‘Investment Client’)

- Click ‘Save’

📌 Pro Tip: Use filters to search for clients based on tags. Example: If you want to follow up with all “Retirement Planning” clients, just filter by that tag.

Step 4. Tracking Client Interactions & Communication

A strong client relationship is built on consistent communication. With GoHighLevel, you can track all interactions in one place:

🔹 Viewing the Client Activity Timeline

Each contact has a timeline showing all interactions:

✔ Emails sent & received

✔ SMS conversations

✔ Phone calls made & recorded

✔ Appointments booked

✔ Notes from previous meetings

📌 How to Access a Client’s Interaction History:

- Open the ‘Contacts’ tab

- Click on a client’s name

- Scroll down to see their full activity history

This helps you remember past discussions and personalize future interactions.

Step 5. Automating Lead Nurturing with Workflows

Many leads don’t convert immediately, so you need a system to nurture them over time. With GoHighLevel, you can create automated workflows to:

✅ Follow up with prospects who haven’t booked an appointment

✅ Send reminders to clients about financial check-ups

✅ Re-engage past clients who haven’t worked with you recently

🔹 Example: Automated Lead Nurturing Workflow

Scenario: You get a new lead from your website who didn’t book a consultation.

Instead of following up manually, set up this workflow:

📌 Day 1 – Send a welcome email with a free financial guide

📌 Day 3 – Send an SMS: “Hey [Name], would you like to schedule a free consultation?”

📌 Day 7 – Follow-up email: “Here’s how I can help you with your financial goals.”

📌 Day 14 – Send a final reminder to book a call

📌 How to Set This Up in GoHighLevel:

- Go to ‘Automation’ > ‘Workflows’

- Click ‘Create New Workflow’

- Select ‘Start from Scratch’

- Add triggers (e.g., “New Lead Added”)

- Add actions (e.g., Send Email, Send SMS)

- Set up timing delays (e.g., Wait 3 Days)

- Click ‘Activate’

Now, every new lead will automatically receive follow-ups without manual effort!

Why This Matters?

✅ A well-structured CRM allows you to manage leads and clients efficiently

✅ Automated workflows ensure you never miss a follow-up

✅ Segmenting clients helps personalize your communication

By setting up your GoHighLevel CRM properly, you’ll stay organized, nurture leads effectively, and close more clients without extra manual work.

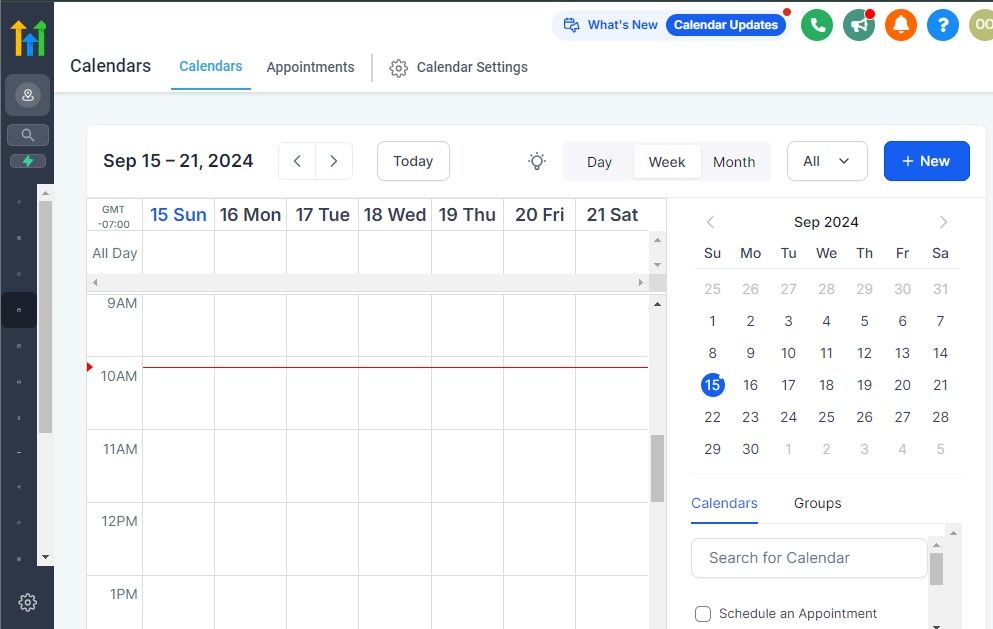

Automating Appointment Booking & Scheduling

As a financial advisor, your time is valuable. Instead of going back and forth with clients to schedule meetings.

GoHighLevel’s appointment booking system allows you to automate scheduling, send reminders, and sync your calendar – all in one place.

In this section, you’ll learn how to:

✅ Set up your online booking calendar for client meetings

✅ Automate appointment reminders via email & SMS

✅ Integrate your booking system with your website & social media

✅ Use workflows to follow up on missed or completed appointments

1. Setting Up Your Booking Calendar in GoHighLevel

GoHighLevel allows you to create custom booking links so clients can schedule meetings with you effortlessly.

🔹 How to Set Up Your Calendar

- Go to ‘Calendars’ in GoHighLevel.

- Click ‘Create Calendar’ and choose your meeting type:

- 📅 One-on-One Meetings – Ideal for personal financial consultations.

- 🏛 Group Sessions – Useful for webinars or educational workshops.

- Set your availability (days, hours, and buffer times between meetings).

- Choose your meeting duration (e.g., 30 min, 60 min).

- Select your time zone and sync with Google Calendar to avoid double bookings.

- Click ‘Save & Publish’ to generate your unique booking link.

📌 Pro Tip: Add custom fields to your booking form (e.g., “What financial goal are you working on?”) to better prepare for each meeting.

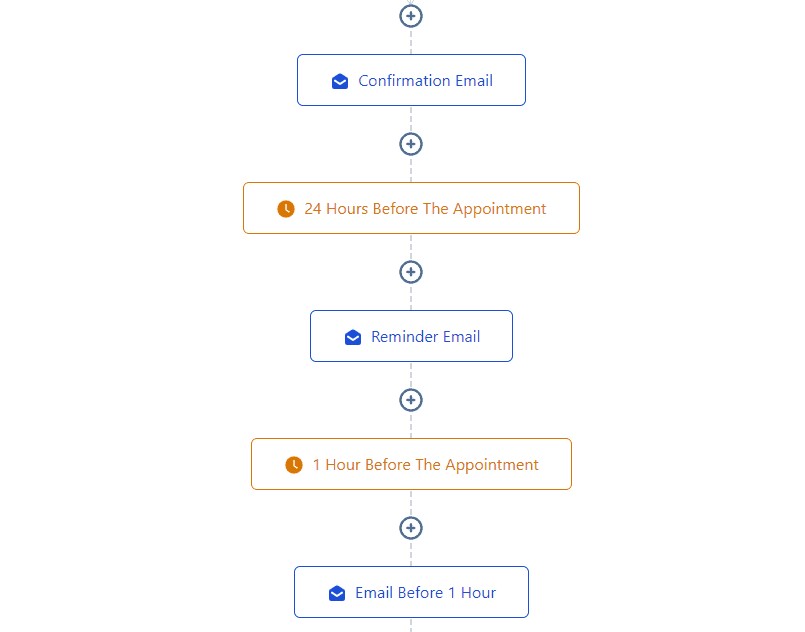

2. Automating Appointment Reminders

To reduce no-shows, GoHighLevel allows you to send automatic reminders via email and SMS before each meeting.

