If you are looking for a simple yet powerful tutorial on how to use GoHighLevel for Accounts – this is all you need!

You already know that as an accountant, managing client relationships, scheduling appointments, handling invoices, and marketing your services can quickly become overwhelming.

And GoHighLevel for Accountants offers an all-in-one solution designed to help you automate workflows, streamline communication, and enhance client engagement – all while saving time and boosting productivity.

HighLevel works for all types of accountants:

You name it – GHL has got you.

Whether you’re a solo accountant, a tax consultant, or running an accounting firm, GoHighLevel provides robust CRM, automation tools, and marketing features tailored to your business needs.

By the end of this guide, you’ll have a step-by-step blueprint to integrate GoHighLevel into your accounting practice efficiently.

Key Takeaways:

- GoHighLevel streamlines client management and automates key accounting processes, saving you time and improving efficiency.

- Integrated marketing, CRM, and automation tools help you attract and retain clients, boosting revenue and client satisfaction.

- By leveraging GoHighLevel’s reporting, invoicing, and scheduling features, your firm can scale effectively while maintaining a high level of service.

Let's start!

How to Use GoHighLevel for Accountants

I won't waste your time, first, we will set up an account and all the strategies you can use will follow.

Here's how to set it up:

Step 1: Creating Your GoHighLevel Account

Since you will be setting up your account – you should do that for FREE!

Luckily, you can get a 30-day free trial here.

To start, go to GoHighLevel.com/30-day-trial and you will be redirected to the page below.

![What is GoHighLevel? [A User Experience] 6 GoHighLevel 30 Day Trial Home Page](https://theolaoye.com/wp-content/uploads/2024/11/GoHighLevel-30-Day-Trial-Home-Page.jpg)

Click on “30-Day Free Trial” and you will be asked basic information about your business, such as:

- Company Name

- Full Name

- Phone Number

- Email Address

![What is GoHighLevel? [A User Experience] 7 GoHighLevel 30 Day Trial Home Page 2](https://theolaoye.com/wp-content/uploads/2024/11/GoHighLevel-30-Day-Trial-Home-Page-2.jpg)

Upon filling in everything, click on “Go To Step #2” where you will be asked to select the plan you want.

For now, you need to Select the GoHighLevel Unlimited Plan and you will be able to upgrade or downgrade later.

You will be asked to input your credit card details next – you will not be debited anything until the end of your trial.

After that, the next is, the onboarding process.

Step 2: GoHighLevel Onboarding

Once you finish the steps above, Go High Level will ask you some onboarding questions to ensure that your account is well set up.

Let’s take a look at them!

The first thing is to tell GHL more about your business, you would need to:

- Select the industry you operate in

- The primary purpose of using GoHighLevel

- The number of your customers

- And if you have a website

Supply the information based on what is right for you.

![What is GoHighLevel? [A User Experience] 8 GoHighLevel Onboarding Process Stage 1](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-1-1024x493.jpg)

If anything isn’t clear to you now, select anything and continue because you can always change it later.

The next page will ask for your business address and billing information.

Then, you need to specify if you’re willing to resell GoHighLevel or not.

Reselling GoHighLevel means that you can resell the entire platform on your name – at your prices and keep the balance.

![What is GoHighLevel? [A User Experience] 9 GoHighLevel Onboarding Process Stage 2](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-2-1024x498.jpg)

Just fill in the blank as you can see above and proceed to the next stage.

![What is GoHighLevel? [A User Experience] 10 GoHighLevel Onboarding Process Stage 3](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-3-1024x516.jpg)

If you take a closer look at the image above, you will see that it’s asking you to select the tools you currently use.

Selecting the tools is going to keep you organized under one single dashboard.

So, select all that apply and proceed to the next stage.

And if you have none for now, just click on “Next ->“

![What is GoHighLevel? [A User Experience] 11 GoHighLevel Onboarding Process Stage 4](https://saaspen.com/wp-content/uploads/2024/08/gohighlevel-onboarding-4-1024x510.jpg)

So, the next stage will ask you to set up your password and a code will be sent to your email for confirmation.

Input the code and you will have the page below which confirms that your GoHighLevel account has been created.

I want to say congratulations, you have just set up your HighLevel account.

Now, you have access to your dashboard which looks like the image below.

![What is GoHighLevel? [A User Experience] 12 GoHighLevel Agency Dashboard](https://saaspen.com/wp-content/uploads/2024/08/GoHighLevel-Agency-Dashboard-1024x463.jpg)

Step 3. Adding Your Team and Setting User Permissions

If you work with a team, GoHighLevel allows you to add users and define their access levels.

- Go to Settings → My Staff → Add Employee and enter team member details.

- Assign specific roles such as Admin, Accountant, or Assistant, ensuring the right permissions are granted.

- Enable two-factor authentication (2FA) for added security.

Practical Tip: If you have an assistant handling appointment scheduling, restrict their access to CRM and calendar while keeping client financials private.

Step 4. Connecting Your Email, Phone, and SMS Systems

To ensure seamless communication with your clients, integrate your email and phone services.

- Email Integration: Connect Gmail, Outlook, or a custom SMTP server to send emails directly from GoHighLevel.

- Phone & SMS Setup: GoHighLevel provides built-in VoIP services. Alternatively, integrate Twilio to enable SMS and call features.

- Caller ID & Business Number: Set up a dedicated business number for professional client interactions.

Example: If you regularly send tax season reminders, automating SMS follow-ups ensures no client misses their filing deadline.

Step 5. Customizing Your CRM for Accounting Clients

GoHighLevel’s CRM helps you organize and track client interactions efficiently.

- Create custom client pipelines for prospects, active clients, and returning clients.

- Use tags and filters (e.g., “Tax Client,” “Monthly Bookkeeping,” “Audit Assistance”) for easy segmentation.

- Set up automation triggers to send welcome emails or document requests when a new client is onboarded.

Practical Tip: If a client books a tax consultation, GoHighLevel can automatically send a checklist of required documents, saving you time.

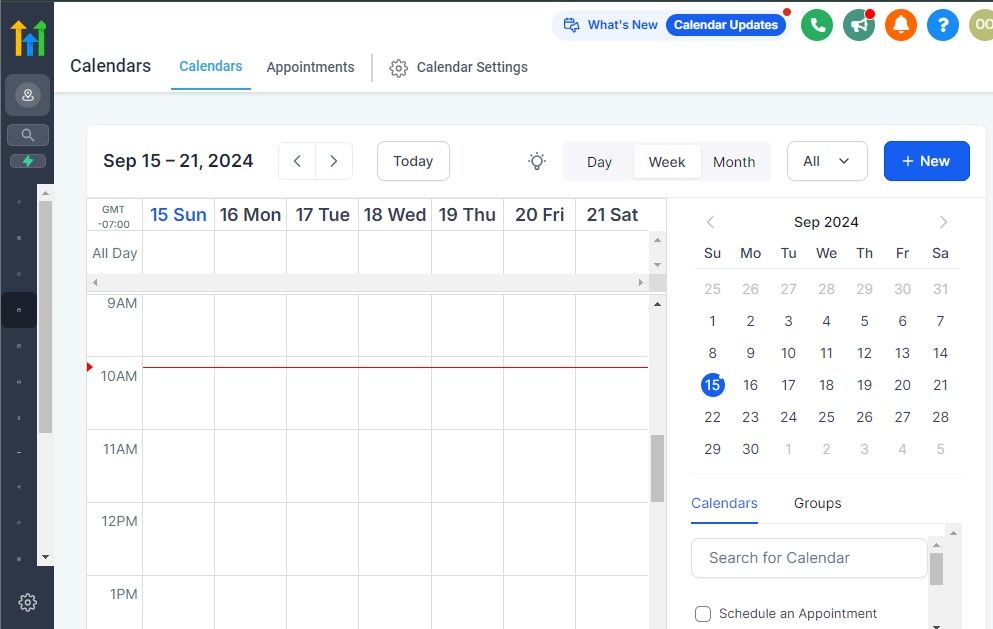

Step 6. Configuring Your Calendar for Appointments

An efficient booking system eliminates back-and-forth scheduling.

- Go to Calendars → Create New Calendar and set your availability.

- Enable automatic confirmations and reminders via email and SMS.

- Sync with Google Calendar or Outlook to avoid double bookings.

- Set up different appointment types (e.g., Tax Consultation, Financial Review, Audit Assistance).

Example: If you only offer tax consultations on Mondays and Wednesdays, GoHighLevel ensures clients can only book within those time slots.

Step 7. Setting Up Payments and Invoicing

GoHighLevel integrates with Stripe and PayPal, allowing you to collect payments directly from clients.

- Go to Payments → Integrations and connect your preferred payment gateway.

- Enable invoice generation and automated payment reminders.

- Create subscription plans for recurring clients (e.g., monthly bookkeeping services).

Practical Tip: If a client’s invoice is overdue, GoHighLevel can automatically send follow-ups until payment is received.

Once your GoHighLevel account is fully set up, you’ll have a structured system for managing clients, scheduling appointments, and automating communication.

Managing Client Relationships with GoHighLevel CRM

As an accountant, maintaining strong client relationships is essential for business growth and client retention.

GoHighLevel’s CRM (Customer Relationship Management) system helps you organize client information, track interactions, and automate follow-ups—ensuring that no client falls through the cracks.

In this section, you’ll learn how to effectively use GoHighLevel’s CRM to streamline client management and improve your accounting practice.

1. Importing and Organizing Client Data

To get started, you need to centralize all client information in GoHighLevel.

Steps to Import Client Data:

- Navigate to Contacts → Import Contacts and upload a CSV file containing client details (name, email, phone number, company, etc.).

- If you already use a CRM (e.g., HubSpot, Zoho, or Excel spreadsheets), export your contacts and import them into GoHighLevel.

- Manually add new clients by clicking “Add Contact” and filling in the details.

Example: If you’re managing bookkeeping for 50+ clients, having all their data in one place allows for quick lookups and seamless communication.

Best Practices for Organizing Clients:

- Use tags to categorize clients (e.g., Tax Client, Bookkeeping, Business Advisory, High-Priority).

- Create custom fields for essential accounting details (e.g., Tax ID, Last Filing Date, Business Type).

- Segment clients based on industry, service type, or engagement level for better personalization.

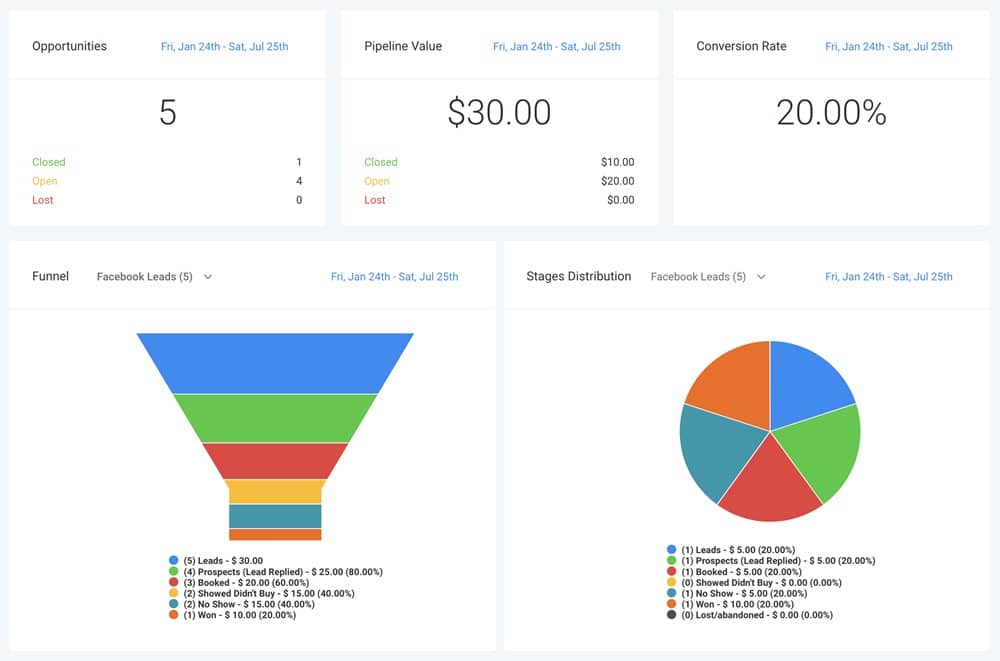

2. Creating Custom Pipelines for Leads, Prospects, and Clients

GoHighLevel’s pipeline management system helps you visualize your client journey and track progress.

Steps to Set Up Your Pipeline:

Go to Opportunities → Create Pipeline and name it (e.g., Accounting Clients).

Define key stages such as:

- New Lead (Inquiry Received)

- Consultation Scheduled

- Proposal Sent

- Contract Signed

- Active Client

Drag and drop clients between stages as they move through your process.

Example: If a potential client books a consultation but hasn’t signed a contract, you can set an automated follow-up reminder to check in with them.

Benefits of Pipeline Management:

✅ Easily track where each client is in the onboarding process.

✅ Automate follow-ups based on pipeline stage.

✅ Get a clear overview of revenue opportunities and pending deals.

3. Using Notes, Tags, and Filters for Better Client Management

Keeping detailed records of your client interactions ensures you never miss a critical detail.

How to Use Notes and Tags:

- When speaking with a client, add notes in their profile to track discussions (e.g., “Client requested tax filing extension for Q2”).

- Apply relevant tags to classify clients based on their needs and service type.

- Use filters to quickly find clients based on tags, industry, or engagement level.

Example: If you have a group of business owners needing payroll assistance, filtering by the “Payroll” tag helps you quickly identify and follow up with them.

4. Automating Follow-ups and Client Reminders

Instead of manually checking in with clients, let GoHighLevel handle follow-ups for you.

Setting Up Automated Follow-ups:

- Go to Automation → Create Workflow and set triggers (e.g., “Send Reminder Email if Invoice is Unpaid After 7 Days”).

- Automate appointment reminders for tax filing deadlines, quarterly reviews, and financial audits.

- Set up post-service follow-ups to check client satisfaction and request testimonials.

Example: If a client’s tax deadline is approaching, GoHighLevel can automatically send them an email and SMS reminder a week before.

Types of Follow-ups You Can Automate:

✅ Appointment Reminders: Reduce no-shows by sending SMS and email reminders.

✅ Billing & Invoicing: Automate overdue payment reminders.

✅ Client Check-ins: Send a quarterly update with tax-saving tips and regulatory changes.

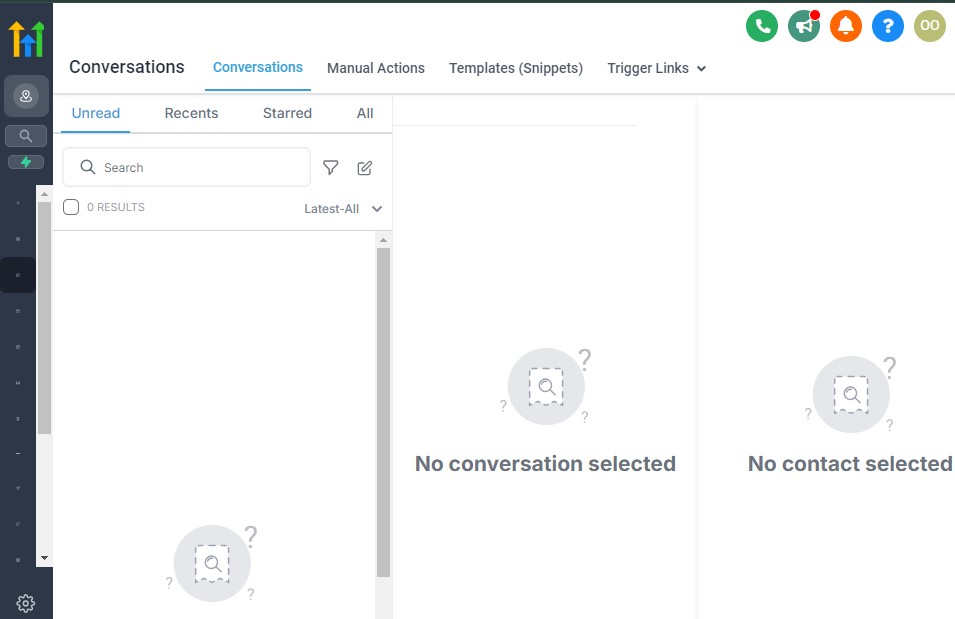

5. Tracking Client Interactions and Communication History

Having a record of every client conversation prevents miscommunication and ensures a seamless experience.