🔹 Setting Up Reminder Notifications

- Go to ‘Calendars’ > ‘Settings’

- Enable SMS & email reminders

- Set reminder timing:

- ✅ 24 Hours Before – Email: “Reminder: Your financial consultation is tomorrow.”

- ✅ 1 Hour Before – SMS: “Hi [Name], just a reminder about our call in 1 hour.”

📌 Pro Tip: Include a reschedule/cancel link in your reminder email to let clients adjust their meeting without ghosting you.

3. Embedding Your Booking Link on Your Website & Social Media

To make scheduling seamless, integrate your booking system with your:

✔ Website – Add a “Book a Consultation” button.

✔ Social Media – Link your calendar in your Instagram bio or Facebook page.

✔ Email Signature – Add your booking link for quick access.

🔹 How to Embed Your Booking Calendar on Your Website

- Go to ‘Calendars’ > ‘Links’

- Copy your booking URL

- Paste the link in a “Book an Appointment” button on your website

📌 Pro Tip: If you use funnels or landing pages, you can embed the booking calendar directly onto the page instead of redirecting users elsewhere.

4. Automating Follow-Ups for Missed & Completed Appointments

What happens if a client misses a meeting? Instead of manually chasing them, set up automated follow-ups.

🔹 Workflow Example: Missed Appointment Follow-Up

📌 Trigger: Client didn’t show up for the scheduled meeting

📌 Action 1: Send SMS – “Hey [Name], I noticed we missed our meeting today. Would you like to reschedule?”

📌 Action 2: If no response after 24 hours → Send an email reminder with your booking link.

📌 Action 3: If no response after 3 days → Add to your ‘Lost Leads’ list for future re-engagement.

🔹 Workflow Example: Post-Appointment Follow-Up

📌 Trigger: Appointment completed

📌 Action 1: Send a ‘Thank You’ email with a recap of your discussion.

📌 Action 2: Send an SMS – “Hi [Name], thanks for meeting today! Let me know if you have any questions.”

📌 Action 3: After 1 week → Follow up with a check-in email.

📌 How to Set This Up in GoHighLevel:

- Go to ‘Automation’ > ‘Workflows’

- Click ‘Create New Workflow’

- Select ‘Appointment Status Trigger’

- Add actions (Send SMS, Send Email, etc.)

- Click ‘Save & Activate’

Why This Matters?

✅ No more manual scheduling – clients book at their convenience

✅ Fewer no-shows with automated SMS & email reminders

✅ Seamless integration with your website & social media

✅ Follow-ups keep leads engaged and improve conversions

By automating your appointment booking process, you save time and ensure a professional, smooth scheduling experience for your clients.

Automating Client Communication & Follow-Ups

As a financial advisor, staying in touch with clients is crucial for building trust and long-term relationships.

However, manually following up with every lead and client is time-consuming. With GoHighLevel's automation tools, you can set up workflows that:

✅ Nurture leads with automated follow-up emails & SMS

✅ Engage existing clients with regular check-ins and updates

✅ Re-engage inactive clients to bring them back

✅ Personalize communication while saving time

This section will show you how to automate your client communication efficiently without losing the personal touch.

1. Setting Up Automated Follow-Ups for Leads

When potential clients fill out a lead form or book an appointment, they often need multiple touchpoints before making a decision.

Instead of manually sending reminders, GoHighLevel’s automation ensures that leads stay engaged.

🔹 How to Set Up a Lead Nurture Workflow

- Go to ‘Automation’ > ‘Workflows’

- Click ‘Create Workflow’ → Choose ‘Start from Scratch’

- Set the Trigger:

- 📌 If a new lead fills out a form → Send a welcome email

- 📌 If a lead books a consultation → Confirm the meeting and send resources

- Add Follow-Up Actions (Time-delayed emails, SMS, and calls):

- Day 1: “Thanks for your interest! Here's what to expect.”

- Day 3: “Quick question: What’s your biggest financial concern right now?”

- Day 7: “Still interested in a free consultation? Book here!”

- Save & Activate the workflow.

📌 Pro Tip: Customize your follow-up messages based on what service the lead inquired about (e.g., retirement planning, investment advice).

2. Automating Check-Ins & Ongoing Communication for Clients

After onboarding a new client, regular check-ins help maintain relationships and encourage repeat business.

Instead of relying on memory, use GoHighLevel’s automation to send periodic updates.

🔹 How to Automate Client Check-Ins

- Go to ‘Automation’ > ‘Workflows’

- Set the Trigger: Client completes a consultation or signs up for a service

- Add Follow-Up Actions:

- ✅ After 1 Week → Send a check-in email: “How’s everything going so far?”

- ✅ After 30 Days → Offer a progress review call: “Let’s review your financial plan.”

- ✅ Every Quarter → Share market updates & financial tips

📌 Pro Tip: Use SMS reminders for high-priority follow-ups, as they have a 98% open rate compared to email.

3. Re-Engaging Inactive Clients

Some clients may become unresponsive over time. Instead of losing them, reactivate them with a targeted re-engagement campaign.

🔹 Creating a Re-Engagement Campaign

- Go to ‘Marketing’ > ‘Campaigns’

- Choose Email & SMS

- Segment your audience: Filter clients who haven’t engaged in 3+ months

- Send a personalized message:

- Subject Line: “Still interested in improving your finances?”

- Body: “It’s been a while! Let’s catch up and see if your goals have changed.”

- Call-to-Action: “Book a free check-in call here.”

- Add a limited-time incentive (e.g., “Get a free portfolio review this month!”).

📌 Pro Tip: Use automated voicemail drops to make the message feel more personal.

4. Automating Birthday & Anniversary Messages

Small gestures make a big difference in client relationships.

Automated birthday or financial milestone messages show clients you care:

🔹 Setting Up Automated Birthday Greetings

- Go to ‘Automation’ > ‘Workflows’

- Set Trigger: “Client’s Birthday” (Pulls from CRM data)

- Choose Action: Send personalized email & SMS

- Customize message:

- “Happy Birthday, [Name]! Wishing you success & financial growth this year. 🎉”

- Add a special offer: “Schedule a free financial review as a gift!”

📌 Pro Tip: You can also send anniversary messages (e.g., “1 Year Since We Started Working Together – Here’s Your Progress!”).

5. Tracking Client Engagement & Follow-Up Performance

Once you’ve automated your client communication, track the results to optimize your messaging.

🔹 How to Monitor Your Follow-Ups in GoHighLevel

✔ Go to ‘Reporting’ > ‘Conversations’ – Check response rates for emails/SMS.

✔ Use the Pipeline View – See where clients drop off in the engagement process.

✔ A/B Test Different Messages – Experiment with different subject lines and CTAs.

📌 Pro Tip: If an automated workflow isn’t performing well, tweak the timing, message tone, or channel (email vs SMS).

Why Automating Client Communication Matters:

✅ Saves time – No need for manual follow-ups

✅ Keeps leads engaged – Increases conversion rates

✅ Strengthens client relationships – Improves retention

✅ Boosts revenue – Re-engages inactive clients

By automating your client communication, you ensure that every lead and client gets consistent, timely, and personalized attention – without adding to your workload.

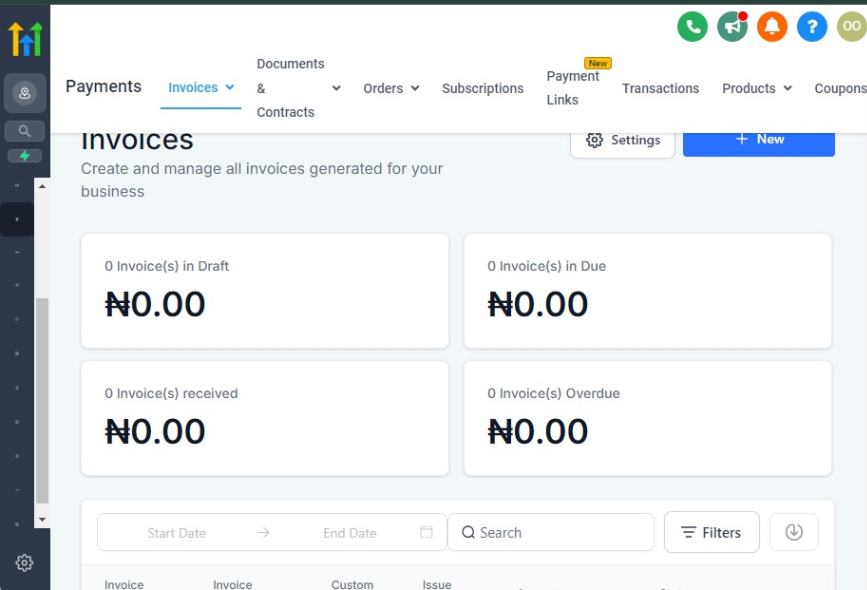

Payment Collection & Invoicing for Financial Services

Managing payments efficiently is essential for financial advisors. With GoHighLevel’s built-in invoicing and payment collection tools, you can:

✅ Send invoices automatically after consultations or services

✅ Accept payments online through Stripe, PayPal, and other integrations

✅ Set up recurring billing for retainer clients

✅ Track and manage transactions within your dashboard

This section will guide you through automating your billing process to ensure faster payments, fewer missed invoices, and better cash flow management.

1. Setting Up Payment Integrations

Before you start invoicing clients, connect your preferred payment processor.

GoHighLevel integrates with Stripe, PayPal, Authorize.net, and other gateways.

🔹 How to Connect a Payment Gateway

- Go to ‘Payments’ > ‘Integrations’

- Click ‘Connect’ next to your payment processor

- Log in to your Stripe or PayPal account to authorize the connection

- Set your default currency and payment settings

📌 Pro Tip: If you charge clients on a subscription basis, enable recurring payments during the setup.

2. Creating & Sending Invoices

Instead of manually generating invoices, you can use GoHighLevel’s invoice feature to bill clients automatically.

🔹 How to Create an Invoice

- Go to ‘Payments’ > ‘Invoices’

- Click ‘Create New Invoice’

- Enter Client Details (Auto-filled if they’re in your CRM)

- Add Service Description & Amount

- Example: “Comprehensive Financial Plan – $500”

- Enable Payment Link: Allows clients to pay online

- Click ‘Send Invoice’ via email/SMS

📌 Pro Tip: Set payment due dates and enable automatic reminders for unpaid invoices.

3. Automating Payment Reminders

Late payments can disrupt your cash flow. Instead of chasing clients manually, set up automatic reminders.

🔹 How to Set Up Payment Reminders

Go to ‘Automation’ > ‘Workflows’

Create a New Workflow for unpaid invoices

Set Triggers:

- 📌 1 Day Before Due Date → Send a polite reminder

- 📌 On Due Date → Send an invoice with a direct payment link

- 📌 7 Days Overdue → Follow-up with urgency

Save & Activate the workflow

Example Reminder Message (SMS):

📩 “Hi [Client Name], your invoice for [Service Name] is due tomorrow. You can pay securely here: [Payment Link]. Let me know if you have any questions!”

📌 Pro Tip: For clients who repeatedly delay payments, offer auto-deductions from a saved card for future invoices.

4. Setting Up Recurring Payments for Retainer Clients

If you offer ongoing financial advisory services, setting up recurring billing saves you time.

🔹 How to Set Up Recurring Billing

- Go to ‘Payments’ > ‘Subscriptions’

- Click ‘Create Subscription’

- Choose the client and service

- Set the billing cycle (monthly, quarterly, yearly)

- Enable automatic payments

📌 Pro Tip: Use GoHighLevel’s Membership feature to give retainer clients exclusive access to premium resources.

5. Tracking Payments & Managing Transactions

You can monitor all payments, pending invoices, and revenue reports inside GoHighLevel’s dashboard.

🔹 How to Track Payments

✔ Go to ‘Payments’ > ‘Transactions’ – View completed & pending payments

✔ Use ‘Reporting’ > ‘Revenue Report’ – Track total earnings & outstanding invoices

✔ Set Up Notifications – Get alerts for new payments

📌 Pro Tip: Use GoHighLevel’s pipeline view to see which clients have overdue invoices and trigger follow-up actions.

Why Automating Payments Matters:

✅ Saves Time – No more manual invoicing & reminders

✅ Improves Cash Flow – Get paid faster with online payments

✅ Reduces Late Payments – Automated reminders keep clients accountable

✅ Enhances Client Experience – Easy, hassle-free payment process

By automating your payment collection, you’ll ensure that your financial advisory business runs smoothly and profitably – without spending hours on admin work.

Running Marketing Campaigns to Attract More Clients

To grow your financial advisory business, you need a steady stream of high-quality leads.

GoHighLevel’s marketing tools allow you to create and automate powerful campaigns that attract and convert potential clients.

In this section, you'll learn how to:

✅ Generate leads using landing pages, funnels, and lead magnets

✅ Automate follow-ups to nurture leads into paying clients

✅ Run email, SMS, and social media campaigns

✅ Retarget website visitors to stay top of mind

Let’s break it down step by step.