How to Access Communication Logs:

- Open a client’s profile in GoHighLevel to view past emails, calls, and messages.

- Use the Conversations tab to see all interactions in one place.

- Attach documents (e.g., financial statements, tax forms) directly to the client record for easy access.

Example: If a client disputes an invoice, you can quickly pull up past emails and messages to clarify agreements.

With GoHighLevel’s CRM, you can centralize client information, automate follow-ups, and manage relationships effortlessly. The next section will explore how to automate client communication and follow-ups to save time and enhance your accounting firm’s efficiency.

GoHighLevel for Accounts – Automating Client Communication and Follow-ups

As an accountant, staying on top of client communication can be time-consuming, especially when handling appointment reminders, tax deadlines, invoice follow-ups, and routine check-ins.

GoHighLevel helps you automate these tasks, ensuring that clients receive timely responses and reminders without requiring manual effort.

In this section, you’ll learn how to:

✅ Set up automated emails, SMS, and voicemail drops.

✅ Use workflows to streamline follow-ups.

✅ Personalize automated messages for better client engagement.

✅ Track and optimize client communication.

1. Setting Up Automated Email and SMS Communication

With GoHighLevel, you can create automated emails and SMS messages for different client interactions, such as appointment confirmations, invoice reminders, and tax filing updates.

Steps to Automate Emails and SMS:

- Go to Automation → Workflows → Create New Workflow.

- Choose a trigger (e.g., Client books an appointment, Invoice is overdue).

- Select an action:

- Email (e.g., “Your tax filing deadline is approaching – submit your documents now.”)

- SMS (e.g., “Reminder: Your financial consultation is scheduled for tomorrow at 10 AM.”)

- Voicemail Drop (e.g., Pre-recorded reminder for upcoming meetings).

- Personalize messages using dynamic fields (First Name, Service Type, Due Date).

- Set delivery time (e.g., Send follow-up SMS 24 hours after an appointment).

Example: If a client schedules a tax consultation, GoHighLevel can instantly send an email with a checklist of required documents, ensuring they come prepared.

2. Automating Follow-ups for Tax Deadlines, Invoices, and Appointments

GoHighLevel allows you to set up drip campaigns that remind clients about important dates and payments.

Examples of Automated Follow-ups:

✅ Tax Deadline Reminders: Send a series of SMS and emails before major tax deadlines.

✅ Invoice Payment Reminders: Follow up on unpaid invoices at scheduled intervals.

✅ Appointment Confirmations & Rescheduling: Reduce no-shows with automatic reminders.

✅ Onboarding Sequences: Guide new clients through your accounting process.

How to Set Up a Tax Deadline Reminder Workflow:

- Trigger: Tax deadline approaching (e.g., 30 days before tax filing due date).

- Action 1: Send an email with document submission instructions.

- Action 2: Send an SMS reminder a week before the deadline.

- Action 3: Call or drop a voicemail the day before.

- Action 4: If no response, trigger a follow-up task for manual outreach.

Example: If a business client needs to submit quarterly tax filings, GoHighLevel can automatically remind them 30, 14, and 3 days before the deadline.

3. Personalizing Automated Messages for Better Engagement

Automation doesn’t have to feel robotic – GoHighLevel allows you to personalize messages so clients feel valued.

Best Practices for Personalization:

- Use merge tags (e.g., Hi [First Name], your next financial review is scheduled for [Date].).

- Create segmented lists (e.g., different messages for small business owners vs. individual tax clients).

- Adjust message timing (e.g., send reminders during business hours for higher response rates).

- Offer one-click actions (e.g., “Click here to confirm your appointment”).

Example: Instead of sending a generic invoice reminder, personalize it:

- Generic: “Your invoice is overdue.”

- Personalized: “Hi John, your bookkeeping invoice for January ($500) is overdue. Please complete the payment by March 20 to avoid late fees. Click here to pay: [Link].”

4. Tracking and Optimizing Client Communication

GoHighLevel provides detailed analytics to track how well your automated communication is performing.

How to Monitor Effectiveness:

- Go to Reporting → Conversations to see open rates, response times, and unread messages.

- Identify which emails and SMS get the most engagement.

- Adjust workflows based on response patterns (e.g., if emails aren’t opened, try SMS reminders instead).

Example: If you notice that tax deadline reminders via email have low open rates, you can switch to SMS or voicemail drops for better engagement.

Automating client communication ensures you never miss a follow-up while maintaining a high level of service. By setting up smart workflows, personalizing messages, and tracking engagement, you can enhance client relationships and boost efficiency.

Streamlining Appointment Scheduling with GoHighLevel

Managing client appointments efficiently is crucial for accountants, as missed meetings or scheduling conflicts can lead to lost time and revenue.

GoHighLevel’s built-in calendar and scheduling system allows you to automate appointment bookings, reduce no-shows, and improve client communication.

In this section, you’ll learn how to:

✅ Set up and customize your GoHighLevel calendar.

✅ Enable self-scheduling for clients.

✅ Automate appointment reminders and confirmations.

✅ Integrate GoHighLevel with external calendars for seamless scheduling.

1. Setting Up Your GoHighLevel Calendar

A well-organized calendar helps you manage client meetings, consultations, and follow-ups efficiently.

Steps to Configure Your Calendar:

- Go to Calendars → Create New Calendar in your GoHighLevel dashboard.

- Set availability preferences (e.g., work hours, buffer time between appointments).

- Choose appointment types (e.g., tax consultation, bookkeeping review, financial audit).

- Define meeting durations (e.g., 30-minute, 60-minute sessions).

- Set a time zone to avoid confusion for remote clients.

Example: If you offer multiple services, you can create different calendars for tax planning, business consulting, and personal financial reviews.

2. Enabling Client Self-Scheduling for Convenience

Instead of manually scheduling appointments, allow clients to book directly through your GoHighLevel calendar.

How to Enable Self-Scheduling:

- Share your booking link via email, SMS, or your website.

- Embed the scheduling widget on your website or client portal.

- Customize confirmation messages to include meeting details and required documents.

Example: A business owner needing payroll assistance can visit your website, pick an available time slot, and book an appointment instantly – without back-and-forth emails.

3. Automating Appointment Confirmations and Reminders

To reduce no-shows, GoHighLevel lets you send automatic confirmations and reminders via email and SMS.

Setting Up Automated Reminders:

- Go to Automations → Create Workflow and choose “Appointment Scheduled” as the trigger.

- Add an instant confirmation email with meeting details.

- Schedule reminders:

- 48 hours before – Email reminder with an option to reschedule.

- 24 hours before – SMS reminder with a calendar link.

- 1 hour before – Final reminder via SMS or voicemail drop.

Example: If a client books a tax consultation, they receive an instant confirmation, a reminder the day before, and a final SMS an hour before the meeting.

4. Integrating with Google and Outlook Calendars

To avoid double-booking and sync appointments across platforms, connect GoHighLevel with Google Calendar or Outlook.

How to Integrate External Calendars:

- Go to Settings → Integrations → Calendar Sync.

- Choose Google Calendar or Outlook and log in to your account.

- Enable two-way sync so GoHighLevel updates your calendar in real time.

Example: If you add a personal appointment to Google Calendar, GoHighLevel automatically blocks that time to prevent clients from booking it.

5. Managing Cancellations and Rescheduling Efficiently

Clients sometimes need to reschedule – make it easy for them while keeping your calendar organized.

Best Practices for Handling Cancellations:

- Include a reschedule link in appointment confirmations.

- Set a cancellation policy (e.g., 24-hour notice required).

- Automate follow-up messages for missed appointments, offering to reschedule.

Example: If a client cancels a tax filing meeting, GoHighLevel can automatically send them a new scheduling link to pick another date.

GoHighLevel’s scheduling features save you time, reduce no-shows, and give clients the flexibility to book meetings easily. By automating appointment confirmations, reminders, and rescheduling, you ensure a smooth experience for both you and your clients.

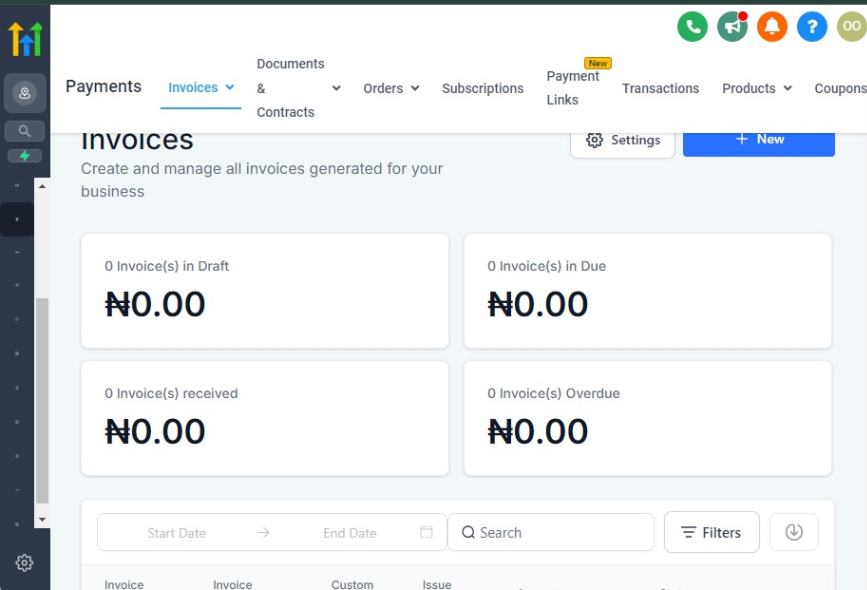

Automating Billing, Payments, and Invoices with GoHighLevel

Managing billing, payments, and invoices manually can be time-consuming and prone to errors.

As an accountant, automating these processes helps you get paid on time, reduce administrative workload, and provide a seamless experience for your clients.

GoHighLevel’s built-in payment and invoicing features allow you to streamline financial transactions efficiently.

In this section, you’ll learn how to:

✅ Set up GoHighLevel’s invoicing and payment system.

✅ Automate invoice generation and payment reminders.

✅ Integrate GoHighLevel with payment gateways.

✅ Track and manage payments for better financial control.

1. Setting Up Invoicing and Payment Collection

GoHighLevel provides a robust invoicing tool that allows you to send professional invoices and receive payments easily.

Steps to Set Up Invoicing:

- Go to Payments → Invoices → Create New Invoice.

- Enter client details and select the billing frequency (one-time or recurring).

- Add services or line items (e.g., tax filing, bookkeeping, payroll processing).

- Set due dates and payment terms (e.g., Net 7, Net 30).

- Customize your invoice with your logo and brand colors.

- Enable automatic payment collection for recurring clients.

Example: If you provide monthly bookkeeping services, you can create a recurring invoice that bills your client on the 1st of each month without manual intervention.

2. Automating Invoice Generation and Payment Reminders

Instead of manually following up on unpaid invoices, use GoHighLevel’s automation features to send reminders and overdue notices.

How to Automate Invoice Follow-ups:

Go to Automations → Workflows → Create New Workflow.

Set a trigger: Invoice Sent.

Add follow-up reminders based on the due date:

- 3 days before due date – Friendly payment reminder email.

- On the due date – SMS reminder with a payment link.

- 3 days overdue – Email with a late payment warning.

- 7 days overdue – Escalation email or call task assigned to your team.

Example: If a client’s invoice is due on March 10, GoHighLevel can send an automated email on March 7, an SMS reminder on March 10, and a late payment notice on March 13.

3. Integrating Payment Gateways for Seamless Transactions

To receive payments directly through GoHighLevel, you can integrate payment processors like Stripe, PayPal, and Authorize.net.

Steps to Connect a Payment Gateway:

- Go to Settings → Integrations → Payments.

- Select your preferred payment provider (Stripe, PayPal, etc.).

- Log in to your account and grant GoHighLevel access.

- Enable auto-charge for recurring invoices if applicable.

Example: If you handle corporate tax filing and charge a flat $1,500 fee, your client can receive an invoice with a Pay Now button, allowing them to pay instantly via credit card or PayPal.

4. Tracking and Managing Payments for Better Cash Flow

GoHighLevel offers real-time payment tracking, so you can monitor which invoices are paid, pending, or overdue.

How to Track Payments Efficiently:

- Go to Payments → Transactions to view payment status.

- Filter invoices by paid, pending, overdue, or failed payments.

- Export financial reports to analyze revenue trends.

- Set up automatic late fees for overdue invoices.

Example: If a client’s payment fails, GoHighLevel can automatically trigger a workflow to send an alert and request an alternative payment method.

By automating billing, payments, and invoicing with GoHighLevel, you can eliminate manual follow-ups, reduce late payments, and improve cash flow for your accounting firm. Clients will appreciate the seamless payment process, while you can focus more on delivering financial expertise rather than chasing invoices.

Learn More:

- GoHighLevel Review: (My Experience After 4 Years)

- What is GoHighLevel? [A User Experience]

- GoHighLevel Features: Complete List

- GoHighLevel Integrations

- GoHighLevel Pricing: (Costs Breakdown)

- Is GoHighLevel a CRM?: (Find Out Here💡)

- Is GoHighLevel Legit?: (Find Out Here 💡)

- Is GoHighLevel Worth It? (Find Out Here 💡)

- 15+ GoHighLevel Benefits: (Why You Need It)

Marketing Your Accounting Services with GoHighLevel

Attracting and retaining clients is essential for growing your accounting firm.

With GoHighLevel’s all-in-one marketing tools, you can generate leads, nurture prospects, and convert them into loyal clients – without relying on outdated or manual marketing methods.

In this section, you’ll learn how to:

✅ Build a high-converting landing page for your accounting services.

✅ Set up automated email and SMS marketing campaigns.

✅ Use social media and paid ads to attract leads.

✅ Track and optimize your marketing efforts with analytics.

1. Building a High-Converting Landing Page

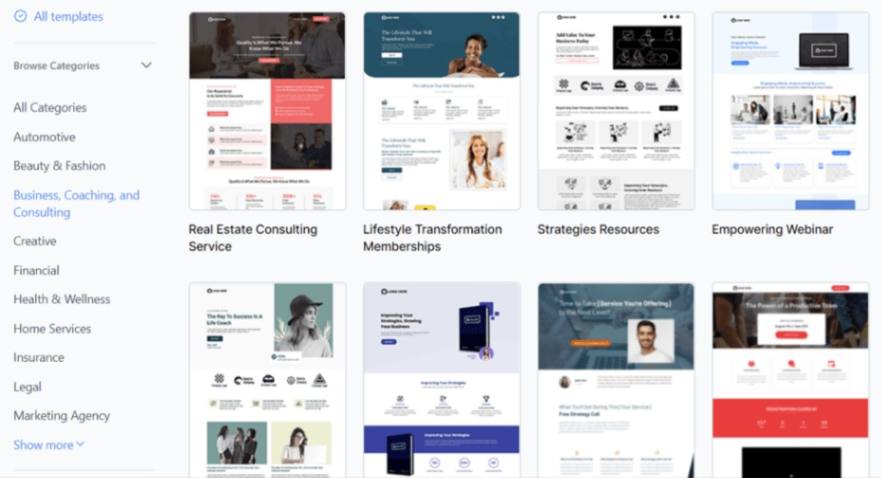

A well-designed landing page helps convert visitors into clients by showcasing your services and making it easy for them to contact you.