1. Creating Lead Magnets to Capture Prospects

A lead magnet is a valuable resource (e.g., a free guide, webinar, checklist) that encourages prospects to share their contact details.

🔹 Example Lead Magnets for Financial Advisors

✔ Free eBook – “10 Smart Investment Strategies for Retirement”

✔ Webinar – “How to Reduce Your Taxes Legally”

✔ Checklist – “7 Steps to Achieve Financial Freedom”

✔ Calculator – “Retirement Savings Planner”

📌 Pro Tip: Use GoHighLevel’s funnel builder to create high-converting opt-in pages for your lead magnet.

2. Building a High-Converting Lead Funnel

Once you have a lead magnet, you need a funnel to collect leads and nurture them toward a consultation.

🔹 How to Create a Lead Funnel in GoHighLevel

Go to ‘Funnels’ > ‘Create New Funnel’

Add Funnel Steps:

- Opt-in Page – Offer your lead magnet in exchange for contact details

- Thank You Page – Deliver the free resource + invite them to schedule a call

- Follow-Up Emails/SMS – Nurture leads with automated messages

Connect Your CRM – Automatically add leads to your GoHighLevel database

📌 Pro Tip: Embed a booking link on your Thank You Page to encourage immediate action.

3. Running Email & SMS Drip Campaigns

Once a lead enters your system, you need to nurture them until they book a consultation.

GoHighLevel lets you set up automated email & SMS sequences to build trust.

🔹 How to Set Up a Drip Campaign

Go to ‘Marketing’ > ‘Campaigns’ > ‘Create New Campaign’

Select Communication Type (Email or SMS)

Create a Series of Messages:

- Day 1: Welcome email + Lead magnet delivery

- Day 3: Financial tip + Invite to schedule a consultation

- Day 5: Testimonial from a satisfied client

- Day 7: “Limited Spots Available” Call-to-action

📌 Pro Tip: Use personalized tags (e.g., [First Name]) in emails/SMS to make messages feel more engaging.

4. Running Paid Ads (Facebook, Google, LinkedIn)

Paid advertising is a great way to scale your lead generation.

With GoHighLevel, you can manage Facebook, Google, and LinkedIn ads inside the platform.

🔹 Steps to Set Up Facebook Ads in GoHighLevel

Go to ‘Ads’ > ‘Facebook Ads’

Click ‘Create New Campaign’

Choose Your Objective (Lead Generation, Website Traffic, Appointments)

Set Your Target Audience:

- Age, income level, location

- Interests: Investing, retirement planning, tax strategies

Create Ad Copy & Design

Connect Your Lead Form to GoHighLevel’s CRM

📌 Pro Tip: Use retargeting ads to bring back website visitors who didn’t book a consultation.

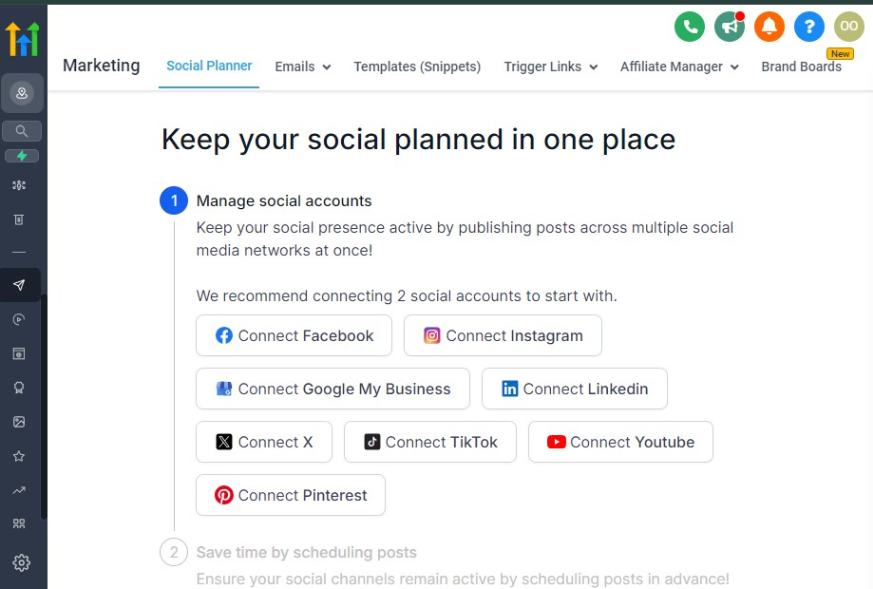

5. Using GoHighLevel’s Social Media Planner

Staying active on social media helps you build trust and credibility.

GoHighLevel’s Social Planner lets you schedule posts across multiple platforms.

🔹 How to Schedule Social Media Posts

- Go to ‘Marketing’ > ‘Social Planner’

- Connect Your Social Accounts (Facebook, Instagram, LinkedIn, Twitter)

- Create Posts in Advance – Share valuable tips, client success stories, and industry updates

- Schedule Weekly Content – Stay consistent without daily posting

📌 Pro Tip: Use educational carousels, short-form videos, and polls to engage your audience.

6. Tracking & Optimizing Campaign Performance

Once your marketing campaigns are live, track your results using GoHighLevel’s reporting tools.

🔹 How to Measure Campaign Success

✔ Go to ‘Reporting’ > ‘Marketing Analytics’

✔ Check email open rates, click-through rates, and conversion rates

✔ Adjust ads and content based on what’s working best

📌 Pro Tip: Use A/B testing to see which emails, ads, and landing pages perform best.

Why Marketing Automation is a Game-Changer for Financial Advisors:

✅ Generates consistent leads – Never rely on word-of-mouth alone

✅ Saves time – Automate follow-ups instead of manual outreach

✅ Improves conversion rates – Lead nurturing helps turn prospects into clients

✅ Maximizes ROI – Track campaign results and optimize for better performance

By leveraging GoHighLevel’s marketing features, you’ll attract more clients, build stronger relationships, and grow your financial advisory business efficiently.

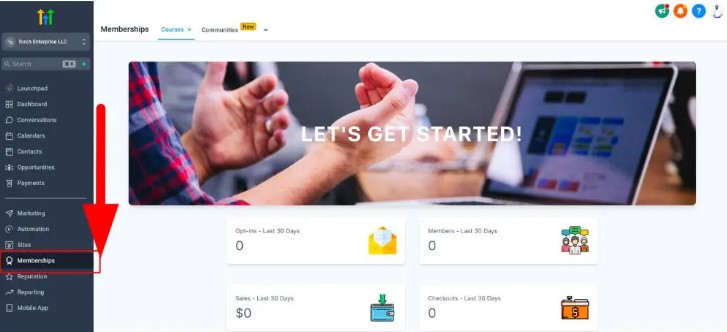

Creating a Membership & Client Portal for Exclusive Financial Resources

As a financial advisor, offering exclusive content, financial education, and premium client resources can set you apart.

GoHighLevel allows you to create a membership site and client portal where your clients can access valuable content, track their progress, and stay engaged with your services.

Why a Membership Portal Matters for Financial Advisors?

✅ Positions you as an authority – Clients trust experts who provide valuable education

✅ Improves client retention – A membership portal keeps clients engaged

✅ Creates a new revenue stream – Offer premium courses, coaching, or financial tools

✅ Automates client onboarding – Store FAQs, calculators, and important documents in one place

1. Setting Up a Membership Portal in GoHighLevel

🔹 Step-by-Step Guide to Creating a Membership Site

Go to ‘Sites’ > ‘Memberships’ > ‘Create New Membership’

Choose a Name & Category (e.g., “Financial Freedom Academy” or “Retirement Success Hub”)

Design Your Membership Dashboard

- Add your branding, logo, and colors

- Customize the navigation for easy access

Set Membership Access Levels

- Free membership (for lead nurturing)

- Paid membership (for premium financial coaching)

📌 Pro Tip: Use GoHighLevel’s pre-built membership templates to get started quickly.

2. Adding Exclusive Financial Content

Your membership portal should deliver valuable content that keeps clients engaged.

🔹 Types of Financial Resources You Can Offer

✔ Video Lessons – “How to Build a Diversified Investment Portfolio”

✔ PDF Guides & Checklists – “Step-by-Step Retirement Planning Guide”

✔ Financial Calculators – “Debt Payoff & Savings Growth Calculator”

✔ Live Webinars & Q&A Sessions – “Monthly Market Trends & Analysis”

✔ Exclusive Community – Private groups for discussions and networking

📌 Pro Tip: Upload content in modules or lessons to make it easier for clients to navigate.

3. Monetizing Your Membership Site

GoHighLevel allows you to charge for premium access, creating an additional revenue stream.

🔹 How to Sell Access to Your Membership?

Set Pricing Tiers

- Free Tier: Basic financial resources to nurture leads

- One-Time Payment: Access to premium courses or training

- Monthly Subscription: Ongoing coaching, tools, and resources

Integrate Payment Processing

- Connect Stripe or PayPal to handle transactions

- Automate invoicing for recurring payments

Offer Limited-Time Promotions

- Use GoHighLevel’s email & SMS automation to promote membership

📌 Pro Tip: Give a 7-day free trial to encourage sign-ups.

4. Automating Client Access & Onboarding

Once a client joins your membership, GoHighLevel can automate their onboarding process.

🔹 Steps to Automate Membership Onboarding

✔ Welcome Email Sequence – Send a personalized email with login details

✔ Automated Course Drip Release – Unlock new content weekly/monthly

✔ Reminder Notifications – Encourage engagement with automated SMS alerts

📌 Pro Tip: Use GoHighLevel’s workflow automation to trigger onboarding emails & SMS.

5. Tracking Membership Engagement & Performance

To keep your membership site effective, monitor how clients interact with your content.

🔹 Metrics to Track in GoHighLevel

✔ Login Frequency – Identify active vs. inactive members

✔ Course Completion Rates – See which content is most valuable

✔ Retention & Churn Rates – Improve engagement to reduce cancellations

📌 Pro Tip: Send re-engagement emails to inactive users offering a bonus resource.

Why Financial Advisors Need a Membership Site:

✅ Adds value beyond consultations – Clients get access to exclusive knowledge

✅ Creates passive income – Monetize educational content

✅ Improves client loyalty – Keep clients engaged long-term

✅ Automates onboarding & education – Saves time on repetitive explanations

By setting up a GoHighLevel membership portal, you can educate, engage, and monetize your audience while streamlining your client experience.

Learn More:

- GoHighLevel Review: (My Experience After 4 Years)

- What is GoHighLevel? [A User Experience]

- GoHighLevel Features: Complete List

- GoHighLevel Integrations

- GoHighLevel Pricing: (Costs Breakdown)

- Is GoHighLevel a CRM?: (Find Out Here💡)

- Is GoHighLevel Legit?: (Find Out Here 💡)

- Is GoHighLevel Worth It? (Find Out Here 💡)

- 15+ GoHighLevel Benefits: (Why You Need It)

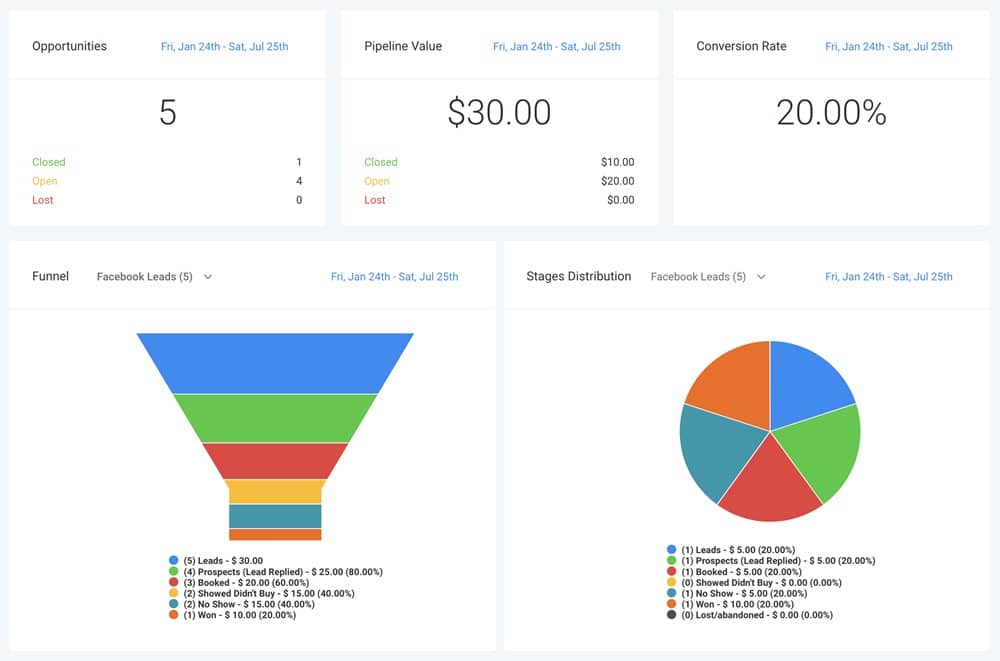

Tracking & Optimizing Your Financial Advisory Business with Reporting

To grow your financial advisory business, you need to track performance, identify trends, and optimize your strategies.

GoHighLevel provides built-in reporting and analytics tools that help you measure key business metrics, track client engagement, and optimize your marketing and sales efforts.

1. Why Tracking & Reporting Matters for Financial Advisors?

✅ Measure Business Performance – Understand what’s working and what needs improvement

✅ Improve Client Retention – Identify patterns in client behavior to enhance your services

✅ Optimize Marketing & Sales – See which campaigns bring in the most leads & revenue

✅ Enhance Productivity – Automate reports to make data-driven decisions

📌 Pro Tip: Regularly reviewing reports helps you make smarter, data-backed business decisions instead of guessing.