How to Create a Landing Page in GoHighLevel:

Go to Sites → Funnels & Websites → Create New Funnel.

Choose a landing page template or start from scratch.

Add essential elements:

- A clear headline (e.g., “Expert Tax & Accounting Services for Small Businesses”).

- A brief service description with client benefits.

- A call-to-action (CTA) (e.g., “Schedule a Free Consultation”).

- A contact form to capture leads.

- Testimonials and case studies for credibility.

Optimize for mobile and publish your page.

Example: If you specialize in helping freelancers with tax planning, your landing page could highlight common tax deductions they might be missing and offer a free tax review.

2. Automating Email and SMS Marketing Campaigns

Email and SMS marketing are powerful tools for nurturing leads and keeping your services top of mind for potential clients.

How to Set Up an Email/SMS Campaign in GoHighLevel:

Go to Marketing → Campaigns → Create New Campaign.

Select Email or SMS as your marketing channel.

Create a lead nurturing sequence:

- Day 1: Welcome email introducing your firm.

- Day 3: Email with a free tax or accounting resource.

- Day 7: Case study on how you helped a similar client.

- Day 14: Special offer or reminder to schedule a call.

Automate follow-ups for unresponsive leads.

Example: If a small business owner downloads your tax guide, GoHighLevel can automatically send a follow-up email offering a free 15-minute consultation.

3. Running Paid Ads and Social Media Campaigns

GoHighLevel allows you to launch and manage Facebook, Instagram, and Google Ads to drive targeted traffic to your landing page.

Steps to Create a Paid Ad Campaign:

- Go to Marketing → Ads Manager.

- Choose Facebook, Instagram, or Google Ads.

- Define your audience:

- Demographics: Business owners, freelancers, or individuals needing tax services.

- Location: Local businesses or nationwide clients.

- Interests: People searching for bookkeeping, accounting, or tax help.

- Set a budget and launch the campaign.

- Monitor ad performance and optimize for better results.

Example: Running a Facebook ad offering a “Free Business Tax Consultation” can attract local business owners looking for tax-saving strategies.

4. Tracking and Optimizing Your Marketing Efforts

GoHighLevel provides real-time analytics to track the effectiveness of your campaigns and make data-driven decisions.

How to Measure Your Marketing Success:

- Go to Reporting → Analytics to monitor campaign performance.

- Track email open rates, SMS click rates, and ad conversions.

- Adjust campaigns based on insights (e.g., tweaking ad copy or subject lines for better engagement).

- Use A/B testing to see what works best.

Example: If your email open rates are low, testing different subject lines like “5 Tax Mistakes That Cost Small Business Owners Thousands” can improve engagement.

By leveraging GoHighLevel’s marketing tools, you can generate a steady stream of accounting leads, nurture potential clients, and establish your firm as a trusted financial expert.

Building an Online Presence with GoHighLevel’s Website & Funnels

A strong online presence is essential for accountants looking to attract and retain clients.

With GoHighLevel’s website builder and sales funnels, you can create a professional website, capture leads, and guide potential clients through a structured conversion journey – all without needing advanced technical skills.

In this section, you’ll learn how to:

✅ Build a professional accounting website using GoHighLevel.

✅ Create lead generation funnels to capture client inquiries.

✅ Optimize your site for search engines (SEO) to attract organic traffic.

✅ Integrate essential tools like appointment booking and contact forms.

1. Creating a Professional Accounting Website

Your website serves as your digital storefront. It should clearly communicate your expertise, services, and how potential clients can reach you.

How to Build a Website in GoHighLevel:

Navigate to Sites → Funnels & Websites → Websites.

Click Create New Website and select a template or start from scratch.

Add essential pages:

- Home Page: Overview of your services and unique value.

- About Page: Your background, qualifications, and experience.

- Services Page: Breakdown of bookkeeping, tax preparation, payroll, etc.

- Contact Page: Inquiry form, phone number, and office location.

- Blog (Optional): Share tax tips, accounting insights, and financial advice.

Customize branding (logo, colors, fonts) to align with your firm.

Optimize for mobile responsiveness.

Click Publish to make your website live.

Example: If you specialize in tax services for small businesses, your homepage could highlight “Maximize Your Tax Savings with Expert Accounting” as a headline, with a Schedule a Consultation button.

2. GoHighLevel for Accountants – Building Lead Generation Funnels

Funnels help guide potential clients from awareness to action, ensuring a structured conversion process.

Steps to Create a Lead Funnel:

- Go to Sites → Funnels & Websites → Funnels.

- Click Create New Funnel and name it (e.g., “Small Business Tax Funnel”).

- Add key funnel steps:

- Landing Page: Captures visitor details with a compelling offer.

- Thank You Page: Confirms their submission and guides them to the next step.

- Follow-Up Sequence: Automates emails or SMS reminders.

- Offer a lead magnet (e.g., free tax consultation, financial checklist) to encourage sign-ups.

- Connect the funnel to your CRM for automated lead nurturing.

Example: A CPA offering year-end tax planning could create a funnel with a landing page offering a Free 10-Minute Tax Strategy Call, capturing leads for future services.

3. Optimizing Your Website for SEO

Search Engine Optimization (SEO) helps your website rank higher on Google, making it easier for potential clients to find you.

SEO Best Practices for Accountants:

- Use Keywords Strategically: Include terms like “small business accountant,” “tax preparation services,” and “best CPA near me.”

- Optimize Meta Titles & Descriptions: Write compelling page titles and descriptions for better visibility.

- Add a Blog: Share valuable content on tax tips, financial planning, and bookkeeping strategies.

- Improve Website Speed: Optimize images and use fast-loading templates.

- Ensure Mobile-Friendliness: Most users will visit your site from their phones.

Example: A blog post titled “Top 5 Tax Deductions for Freelancers” can drive organic traffic from freelancers searching for tax-saving strategies.

4. Integrating Essential Website Features

GoHighLevel allows you to add powerful features that enhance user experience and increase conversions.

Must-Have Integrations:

✅ Appointment Booking System – Let clients schedule consultations directly from your website.

✅ Live Chat Widget – Engage visitors and answer questions instantly.

✅ Testimonial Section – Showcase reviews and success stories to build trust.

✅ Call-to-Action (CTA) Buttons – Use “Book a Call” or “Get a Free Consultation” buttons prominently.

Example: If a business owner lands on your site after searching for “tax accountant near me,” they should be able to book a consultation within seconds through an embedded appointment scheduler.

Your online presence is often the first impression potential clients have of your accounting firm. By leveraging GoHighLevel’s website and funnel builder, you can establish credibility, generate consistent leads, and convert visitors into paying clients.

Reputation Management and Client Reviews

Your accounting firm’s reputation plays a critical role in attracting new clients and retaining existing ones.

Positive client reviews build trust, enhance credibility, and influence potential clients’ decision-making.

GoHighLevel provides a powerful reputation management system that helps you collect, monitor, and respond to reviews effortlessly.

In this section, you’ll learn how to:

✅ Collect more client reviews using automated requests.

✅ Monitor and manage online reviews across different platforms.

✅ Respond professionally to reviews to strengthen client relationships.

✅ Use positive testimonials to boost your marketing efforts.

1. Automating Client Review Requests

Most satisfied clients won’t leave a review unless prompted.

With GoHighLevel, you can automate review requests to ensure a steady flow of positive feedback.

How to Set Up Automated Review Requests:

Go to Reputation → Review Request in GoHighLevel.

Click Create New Request and select Email or SMS.

Personalize the message:

- Keep it short and professional.

- Express appreciation for their business.

- Provide a direct link to leave a review.

Automate the process by linking it to your CRM:

- Send a review request after a successful tax filing.

- Trigger an automated request after a completed bookkeeping service.

Set reminders for clients who don’t respond.

Example: After completing a business tax filing, GoHighLevel can automatically send a message like:

“Hi [Client Name], thank you for trusting us with your tax needs! We’d really appreciate it if you could take a moment to leave a review: [Insert Review Link]. Your feedback helps us serve you better!”