2. Key Metrics to Track in GoHighLevel

🔹 Lead & Sales Performance Metrics

✔ Number of Leads Generated – How many prospects are entering your funnel?

✔ Conversion Rate – How many leads turn into paying clients?

✔ Lead Source Analysis – Which marketing channels bring the most leads?

✔ Sales Pipeline Performance – Track deals in different pipeline stages

📌 Pro Tip: Use GoHighLevel’s Lead Source Report to see which campaigns bring in the most valuable leads.

🔹 Client Engagement & Retention Metrics

✔ Appointment No-Show Rate – Track how many scheduled calls are missed

✔ Client Engagement Score – Monitor who interacts with your emails, calls, and messages

✔ Churn Rate – How many clients stop using your services?

📌 Pro Tip: If no-shows are high, automate appointment reminders via SMS & email.

🔹 Marketing & Campaign Performance Metrics

✔ Email Open & Click Rates – See which emails perform best

✔ SMS Engagement – Measure response rates from text messages

✔ Ad Campaign ROI – Track the return on investment for paid ads

✔ Website & Landing Page Conversions – Check which pages turn visitors into leads

📌 Pro Tip: Use A/B testing on emails & landing pages to improve conversion rates.

3. How to Access Reports in GoHighLevel

GoHighLevel’s reporting dashboard makes it easy to track performance in real-time.

🔹 Steps to View & Use Reports in GoHighLevel

Go to ‘Reporting’ in the Dashboard

Select the Report Type

- Lead Reports – See lead sources & conversion rates

- Sales Reports – Monitor revenue trends & pipeline performance

- Marketing Reports – Analyze email, SMS, and ad campaign results

Additional Settings

- Filter Data by Date Range & Metrics

- Export Reports – Share with your team or use for client presentations

📌 Pro Tip: Set up automated reports to get weekly/monthly insights via email.

4. Optimizing Your Business Based on Reports

Once you analyze your reports, use the insights to improve your financial advisory business.

🔹 Actionable Steps to Optimize Performance

✔ Refine Your Marketing Strategy – Focus on lead sources that bring in high-value clients

✔ Improve Client Retention – Automate personalized follow-ups for inactive clients

✔ Adjust Pricing & Services – Use sales data to optimize your service packages

✔ Enhance Team Productivity – Identify bottlenecks in your workflow & fix them

📌 Pro Tip: Use GoHighLevel’s workflows & automation to act on insights immediately.

Why Reporting is Essential for Financial Advisors?

✅ Enables data-driven decisions – No more guessing, only strategic actions

✅ Helps you scale faster – Track what’s working & invest in successful strategies

✅ Reduces wasted efforts – Focus on high-performing marketing & sales activities

✅ Boosts client satisfaction – Improve communication & retention based on engagement data

By leveraging GoHighLevel’s reporting tools, you can track, optimize, and grow your financial advisory business with real-time data and actionable insights.

How to Use GoHighLevel’s Pipeline & Workflow Automation for Financial Advisors

As a financial advisor, managing client relationships, following up with leads, and tracking deals can quickly become overwhelming.

GoHighLevel’s pipeline and workflow automation helps you streamline your processes, ensuring that no opportunity slips through the cracks.

This section will walk you through how to set up and optimize your sales pipeline and automation workflows to improve efficiency and maximize client conversions.

1. Why Pipeline & Workflow Automation Matter for Financial Advisors

✅ Organize & Track Leads – Easily visualize where each prospect is in the sales process

✅ Automate Client Follow-Ups – No more manual reminders; the system keeps in touch for you

✅ Improve Conversion Rates – Guide leads smoothly from inquiry to booked appointment to client

✅ Save Time & Scale Faster – Automate repetitive tasks, so you focus on high-value activities

📌 Pro Tip: Setting up an automated pipeline means you never lose track of a potential client due to forgotten follow-ups.

2. Setting Up Your Sales Pipeline in GoHighLevel

GoHighLevel’s pipeline feature allows you to map out every stage of your client journey, from the first contact to becoming a paying client.

🔹 How to Create & Customize Your Pipeline

Go to ‘Opportunities’ in GoHighLevel

Click ‘Create New Pipeline’

Add Custom Stages Based on Your Sales Process

- New Lead – Just inquired about your services

- Initial Consultation Booked – Scheduled an appointment

- Follow-Up Needed – Missed appointment or not ready yet

- Proposal Sent – Waiting for client approval

- Closed – Won – Converted into a client

- Closed – Lost – Did not proceed

Assign Automation to Each Stage

- Auto-send reminders when leads move to “Follow-Up Needed”

- Trigger a contract or invoice when a lead moves to “Proposal Sent”

- Set a Thank You email when a deal is “Closed – Won”

📌 Pro Tip: Keep your pipeline simple yet structured, so it’s easy to track where each client stands.

3. Automating Client Follow-Ups & Nurturing

Many financial advisors lose leads simply because they don’t follow up consistently.

With GoHighLevel, you can automate follow-ups across email, SMS, and voicemail drops, ensuring you stay top-of-mind.

🔹 How to Automate Follow-Ups Based on Pipeline Stages

Go to ‘Automation’ and Create a New Workflow

Set the Trigger Based on Pipeline Stage

- If a client moves to “Follow-Up Needed,” send an automated reminder

- If a lead doesn’t book an appointment, send a gentle nudge via SMS

- If a proposal is sent but not accepted, trigger an email reminder after 3 days

Customize Your Messages

- Keep emails concise and personalized

- Use SMS for quick engagement

- Add a voicemail drop for a personal touch

📌 Example Workflow:

🚀 A lead enters the pipeline as “New Inquiry” → Automated welcome email with a booking link

⏳ If no appointment is booked in 2 days → Follow-up SMS reminder

📅 If an appointment is booked → Confirmation email & SMS reminder

📌 Pro Tip: Set up multi-channel automation (email + SMS + voicemail) to increase engagement.

4. Automating Proposal & Onboarding Processes

Once a lead is ready to move forward, automating your proposal and onboarding steps can save time and enhance the client experience.

🔹 How to Automate the Proposal & Onboarding Process

Trigger a Contract or Proposal When a Lead Reaches “Proposal Sent” Stage

- Use GoHighLevel’s integration with DocuSign or PandaDoc to auto-send contracts

- Include a secure payment link to streamline the deposit process

Set Up an Automated Client Onboarding Workflow

- Send a Welcome Email with a list of required documents

- Trigger an SMS with a link to book an onboarding call

- Add them to a new client nurture sequence for ongoing education

📌 Pro Tip: Automating onboarding creates a professional first impression and ensures every client gets a seamless experience.

5. Managing Clients Efficiently with Automated Workflows

Beyond sales and onboarding, GoHighLevel allows you to automate other aspects of client management to increase efficiency.

🔹 Examples of Automated Workflows for Financial Advisors

✔ Annual Review Reminder – Auto-send a reminder to book a financial review

✔ Birthday & Anniversary Emails – Strengthen relationships with personalized messages

✔ Renewal Notifications – Remind clients when insurance or investment plans need renewal

✔ Re-Engagement Campaigns – Reach out to inactive clients with value-driven content

📌 Pro Tip: Use GoHighLevel’s AI-driven workflows to personalize interactions based on client behavior.

Why You Need Pipeline & Workflow Automation:

✅ Stay Organized – Know exactly where each client is in your sales process

✅ Increase Efficiency – Automate time-consuming tasks & focus on high-value clients

✅ Boost Conversions – Never lose leads due to lack of follow-ups

✅ Enhance Client Experience – Provide seamless communication and a smooth onboarding process

By leveraging GoHighLevel’s pipeline and workflow automation, you can convert more leads, retain more clients, and scale your financial advisory business effortlessly.

Case Studies and Success Stories

Real-world examples provide valuable insights into how financial advisors can leverage GoHighLevel to achieve their business goals and drive success.

Let's explore some case studies and success stories that illustrate the impact of GoHighLevel in the financial advisory industry:

Case Study #1

Financial Advisory Firm Increases Client Engagement

Overview: A financial advisory firm sought to enhance client engagement and streamline communication processes.

Solution: By implementing GoHighLevel's marketing automation and CRM tools, the firm automated client communication, personalized outreach, and tracked client interactions.

Results: The firm experienced a significant increase in client engagement, with higher open and click-through rates for marketing campaigns.

Advisors were able to nurture leads more effectively and deliver personalized financial advice, leading to improved client satisfaction and retention.

Success Story #2

Independent Financial Advisor Grows Client Base

Overview: An independent financial advisor aimed to expand their client base and increase revenue streams.

Solution: Using GoHighLevel's sales funnel management and appointment scheduling features, the advisor created targeted marketing campaigns and streamlined the client onboarding process.

Results: The advisor successfully attracted new clients through targeted lead-generation efforts and optimized sales funnels.

With efficient appointment scheduling and follow-up processes, the advisor was able to convert leads into clients and achieve steady business growth.

Case Study #3

Compliance-Driven Financial Advisory Firm

Overview: A compliance-driven financial advisory firm prioritized data security and regulatory compliance in client communications.

Solution: Leveraging GoHighLevel's compliance and security features, the firm implemented encrypted communication channels, access controls, and audit trails to ensure compliance with industry regulations.

Results: The firm achieved peace of mind knowing that client data was securely stored and managed within GoHighLevel.

Compliance audits were streamlined, and regulatory requirements were met, reinforcing client trust and confidence in the firm's services.

These case studies and success stories demonstrate the tangible benefits that financial advisors can realize by incorporating GoHighLevel into their practice.

GoHighLevel for Financial Advisors: Training and Support Resources

To ensure financial advisors can maximize the benefits of GoHighLevel, the platform offers comprehensive training and support resources tailored to their needs.

Let's explore some of the training and support options available:

Onboarding Assistance

GoHighLevel provides personalized onboarding assistance to help financial advisors get started with the platform quickly and efficiently.

Dedicated account managers guide advisors through the setup process, offer training sessions, and provide ongoing support to address any questions or concerns.

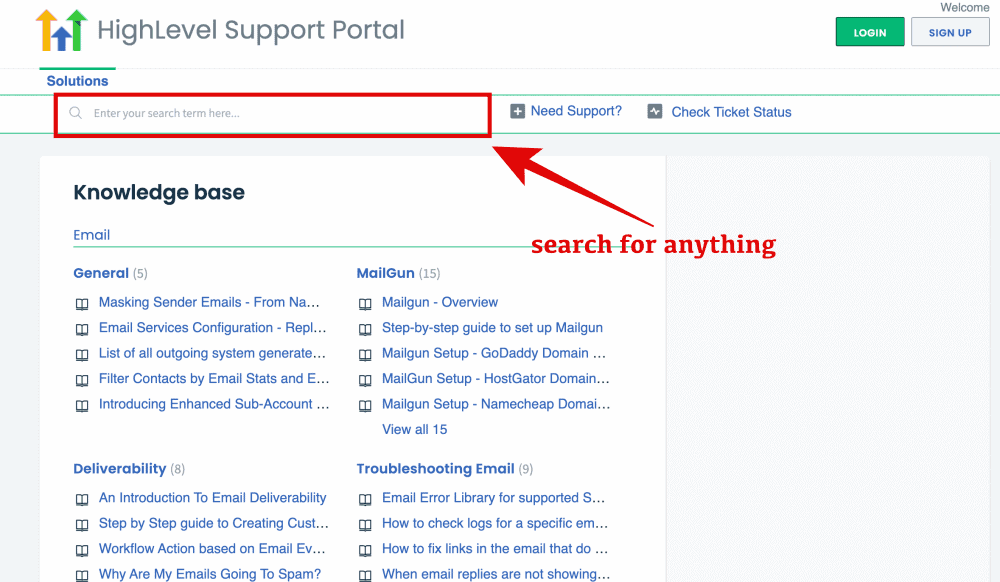

Training Materials and Tutorials

GoHighLevel offers a wealth of training materials, tutorials, and knowledge base articles to help financial advisors learn how to use the platform effectively.

From video tutorials to step-by-step guides, advisors can access a variety of resources to deepen their understanding of GoHighLevel's features and functionalities.

Live Webinars and Workshops

GoHighLevel hosts live webinars and workshops regularly, covering a range of topics relevant to financial advisors.

These interactive sessions provide valuable insights, best practices, and real-world examples to help advisors optimize their use of GoHighLevel and achieve their business goals.

Community Forums and User Groups

GoHighLevel facilitates community engagement through forums, user groups, and online communities where financial advisors can connect with peers, share insights, and collaborate on best practices.

By participating in these forums, advisors can learn from others' experiences, troubleshoot issues, and stay up-to-date on the latest platform updates and developments.

Dedicated Support Team

In addition to self-service resources, GoHighLevel offers access to a dedicated support team available via email, chat, or phone to assist financial advisors with any technical or account-related inquiries.

The support team is committed to providing prompt and helpful assistance to ensure advisors can overcome any challenges they encounter while using the platform.

With robust training and support resources at their disposal, financial advisors can feel confident knowing that GoHighLevel is committed to their success and is available to support them every step of the way.

How to Use GoHighLevel’s AI & Integrations for Enhanced Productivity

As a financial advisor, efficiency is crucial to managing multiple clients, tracking leads, and ensuring compliance while still providing personalized service.

GoHighLevel’s AI tools and third-party integrations allow you to automate tasks, enhance client interactions, and streamline your workflow, ultimately improving productivity.