2. Monitoring and Managing Online Reviews

Your firm’s online reputation extends beyond your website.

Clients often check Google My Business, Facebook, Yelp, and other platforms before making a decision.

How to Track Reviews in GoHighLevel:

- Go to Reputation → Review Management to view all client feedback in one place.

- Connect external platforms (Google, Facebook, Yelp) to track new reviews in real time.

- Set up email or SMS alerts when a new review is posted.

- Identify trends (e.g., recurring client praises or complaints) to improve service quality.

Example: If multiple clients mention that your online appointment scheduling is confusing, this is a sign to streamline your booking system.

3. Responding to Reviews Professionally

Engaging with client reviews – both positive and negative – demonstrates professionalism and commitment to client satisfaction.

Best Practices for Responding to Reviews:

✅ Positive Reviews: Express gratitude and highlight key points.

✅ Negative Reviews: Stay calm, acknowledge concerns, and offer solutions.

✅ Neutral Reviews: Address any concerns and encourage continued engagement.

Response Templates:

✅ For Positive Reviews:

“Thank you, [Client Name]! We appreciate your kind words and are glad we could help with your [service provided]. Looking forward to working with you again!”

✅ For Negative Reviews:

“Hi [Client Name], we’re sorry to hear about your experience. We’d love to discuss this further and make things right. Please reach out to us at [email/phone].”

✅ For Neutral Reviews:

“Thanks for your feedback, [Client Name]! We’re always looking to improve our services. Let us know how we can serve you better.”

Example: If a client leaves a 3-star review mentioning slow response times, replying with:

“We appreciate your feedback, [Client Name]. We’re working to improve response times and value your business. If there’s anything we can do to assist further, please let us know!”

shows accountability and a willingness to improve.

4. Leveraging Positive Reviews for Marketing

Showcasing client testimonials can enhance your firm’s credibility and attract new clients.

Ways to Use Reviews in Marketing:

✅ Feature testimonials on your website – Add a dedicated “Client Testimonials” section.

✅ Use reviews in ads – Incorporate positive feedback into Facebook or Google Ads.

✅ Showcase success stories on social media – Share screenshots or quotes from satisfied clients.

✅ Include reviews in email campaigns – Reinforce trust with prospects by displaying client praise.

Example: If a small business client leaves a review saying, “XYZ Accounting helped us save $5,000 in taxes this year!” – featuring this testimonial on your website and social media can attract other business owners seeking similar results.

Your reputation is one of your firm’s most valuable assets. With GoHighLevel’s automated review requests, monitoring tools, and response management, you can build trust, enhance client relationships, and strengthen your online presence.

Reporting and Analytics for Accountants

To run a successful accounting firm, you need clear insights into your business performance, client interactions, and marketing effectiveness.

GoHighLevel’s reporting and analytics tools help you track key metrics, optimize operations, and make data-driven decisions.

In this section, you’ll learn how to:

✅ Use GoHighLevel’s dashboard for real-time business insights.

✅ Track client engagement and communication effectiveness.

✅ Monitor marketing performance and ROI.

✅ Measure revenue, invoices, and financial growth.

✅ Generate detailed reports for better decision-making.

1. Using GoHighLevel’s Dashboard for Real-Time Insights

GoHighLevel’s dashboard provides a bird’s-eye view of your accounting firm’s performance, helping you monitor everything from new leads to revenue.

How to Access the Dashboard:

- Go to Reporting → Dashboard in your GoHighLevel account.

- Customize widgets to track metrics relevant to your firm, such as:

✅ Number of new leads generated.

✅ Client appointment bookings.

✅ Pending and completed invoices.

✅ Email and SMS engagement rates.

✅ Revenue trends.

Example: If you see a sudden drop in new consultations, this might indicate a need to adjust your marketing strategy or outreach efforts.

2. Tracking Client Engagement & Communication

Understanding how clients interact with your firm helps improve communication strategies.

Key Communication Reports:

✅ Email & SMS Reports – Measure open rates, response rates, and conversion rates from follow-up sequences.

✅ Call Tracking Reports – See call volume, duration, and missed call statistics.

✅ Client Interaction History – View all past emails, calls, and appointment records for each client.

How to Monitor Communication Reports in GoHighLevel:

- Navigate to Reporting → Conversation Reports to view client interactions.

- Identify response trends and improve engagement based on the data.

- Set up automated follow-ups for clients who don’t respond.

Example: If your tax preparation reminder emails have a low open rate, you might need to tweak your subject line to make it more engaging, such as “Don't Miss Out: Maximize Your Tax Savings This Year” instead of “Tax Prep Reminder”.

3. Monitoring Marketing Performance & ROI

GoHighLevel’s marketing analytics help you evaluate which campaigns are driving results.

Essential Marketing Reports:

✅ Lead Source Tracking – Identify where your leads are coming from (Google, social media, referrals, etc.).

✅ Ad Performance Metrics – If running Facebook or Google Ads, track conversion rates.

✅ Landing Page & Funnel Analytics – See how many visitors convert into leads.

✅ Email & SMS Campaign Effectiveness – Monitor open rates, click-through rates, and responses.

How to Access Marketing Reports in GoHighLevel:

- Go to Reporting → Marketing Reports.

- Analyze traffic, conversion rates, and cost per lead.

- Adjust campaigns based on underperforming areas.

Example: If a Google Ads campaign for bookkeeping services generates a high number of clicks but low conversions, you may need to improve your landing page by adding a clear call to action or simplifying the form.

4. Measuring Revenue, Invoices & Financial Performance

GoHighLevel provides payment and revenue tracking tools to help you stay on top of your firm’s finances.

Key Financial Reports:

✅ Total Revenue & Growth Trends – See monthly and yearly revenue performance.

✅ Invoice Reports – Track issued, paid, and overdue invoices.

✅ Recurring Payments & Subscriptions – Monitor ongoing client retainers.

✅ Payment Method Insights – Identify how clients prefer to pay (credit card, bank transfer, etc.).

How to Access Financial Reports in GoHighLevel:

- Go to Payments → Reports to view revenue and invoice data.

- Filter reports by date, client type, or payment method for deeper insights.

- Automate invoice reminders for overdue payments.

Example: If you notice multiple overdue invoices, you could set up automated reminders in GoHighLevel to send payment follow-ups, reducing delays in cash flow.

5. Generating & Exporting Detailed Reports

You may need to generate detailed reports for internal reviews, client updates, or compliance purposes.

Steps to Generate Reports in GoHighLevel:

- Navigate to Reporting → Custom Reports.

- Choose the data points you want to include (e.g., client growth, revenue, engagement rates).

- Apply filters for specific time periods, services, or campaigns.

- Export reports as PDF or CSV files for internal use or client presentations.

Example: If your firm offers quarterly tax consultation packages, you could generate a report showing the number of consultations booked, revenue generated, and client feedback to assess business performance.

GoHighLevel’s reporting and analytics tools help you track key business metrics, optimize client interactions, and improve financial performance. By leveraging real-time data, you can make informed decisions that drive growth and efficiency in your accounting firm.

Integrating GoHighLevel with Other Accounting Tools

To maximize efficiency in your accounting firm, you need seamless integration between GoHighLevel and the tools you already use for bookkeeping, tax preparation, and financial management.

Integrating GoHighLevel with other accounting software helps automate workflows, reduce manual data entry, and improve accuracy.

In this section, you’ll learn how to:

✅ Connect GoHighLevel with QuickBooks, Xero, and FreshBooks for automated bookkeeping.

✅ Sync client data between GoHighLevel and your accounting software.

✅ Automate invoice creation and payment tracking.

✅ Use Zapier to integrate with non-native tools.

✅ Enhance workflow automation with webhooks and APIs.

1. Connecting GoHighLevel with QuickBooks, Xero, and FreshBooks

GoHighLevel does not have a built-in accounting module, but you can integrate it with leading accounting software like QuickBooks, Xero, and FreshBooks to streamline financial management.

How to Connect GoHighLevel with QuickBooks (or Similar Accounting Software):

Use Zapier for Integration

- Go to Zapier → Create a Zap.