This section will cover using AI and key integrations to maximize efficiency in your financial advisory business.

1. Why AI & Integrations Matter for Financial Advisors

✅ Save Time on Administrative Tasks – Automate client communication, scheduling, and data entry

✅ Enhance Client Engagement – Use AI-powered chat and email responses for real-time interactions

✅ Streamline Compliance & Document Management – Integrate with financial tools to maintain records

✅ Optimize Marketing & Lead Generation – Automate follow-ups and analyze campaign performance

📌 Pro Tip: Leveraging AI and integrations can cut down manual work by 30-50%, allowing you to focus on high-value tasks like client strategy and portfolio management.

2. Using GoHighLevel’s AI for Smarter Client Interactions

GoHighLevel's AI tools help you manage inquiries, automate responses, and provide better customer service without manual effort.

🔹 AI-Powered Chatbots for Instant Client Engagement:

- Set up AI chatbots on your website to capture leads and answer common questions

- Automate appointment booking directly from the chat

- Use AI to qualify leads before they reach you

Example:

- A potential client visits your website and asks, “What investment strategies do you offer?”

- The AI chatbot replies, “We provide customized investment solutions. Would you like to book a free consultation?”

- The chatbot captures their details and schedules a call

📌 Pro Tip: AI chatbots reduce response time and help you engage leads 24/7.

🔹 AI-Powered Email & SMS Responses

GoHighLevel’s AI can draft and send follow-up emails or SMS messages based on client interactions.

- AI detects when a lead doesn’t reply and automatically sends a follow-up

- AI can personalize messages based on client behavior & past interactions

Example:

- If a client hasn’t responded in 3 days, GoHighLevel’s AI can send:

“Hey [Client Name], I wanted to follow up on our last conversation about retirement planning. Let me know if you have any questions.”

📌 Pro Tip: AI-powered follow-ups can increase engagement rates by up to 40%.

3. Best GoHighLevel Integrations for Financial Advisors

GoHighLevel integrates with essential financial tools, making it easier to manage payments, compliance, document signing, and reporting.

🔹 Key Financial Integrations & Their Benefits

| Integration | Use Case | Benefit |

|---|---|---|

| QuickBooks / Xero | Automate invoicing & expense tracking | Saves time on bookkeeping & compliance |

| DocuSign / PandaDoc | Digital contract & proposal signing | Speeds up client onboarding & agreement processing |

| Calendly / Acuity | Appointment scheduling | Syncs with your CRM & prevents double bookings |

| Stripe / PayPal | Online payment processing | Makes it easy for clients to pay for consultations & services |

| Zapier | Custom integrations with 5,000+ apps | Connects GoHighLevel with specialized tools like CRM & financial software |

📌 Pro Tip: Integrating QuickBooks with GoHighLevel allows you to track client payments automatically and reduce manual financial tracking.

4. Automating Compliance & Secure Document Management

Financial advisors need secure ways to store client data and documents while ensuring compliance with industry regulations.

🔹 Steps to Automate Compliance & Document Handling

- Use GoHighLevel’s Custom Forms to collect client financial data securely

- Integrate with DocuSign for legally binding digital signatures

- Use Cloud Storage (Google Drive, Dropbox, OneDrive) for easy document access

- Set Up Automated Reminders for compliance renewals & KYC updates

📌 Pro Tip: Automating document workflows reduces paperwork errors and ensures compliance with industry regulations.

5. AI-Driven Reporting & Business Insights

GoHighLevel’s AI-powered reporting tools help you track key business metrics and optimize performance.

🔹 How to Use AI-Driven Analytics for Financial Advisors

- Monitor Sales & Lead Performance – See which lead sources generate the most conversions

- Track Marketing ROI – Identify which campaigns bring in the highest-value clients

- Optimize Appointment Scheduling – Analyze client booking patterns for better time management

- Measure Client Engagement – AI analyzes email & SMS response rates to improve communication

📌 Pro Tip: AI-driven reporting can help you identify patterns and adjust your sales & marketing strategy for better results.

Why AI & Integrations Are Game-Changers for Financial Advisors:

✅ Save Time & Increase Efficiency – Automate lead management, scheduling, and compliance tasks

✅ Enhance Client Experience – Provide instant responses & seamless interactions

✅ Streamline Payments & Contracts – Make it easy for clients to sign agreements & pay for services

✅ Gain Data-Driven Insights – Use AI analytics to refine your marketing and business strategy

By leveraging GoHighLevel’s AI tools and integrations, you can eliminate manual work, enhance client communication, and scale your financial advisory business with ease.

Frequently Asked Questions

Frequently Asked Questions about GoHighLevel for Financial Advisors.

Does GoHighLevel work specifically for financial advisors?

Yes, GoHighLevel is a versatile platform designed to meet the unique needs of financial advisors. Its features encompass holistic client management, lead generation, communication tools, and compliance-centric functionalities tailored for the financial advisory industry.

Is GoHighLevel compliant with industry regulations for financial advisors?

Yes. GoHighLevel includes compliance management features such as audit trails, data encryption, and functionalities designed to adhere to industry regulations. Financial advisors can confidently use the platform while ensuring compliance.

Can I integrate GoHighLevel with my existing CRM?

Yes, using Zapier, you can connect GoHighLevel to your existing CRM and sync client data, appointments, and financial records seamlessly.

Can GoHighLevel’s AI help me generate financial reports for my clients?

No, GoHighLevel’s AI focuses on automation and client engagement rather than financial reporting. However, you can integrate it with tools like QuickBooks or Xero to manage invoicing and expense tracking.

Is it safe to store financial documents in GoHighLevel?

Yes, GoHighLevel offers secure storage, but it’s best to integrate with cloud-based services like Google Drive or Dropbox for added compliance and document security.

What are the best payment integrations for financial advisors using GoHighLevel?

Stripe and PayPal are the best options for collecting payments, allowing you to send invoices and receive funds directly through the platform.

Final Thoughts

As a financial advisor, your success depends on how efficiently you manage client relationships, streamline operations, and market your services.

GoHighLevel for Financial Advisors empowers you to automate key processes, from client onboarding and appointment scheduling to payment collection and compliance management.

By leveraging its AI-driven automation, CRM capabilities, and seamless integrations, you can eliminate manual tasks and focus on delivering high-value financial advice.

With GoHighLevel, you can:

✅ Attract and nurture high-quality leads with automated marketing campaigns.

✅ Enhance client engagement through AI-powered communication and follow-ups.

✅ Simplify scheduling and payments for a frictionless client experience.

✅ Gain real-time business insights to optimize your growth strategy.

Whether you're just starting or looking to scale, GoHighLevel for Financial Advisors provides the tools to grow your financial advisory business efficiently.

By embracing automation and technology, you can spend less time on admin work and more time guiding your clients toward financial success.

Now it's your turn!

Take the first step by setting up GoHighLevel and start transforming how you manage and grow your financial advisory practice. 🚀