- Select GoHighLevel as the trigger app (e.g., when a new invoice is created).

- Select QuickBooks/Xero/FreshBooks as the action app (e.g., create a new invoice in QuickBooks).

- Map the necessary fields (client name, amount, due date, etc.).

- Activate the Zap to automate invoice creation.

Set Up Auto-Sync for Contacts & Transactions

- Sync client data between GoHighLevel and your accounting tool to maintain up-to-date records.

- Automatically log payments and invoices from GoHighLevel into QuickBooks or Xero.

Example: If a client books a tax consultation and makes a payment through GoHighLevel, the system can automatically generate an invoice in QuickBooks, saving you manual work.

2. Syncing Client Data Between GoHighLevel & Your Accounting Software

Keeping client records updated across platforms is crucial for accurate financial reporting.

Steps to Sync Client Data:

✅ Export client lists from GoHighLevel and import them into QuickBooks, Xero, or FreshBooks.

✅ Use Zapier to auto-sync new leads and clients from GoHighLevel to your accounting software.

✅ Ensure that GoHighLevel’s CRM records match your financial records by scheduling periodic data syncs.

Example: When a new client signs a retainer agreement in GoHighLevel, their details can automatically be added as a new customer in QuickBooks, ensuring consistent record-keeping.

3. Automating Invoice Creation & Payment Tracking

To reduce manual invoicing and payment tracking, you can integrate GoHighLevel’s payment system with accounting software.

How to Automate Invoicing:

✅ Use GoHighLevel’s Stripe or PayPal integration to collect payments.

✅ Connect Stripe or PayPal to QuickBooks/Xero for automated reconciliation.

✅ Create automated invoice templates that generate when a client books a service.

Example: If a client signs up for a monthly financial advisory service, GoHighLevel can automatically generate an invoice in FreshBooks and send a payment reminder.

4. Using Zapier to Integrate with Non-Native Tools

If GoHighLevel doesn’t offer a direct integration with your preferred accounting software, Zapier can bridge the gap.

Popular Zapier Automations for Accountants:

✅ Trigger: New lead in GoHighLevel → Action: Add to QuickBooks as a customer.

✅ Trigger: New GoHighLevel payment → Action: Create an invoice in FreshBooks.

✅ Trigger: Appointment booked in GoHighLevel → Action: Log transaction in Xero.

✅ Trigger: Payment failure in GoHighLevel → Action: Send automated follow-up email.

Example: If a client’s credit card payment fails for their tax preparation service, Zapier can automatically trigger a follow-up email and a reminder SMS from GoHighLevel.

5. Enhancing Workflow Automation with Webhooks & APIs

For advanced users, GoHighLevel’s webhooks and API allow deeper integrations with accounting tools.

How to Use Webhooks:

- Send real-time payment data from GoHighLevel to your accounting software.

- Trigger custom workflows (e.g., notify your accountant when a high-value payment is received).

How to Use GoHighLevel’s API:

- Developers can connect GoHighLevel directly to financial software for real-time data sync.

- Automate report generation by pulling data from GoHighLevel into a custom financial dashboard.

Example: If your firm has a custom financial reporting system, an API integration can pull client revenue data directly from GoHighLevel into your dashboard.

Integrating GoHighLevel with your accounting tools allows you to automate financial tasks, reduce manual work, and improve efficiency in your firm. Whether you use QuickBooks, Xero, FreshBooks, or other platforms, syncing your data ensures seamless financial management and accurate reporting.

Advanced Strategies to Scale Your Accounting Firm with GoHighLevel

Once you’ve set up GoHighLevel and streamlined your operations, the next step is scaling your accounting firm.

Scaling requires automation, optimization, and strategic growth initiatives to increase revenue while maintaining efficiency.

In this section, you’ll discover advanced strategies to take your firm to the next level using GoHighLevel:

1. Leveraging Advanced Automation for Growth

Automation is the key to scaling without increasing overhead costs.

GoHighLevel’s workflows and triggers allow you to automate repetitive tasks so you can focus on high-value services.

How to Scale with Automation:

✅ Client Onboarding Automation – Create a workflow that automatically sends a welcome email, intake forms, and next steps after a new client signs up.

✅ Automated Client Follow-ups – Set up nurture sequences for tax reminders, financial planning check-ins, and upselling opportunities.

✅ Task Assignment for Team Members – Automate internal task delegation based on client actions (e.g., when a new client books a call, assign a team member to follow up).

✅ Lead Scoring & Segmentation – Use GoHighLevel’s CRM to segment clients based on their financial needs and automatically offer relevant services.

Example: If a business client hasn’t updated their bookkeeping records for two months, GoHighLevel can automatically send a reminder and a booking link for a consultation.

2. Creating Scalable Sales & Marketing Funnels

A well-structured sales funnel ensures a steady flow of new clients while allowing you to convert leads on autopilot.

GoHighLevel’s funnel builder lets you create high-converting landing pages for your accounting services.

How to Build a Scalable Sales Funnel:

✅ Lead Magnet Funnel – Offer a free financial checklist or tax-saving guide in exchange for contact details.

✅ Webinar Funnel – Host a free webinar on “Tax Strategies for Small Businesses” and capture leads.

✅ Appointment Booking Funnel – Drive traffic to a page where prospects can schedule a free consultation.

✅ Retargeting Campaigns – Use GoHighLevel’s SMS & email automation to nurture cold leads until they convert.

Example: A prospect downloads your “Small Business Tax Checklist” from a landing page. GoHighLevel automatically adds them to an email nurture sequence, eventually leading them to book a tax planning session.

3. Launching a Scalable Membership or Subscription Model

One of the best ways to scale is by offering recurring revenue services.

Instead of one-time engagements, turn your accounting services into a subscription model using GoHighLevel’s membership and billing features.

How to Scale with a Subscription Model:

✅ Offer Monthly Financial Consulting Plans – Provide ongoing financial guidance, tax planning, or bookkeeping services for a monthly fee.

✅ Create an Exclusive Membership Portal – Use GoHighLevel’s Memberships to offer premium content, training, or DIY financial planning resources.

✅ Automate Recurring Billing – Set up monthly retainer payments through Stripe or PayPal inside GoHighLevel.

✅ Use Community Engagement – Build a VIP group for your clients using GoHighLevel’s social tools.

Example: You create a “CFO-as-a-Service” plan where business owners pay a monthly fee for financial forecasting and advisory services, ensuring consistent revenue growth.

4. Expanding Your Firm with White-Label & Outsourced Services

As your firm grows, you don’t need to handle everything in-house.

You can scale by leveraging white-label accounting services and outsourcing tasks while maintaining quality service.

How to Scale Without Hiring More Staff:

✅ Use GoHighLevel’s White-Label Capabilities – Resell GoHighLevel’s CRM & automation features to other accountants or clients.

✅ Outsource Bookkeeping & Payroll Services – Partner with a white-label provider while focusing on high-value advisory services.

✅ Build a Network of Referral Partners – Use GoHighLevel’s affiliate & referral tracking to generate leads through partnerships.

✅ Automate Staff & Contractor Workflows – Assign tasks, monitor performance, and streamline operations using GoHighLevel’s project management features.

Example: Instead of hiring full-time staff, you outsource bookkeeping services to a third-party provider, using GoHighLevel to manage client communication and file-sharing.

5. Tracking Growth with Advanced Reporting & Analytics

Scaling requires data-driven decision-making. GoHighLevel’s reporting tools provide insights into client engagement, revenue trends, and marketing performance.

Key Metrics to Track:

📊 Lead Conversion Rates – Analyze which marketing campaigns bring in the most clients.

📊 Client Retention & Churn – Identify why clients leave and improve retention strategies.

📊 Revenue by Service – Determine which accounting services generate the most profit.

📊 Appointment No-Show Rates – Reduce missed meetings with automated reminders.

📊 Marketing ROI – Track the performance of email, SMS, and paid ad campaigns.

Example: If reports show that clients who attend a free tax webinar have a 50% conversion rate, you can increase webinar promotions for better results.

Scaling your accounting firm with GoHighLevel requires a combination of automation, strategic marketing, and data-driven decisions. By leveraging advanced workflows, subscription models, outsourced services, and analytics, you can grow your firm without increasing overhead.

Frequently Asked Questions

Frequently Asked Questions on GoHighLevel for Accountants.

What is GoHighLevel, and how can it benefit my accounting firm?

GoHighLevel is an all-in-one sales and marketing platform designed to help businesses streamline operations, automate marketing efforts, and enhance client relations. For accounting firms, it offers tools to manage client communications, automate appointment scheduling, handle billing processes, and run targeted marketing campaigns, thereby improving efficiency and client satisfaction.

Does GoHighLevel integrate with accounting software like QuickBooks or Xero?

Yes, GoHighLevel offers native integration with QuickBooks Online, allowing for synchronization of invoices and financial data between the two platforms. Currently, there isn't a native integration with Xero; however, you can use third-party tools like Zapier to connect GoHighLevel with Xero, facilitating data synchronization and workflow automation.

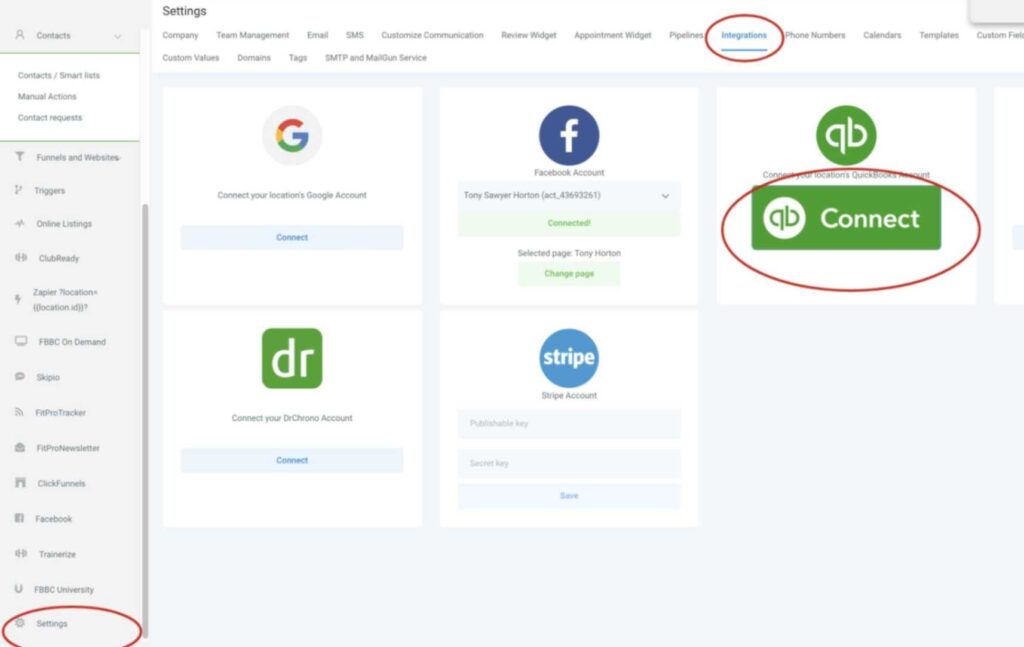

How do I set up the QuickBooks integration in GoHighLevel?

To integrate QuickBooks with GoHighLevel:

- Navigate to Settings > Integrations in your GoHighLevel account.

- Locate the QuickBooks option and click “Connect.”

- You'll be redirected to the Intuit login page; enter your QuickBooks credentials to authorize the connection.

- Configure your sync settings to determine how invoices and data are synchronized between the platforms.

This integration enables automated synchronization of invoices and financial data, reducing manual data entry and potential errors.

Can I automate billing and invoicing processes using GoHighLevel?

Yes, GoHighLevel allows you to automate billing and invoicing by integrating with payment processors like Stripe and PayPal. You can set up automated invoicing workflows, recurring billing for subscription-based services, and payment reminders to streamline your financial operations.

How can GoHighLevel help in marketing my accounting services?

GoHighLevel provides various marketing tools, including:

- Email and SMS Campaigns: Create and automate targeted campaigns to nurture leads and engage existing clients.

- Sales Funnels: Design and implement sales funnels to convert prospects into clients effectively.

- Landing Pages: Develop landing pages for specific services or promotions to capture leads.

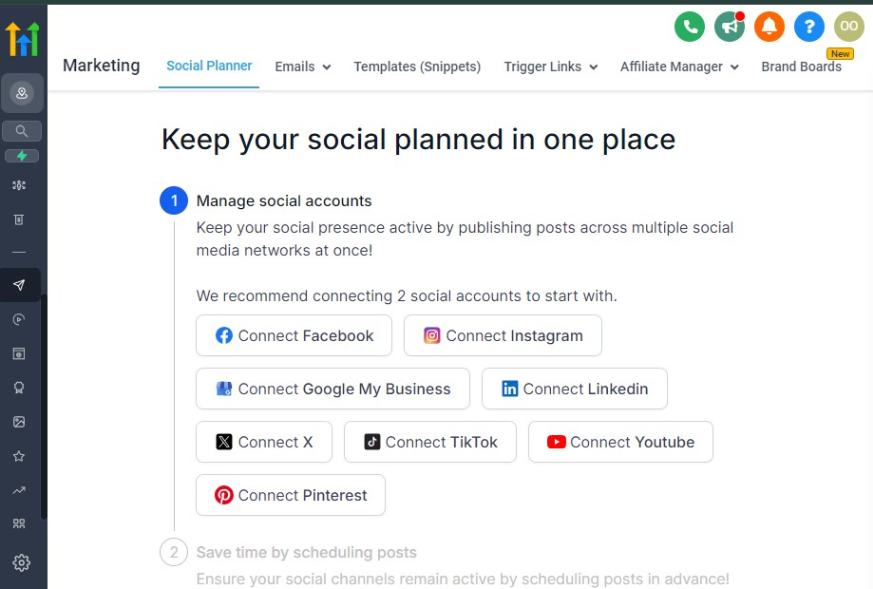

- Social Media Management: Manage and schedule posts across multiple social media platforms to maintain an active online presence.

These features enable you to reach a broader audience and attract potential clients.

Is it possible to create a client portal using GoHighLevel?

Yes, GoHighLevel allows you to create secure client portals where clients can access their financial information, documents, and communication history. This enhances transparency and strengthens client relationships by providing personalized access to their data.

Are there resources available to help me get started with GoHighLevel for my accounting practice?

Yes, GoHighLevel provides various resources, including an Accounting Playbook, tutorials, and a support portal, to assist you in setting up and optimizing the platform for your accounting firm. Additionally, there are community forums and third-party guides that offer insights and best practices.

What kind of support does GoHighLevel offer if I encounter issues or have questions?

GoHighLevel offers 24/7 customer support through various channels, including live chat, email, and a comprehensive support portal with articles and tutorials to help you resolve issues and maximize the platform's potential.

Final Thoughts

GoHighLevel is more than just a CRM – it’s a complete business automation platform that empowers you to streamline operations, enhance client communication, and scale your accounting firm with ease.

By leveraging its CRM, automation, appointment scheduling, billing, marketing, and reporting tools, you can:

✅ Save time by automating repetitive tasks like client follow-ups, invoicing, and appointment reminders.

✅ Improve client relationships with a centralized system for managing interactions and tracking client needs.

✅ Increase revenue by implementing scalable marketing funnels, subscription-based services, and referral programs.

✅ Enhance efficiency by integrating GoHighLevel with your existing accounting software and outsourcing non-core tasks.

✅ Make data-driven decisions with real-time reporting and analytics to optimize your growth strategy.

Whether you’re a solo accountant, a growing firm, or an established practice, GoHighLevel equips you with the tools to operate more efficiently and scale sustainably.

Now, it’s time to take action – set up your workflows, optimize your processes, and watch your firm thrive.

Are you ready to transform your accounting business with GoHighLevel?